Fab Tool Sales Expected to Decline in 2019

After what is expected to be a second-straight record sales year in 2018, the semiconductor equipment market is projected to decline by 4% next year before recovering to grow by more than 20% in 2020, according to the SEMI trade group.

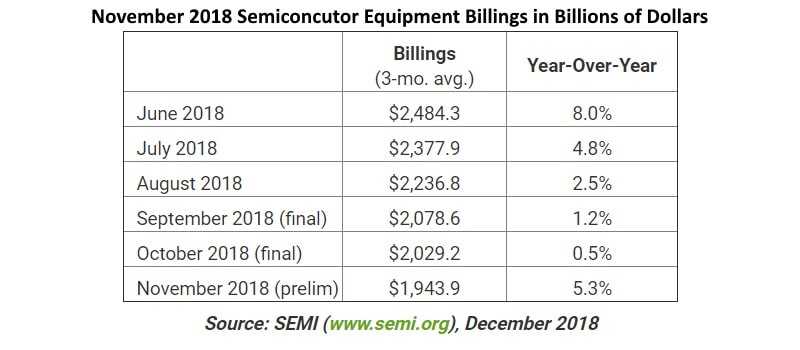

In its year-end forecast, released on Wednesday (Dec. 12) at the Semicon Japan trade show, SEMI estimated that fab tool sales will grow 9.7% this year to reach a record $62.1 billion. The forecast is consistent with other forecasts released earlier this year, despite slowing sales growth in recent months.

But the forecast calls for tool sales to decline to $56.6 billion next year before rebounding to grow 20.7% in 2020, reaching a new record high of $71.9 billion.

SEMI projects that the market for wafer processing equipment — the largest category of semiconductor production equipment — will grow 10.2% this year to reach $50.2 billion. The chip test equipment market is expected to grow by 15.6% this year to reach $5.4 billion, while the assembly and packaging equipment market is forecast to grow 1.9% to reach $4 billion, said SEMI.

Semiconductor equipment market in billions of U.S. dollars. (Source: SEMI)

South Korea — paced by continued record spending by Samsung Electronics — is expected to remain the largest regional market for fab tools for a second-straight year in 2018. China is expected to leapfrog Taiwan in 2018 to become the second-largest market for chip equipment, growing at a rate of 55.7%, said SEMI.

For 2019, SEMI projects that South Korea, China, and Taiwan will remain the top three markets for chip equipment.

在线留言询价

Fab Tool Sales Slip to $15.8 Billion in Q3

- 一周热料

- 紧缺物料秒杀

| 型号 | 品牌 | 询价 |

|---|---|---|

| CDZVT2R20B | ROHM Semiconductor | |

| BD71847AMWV-E2 | ROHM Semiconductor | |

| RB751G-40T2R | ROHM Semiconductor | |

| MC33074DR2G | onsemi | |

| TL431ACLPR | Texas Instruments |

| 型号 | 品牌 | 抢购 |

|---|---|---|

| IPZ40N04S5L4R8ATMA1 | Infineon Technologies | |

| BU33JA2MNVX-CTL | ROHM Semiconductor | |

| TPS63050YFFR | Texas Instruments | |

| BP3621 | ROHM Semiconductor | |

| ESR03EZPJ151 | ROHM Semiconductor | |

| STM32F429IGT6 | STMicroelectronics |

- 周排行榜

- 月排行榜

AMEYA360公众号二维码

识别二维码,即可关注

请输入下方图片中的验证码: