2018 IEEE IEDM to showcase breakthrough in semiconductor technology

The 64thannual IEEE International Electron Devices Meeting (IEDM), the world’s largest, most influential forum for technologists to unveil breakthroughs and new concepts in transistors and related micro/nanoelectronics devices, will be held December 1-5, 2018 at the Hilton San Francisco Union Square hotel. The late-news submission deadline is September 10.

The IEDM’s tradition of spotlighting more leading work in more areas of the field continues, even as the conference evolves to support the interdisciplinary and continuing educational needs of the scientists, engineers and students whose efforts make possible the expansion of the worldwide electronics industry.

“We live in a time when electronics technology touches more aspects of business and industry than ever before,” said Kirsten Moselund, IEDM 2018 Publicity Chair and Research Staff Member at IBM Research–Zurich. “No matter what their specialty is, attendees will come away from the conference with a deeper understanding of the challenges and opportunities before them.”

“In terms of industrial applications, the evening panel session on EUV will give attendees the opportunity to explore and debate this emerging technology with the very people who are driving it forward,” said Rihito Kuroda, IEDM 2018 Publicity Vice Chair and Associate Professor at Tohoku University. “This is just one way in which the IEDM conference gives people insights into the technologies that will become mainstream in a few years.”

Here are details of some of the talks and events that will take place at this year’s IEDM. The papers to be presented in the technical sessions will be chosen in late September and highlights from them will be forthcoming soon thereafter:

Focus Sessions

Quantum Computing – Quantum computing will enable new types of algorithms to tackle problems in areas from materials science to medicine to artificial intelligence. We are still in early stages, facing fundamental questions such as: What is the best way to implement a quantum bit of information? How to connect them together? How to scale to larger systems without being overwhelmed by errors? This session brings together experts at the forefront of quantum computing research. Starting from an applications perspective, attendees will hear about different approaches to address fundamental questions at the device level; the progress achieved so far; and next steps.

Future Technologies Towards Wireless Communications: 5G and Beyond– 5G technology will drastically reduce limitations on accessibility, bandwidth, performance, and latency, but as it triggers fundamentally new applications it also will impose unique hardware requirements. This focus session will set a big picture view and then narrow down to how innovations in CMOS technologies, devices, filters, transceivers and antennas are coming together to enable the 5G platform.

Interconnects to Enable Continued Technology Scaling –BEOL copper (Cu) interconnects are close to end-of-life as a manufacturing technology, while the increasing complexity of MEOL processes requires novel materials. Also, the end of the Cu roadmap will coincide with significant changes in the dominant transistor architecture, and therefore the interaction between transistor architecture and interconnect will drive future interconnect development. This session provides a holistic perspective of interconnect scaling challenges and solutions. It will address the drivers of future interconnect architectures, the process options likely to be implemented in manufacturing, and how they will be tuned to ensure circuit reliability is maintained.

Application Requirements for Quantum Computing, John Preskill, Caltech

Materials and Device Challenges for Near-Term Superconducting Quantum Processors, Jerry Chow, IBM

Towards Scalable Silicon Quantum Computing, Maud Vinet, CEA-Leti

Silicon Isotope Technology for Quantum Computing, Kohei Itoh, Keio University

Qubit Device Integration Using Advanced Semiconductor Manufacturing Process Technology, Ravi Pillarrisetty, Intel

Scalable Quantum Computing with Single Dopant Atoms in Silicon, Andrea Morello, Univ. New South Wales

Majorana Qubits, Leo Kouwenhoeven, Microsoft

Intel 22nm FinFET (22FFL) Process Technology for RF and mmWave Applications and Circuit Design Optimization for FinFET Technology, Hyung-Jin Lee, Intel

RFIC/CMOS Technologies for 5G, mmWave and Beyond, Ali Niknejad, UC Berkeley

GaN HEMTs for 5G Base Station Applications, Shigeru Nakajima, Sumitomo Electron Devices

Highly Integrated mm-Wave Transceivers for Communication Systems,Vadim Issakov, Infineon

BAW Filters for 5G Bands, Robert Aigner, Qorvo

Reconfigurable Micro/Millimeter-wave Filters, Dimitrios Peroulis, PurdueChallenges for Wide Bandgap Device Adoption in Power Electronics– Wide bandgap (WBG) power devices offer potential savings in both energy and cost. But converters powered by WBG devices require innovation at all levels, entailing changes to system design, circuit architecture, qualification metrics and even market models. Can SiC or GaN push beyond what silicon can possibly achieve? What are the big challenges researchers should answer over the next decade? A team of experts will interpret the landscape and discuss challenges to the widespread adoption of these technologies.

GaN and SiC Devices for Automotive Applications, Tetsu Kachi, Nagoya University

SiC MOSFET for Mainstream Adoption, Peter Friedrichs, Infineon

GaN Power Commercialization with Highest Quality-Highest Reliability 650V HEMTs- Requirements, Successes and Challenges, Primit Parikh, Transphorm

The Current Status and Future Prospects of SiC High Voltage Technology, Andrei Mihaila, ABB

Barriers to Wide Bandgap Semiconductor Device Adoption in Power Electronics, Isik Kizilyalli, ARPA-E

High to Ultra-High Voltage SiC Power Device Technology, Yoshiyuki Yonezawa, AIST

Effects of Basal Plane Dislocations on SiC Power Device Reliability, Robert E. Stahlbush, Naval Research Laboratory

Interconnect Design and Technology Optimization for Conventional and Exotic Nanoscale Devices: A Physical Design Perspective, Naeemi, Georgia Tech

Mechanisms of Electromigration Damage in Cu Interconnects, K. Hu, IBM

Interconnect Metals Beyond Copper: Reliability Challenges and Opportunities, K. Croes, Imec

Microstructure Evolution and Effect on Resistivity for Cu Nano-interconnects and Beyond, Paul Ho, UT Austin

Integrating Graphene into Future Generations of BEOL Interconnects,-S. Philip Wong, Stanford

Interconnect Trends for Single Digit Nodes, Mehul Naik, Applied Materials

在线留言询价

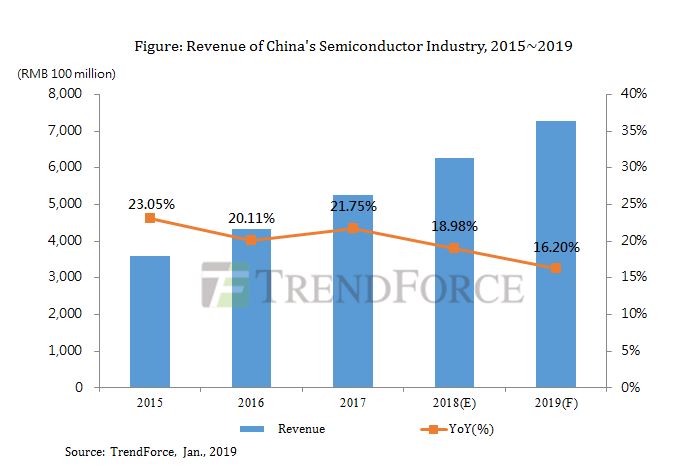

Revenue Growth in China's Semiconductor Industry Would Slow Down to 16.2% in 2019 due to Pessimistic

- 一周热料

- 紧缺物料秒杀

| 型号 | 品牌 | 询价 |

|---|---|---|

| CDZVT2R20B | ROHM Semiconductor | |

| TL431ACLPR | Texas Instruments | |

| RB751G-40T2R | ROHM Semiconductor | |

| MC33074DR2G | onsemi | |

| BD71847AMWV-E2 | ROHM Semiconductor |

| 型号 | 品牌 | 抢购 |

|---|---|---|

| ESR03EZPJ151 | ROHM Semiconductor | |

| IPZ40N04S5L4R8ATMA1 | Infineon Technologies | |

| TPS63050YFFR | Texas Instruments | |

| BU33JA2MNVX-CTL | ROHM Semiconductor | |

| STM32F429IGT6 | STMicroelectronics | |

| BP3621 | ROHM Semiconductor |

- 周排行榜

- 月排行榜

AMEYA360公众号二维码

识别二维码,即可关注

请输入下方图片中的验证码: