- Ameya360 Component Supply Platform >

- Trade news >

- The global compound semiconductor market grows on increasing demand for optoelectronic devices

The global compound semiconductor market grows on increasing demand for optoelectronic devices

According to Allied Market Research, the global compound semiconductor market was valued at USD 66,623 million in 2016 and is expected to reach USD 142,586 million in 2023 while growing at a CAGR of 11.3% from 2017 to 2023. The report indicates that a compound semiconductor is composed of two or more elements. Numerous compound semiconductors can be obtained by changing the combination of elements. Some of the factors affecting the market include the increasing demand for optoelectronic devices, as well as the attraction of compound semiconductor’s significant features, such as less power consumption, low price, and reduced heat dissipation. Rise in usage of optical devices, photovoltaic cells, and modules & wireless communication products is expected to provide an attractive opportunity for the compound semiconductor market. Squire Mining Ltd. (OTC: SQRMF), Nvidia Corporation (NASDAQ: NVDA), Advanced Micro Devices, Inc. (NASDAQ: AMD), KLA-Tencor Corporation (NASDAQ: KLAC), Maxim Integrated Products, Inc. (NASDAQ: MXIM)

As semiconductor technology begins to advance, new segments are swiftly being integrated into the market, such as Machine Learning. AI has observed significant growth in recent years. Initially, AI was considered a topic for academicians, though in recent years with development of various technologies, AI has turned into reality and is influencing many lives and businesses. According to MarketsandMarkets the global artificial intelligence chipset market is expected to be worth USD 16.06 Billion by 2022 and grow at a CAGR of 62.9% between 2016 and 2022.

Squire Mining Ltd. (OTCQB: SQRMF) is also listed on the Canadian Securities Exchange under the ticker (CSE: SQR). Earlier last week, the Company announced breaking news that, “to report on its prototype ASIC chip testing event held in Seoul, South Korea. With executives and board members from Squire, Future Farm, CoinGeek, Gaonchips and Samsung Electronics in attendance, Peter Kim, President of Squire’s subsidiary AraCore Technology Corp. (“Aracore”), and his team of front-end microchip engineers and programmers, unveiled and tested a working prototype mining system comprised of a newly engineered FPGA (field programmable gate array) ASIC microchip that will be converted into AraCore’s first ASIC chip utilizing 10 nanometer technology for mining Bitcoin Cash, Bitcoin and other associated cryptocurrencies. The test results confirm Aracore’s original design specifications indicating that the ASIC chip, once mass manufactured by Samsung Electronics, will be capable of delivering a projected hash rate of 18 to 22 terahash per second (TH/s) with an energy consumption of between 700 and 800 watts.

Taras Kulyk, Chief Executive Officer of CoinGeek Mining and Hardware, said “The CoinGeek team is very pleased with the progress of our strategic partners; Squire Mining and Aracore. With this next generation technology, CoinGeek will continue to pull the blockchain industry out of the proverbial basement and into the boardroom.”

Stefan Matthews, Chairman of nChain, one of the industry leaders in blockchain research and development, and a director of Squire Mining added, “The early results indicate that this ASIC microchip has the potential to be the next generation leader in providing hash power for enterprise mining of Bitcoin Cash and other associated crypto currencies. It has also demonstrated the potential to rapidly process consensus protocols across the blockchain faster whilst utilizing less energy than anything currently in this sector.”

Hash rate speed and microchip efficiency are the two most important measuring criteria in the crypto-mining industry to enable end-users to maximize profitability and ROI in their day to day mining operations.

Simon Moore, Executive Chairman and CEO of Squire Mining, stated, “Aracore’s time and investment to date have been validated by the impressive results of this new microchip. Once completed, we believe the speed and efficiency of our ASIC microchip combined with our respective mining systems powered by this Samsung manufactured microchip together have the potential to substantially increase the profitability of enterprise mining facilities around the globe. We look forward to releasing our mining system to the market in the first half of next year through our exclusive distribution partners CoinGeek, and competing for a significant piece of this multi-billion-dollar enterprise mining market.”

About AraCore Technology Corp. – Aracore is a joint venture company established by Squire and Peter Kimto design and develop next generation ASIC chips for mining Bitcoin Cash, Bitcoin and other associated cryptocurrencies. Squire owns a 75% interest in Aracore and Peter Kim owns the remaining 25% interest.

About Squire Mining Ltd. – Squire is a Canadian based company engaged, through its subsidiaries, in the business of developing data mining infrastructure and system technology to support global blockchain applications in the mining space including applicable specific integrated circuit (ASIC) chips and next generation mining rigs to mine Bitcoin Cash, Bitcoin and other associated cryptocurrencies.”

Nvidia Corporation (NASDAQ: NVDA), in 1999, sparked the growth of the PC gaming market, redefined modern computer graphics, and revolutionized parallel computing. Nvidia recently announced that it invited the world’s top automotive safety and reliability company, TÜV SÜD, to perform a safety concept assessment of its new NVIDIA Xavier system-on-chip (SoC). The 150-year-old German firm’s 24,000 employees assess compliance to national and international standards for safety, durability and quality in cars, as well as for factories, buildings, bridges and other infrastructure. As the world’s first autonomous driving processor, Xavier is the most complex SoC ever created. Its 9 billion transistors enable Xavier to process vast amounts of data. Its GMSL (gigabit multimedia serial link) high-speed IO connects Xavier to the largest array of lidar, radar and camera sensors of any chip ever built. “NVIDIA Xavier is one of the most complex processors we have evaluated,” said Axel Köhnen, Xavier lead assessor at TÜV SÜD RAIL. “Our in-depth technical assessment confirms the Xavier SoC architecture is suitable for use in autonomous driving applications and highlights NVIDIA’s commitment to enable safe autonomous driving.”

Advanced Micro Devices, Inc. (NASDAQ: AMD), for more than 45 years, has driven innovation in high-performance computing, graphics and visualization technologies ― the building blocks for gaming, immersive platforms and the datacenter. AMD recently announced the availability of world’s most powerful desktop processor, the 2nd Gen AMD Ryzen Threadripper 2990WX processor with 32 cores and 64 threads. Designed to power the ultimate computing experiences, 2nd Gen AMD Ryzen Threadripper processors are built using 12nm “Zen+” x86 processor architecture and offer the most threads on any desktop processor with the flagship model delivering up to 53% greater performance than the competition’s flagship model. Second Gen AMD Ryzen Threadripper processors support the most I/O2, and are compatible with existing AMD X399 chipset motherboards via a simple BIOS update, offering builders a broad choice for designing the ultimate high-end desktop or workstation PC. “We created Ryzen Threadripper processors because we saw an opportunity to deliver unheard-of levels of multithreaded computing for the demanding needs of creators, gamers, and PC enthusiasts in the HEDT market,” said Jim Anderson, Senior Vice President and General Manager, Computing and Graphics Business Group, AMD. “With the 2nd Gen processor family we took that challenge to a whole new level – delivering the biggest, most powerful desktop processor the world has ever seen.”

KLA-Tencor Corporation (NASDAQ: KLAC), a provider of process control and yield management solutions, partners with customers around the world to develop sinspection and metrology technologies. Recently, KLA-Tencor Corporation announced two new defect inspection products designed to address a wide variety of integrated circuit (IC) packaging challenges. The Kronos™ 1080 system offers production-worthy, high sensitivity wafer inspection for advanced packaging, providing key information for process control and material disposition. The ICOS™ F160 system examines packages after wafers have been diced, delivering fast, accurate die sort based on detection of key defect types-including sidewall cracks, a new defect type affecting the yield of high-end packages. The two new inspection systems join KLA-Tencor’s portfolio of defect inspection, metrology and data analysis systems that help accelerate packaging yield and increase die sort accuracy. “As chip scaling has slowed, advances in chip packaging technology have become instrumental in driving device performance,” said Oreste Donzella, Senior Vice President and Chief Marketing Officer at KLA-Tencor. “Packaged chips need to achieve simultaneous targets for device performance, power consumption, form factor and cost for a variety of device applications. As a result, packaging design has become more diverse and complex, featuring a range of 2D and 3D structures that are more densely packed and shrinking in size with every generation. At the same time, the value of the packaged chip has grown substantially, along with electronics manufacturers’ expectations for quality and reliability.”

Maxim Integrated Products, Inc. (NASDAQ: MXIM) develops innovative analog and mixed-signal products and technologies to make systems smaller and smarter, with enhanced security and increased energy efficiency. Maxim Integrated recently announced that automotive infotainment designers can now upgrade to bigger, higher resolution displays with greater ease, reduced cost and smaller solution size with the MAX20069 from Maxim Integrated Products, Inc. The MAX20069 provides the industry’s first solution integrating four I2C-controlled, 150mA LED backlight drivers and a four-output thin-film-transistor liquid-crystal display (TFT-LCD) bias in a single chip. The IC can reduce design footprint up to one-third compared to the closest competitor’s parts. “Automotive manufacturers are using more screens, larger panels and brighter displays across several vehicle lines to support a safer and more engaging experience on the road,” said Szukang Hsien, Executive Business Manager, Automotive Business Unit, Maxim Integrated. “Maxim’s integrated LED backlight driver and TFT-LCD bias solution supports newer panel types to help automotive manufacturers adopt lower cost yet higher resolution panels with smaller solution size and a high level of integration.”

Online messageinquiry

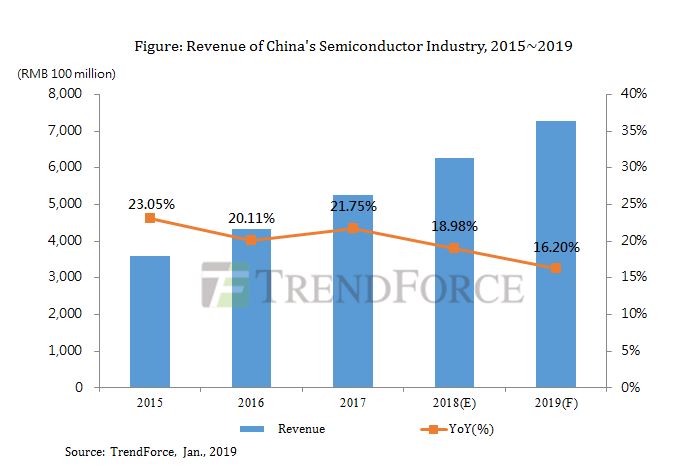

Revenue Growth in China's Semiconductor Industry Would Slow Down to 16.2% in 2019 due to Pessimistic

- Week of hot material

- Material in short supply seckilling

| model | brand | Quote |

|---|---|---|

| TL431ACLPR | Texas Instruments | |

| RB751G-40T2R | ROHM Semiconductor | |

| CDZVT2R20B | ROHM Semiconductor | |

| MC33074DR2G | onsemi | |

| BD71847AMWV-E2 | ROHM Semiconductor |

| model | brand | To snap up |

|---|---|---|

| STM32F429IGT6 | STMicroelectronics | |

| TPS63050YFFR | Texas Instruments | |

| ESR03EZPJ151 | ROHM Semiconductor | |

| BP3621 | ROHM Semiconductor | |

| BU33JA2MNVX-CTL | ROHM Semiconductor | |

| IPZ40N04S5L4R8ATMA1 | Infineon Technologies |

- Week of ranking

- Month ranking

Qr code of ameya360 official account

Identify TWO-DIMENSIONAL code, you can pay attention to

Please enter the verification code in the image below: