- Ameya360 Component Supply Platform >

- Trade news >

- Obscured Policies in Taiwan’s FIT Scheme to Impact on Sustainable Development of Local Solar Supply Chain

Obscured Policies in Taiwan’s FIT Scheme to Impact on Sustainable Development of Local Solar Supply Chain

The Taiwanese Ministry of Economic Affairs (MOEA) has announced a 10.17% decrease to next year’s feed-in tariff (FIT) rates for solar PV installations, which is much higher than the average decrease of 4.25% in the global PV industry. This will make 2019 a tough year for Taiwan’s PV industry, with wider-than-expected impacts on the whole market, says EnergyTrend, a division of TrendForce.

According to EnergyTrend analyst Sharon Chen, since the second half of 2018, local PV companies have successively planned the construction of large-scale ground-mounted PV systems for 2019. Overall, the capacity is close to 1 GW. However, developers in this sector face myriad construction challenges. These include equipment that is resistant to salt corrosion for at least 20 years; and the costs of building substations.

Indeed, contrary to the rules for rooftop PV, most ground-mounted PV systems require developers to build a booster substation by themselves, meaning the costs for grid connection account for around 25% of the total installation costs. In an environment where grid connection costs cannot be reduced and the FIT is greatly cut, EPC companies need to limit equipment costs by using cheaper modules and inverters, for instance, in order to maintain a high internal rate of return (IRR).

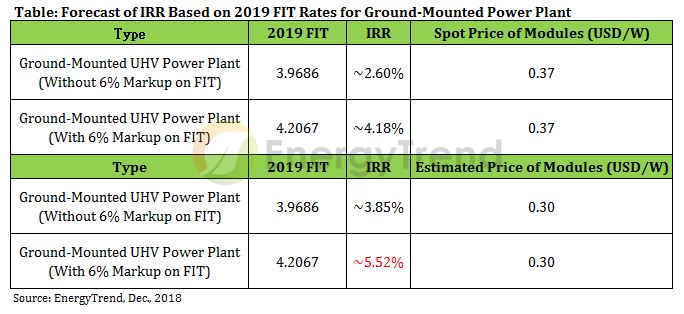

EnergyTrend analyst Sharon Chen points out that current module prices are US$0.37/W on the spot market. In this situation, the IRR will be just 2.60% after the FIT cuts, while it will take 15 years for companies to achieve a break-even point. Meanwhile, in 2019, PV projects will only receive a 6% markup on FITs when they are fitted with VPC-recognized modules and inverters. As such, companies may increase quotes to cover the associated costs of certification. To combat this, modules prices need to be lowered to $0.30/W or less to make IRR rebound to 5%.

However, we believe that even the most competitive module manufacturers in Taiwan may not be able to offer a price as low as this, let alone the prices needed for inverters. Overall, Taiwanese manufacturers will find it difficult to follow the global price decline trends, due to high production costs, meaning modules and inverters made by Chinese manufacturers will continue to be more cost competitive.

It has been a global trend to phase out FITs for solar PV projects. EnergyTrend believes that the best way is to make clear the annual decline in rates to 2025, and to use the subsidy to assist in the development of energy storage, which can supplement intermittent energy sources like solar energy. In this way, companies will also have a chance to assess the risks themselves, so that those which cannot fit in will be naturally eliminated from the industry. In the long term, the solar energy industry needs healthy and stable development.

Online messageinquiry

- Week of hot material

- Material in short supply seckilling

| model | brand | Quote |

|---|---|---|

| TL431ACLPR | Texas Instruments | |

| MC33074DR2G | onsemi | |

| CDZVT2R20B | ROHM Semiconductor | |

| BD71847AMWV-E2 | ROHM Semiconductor | |

| RB751G-40T2R | ROHM Semiconductor |

| model | brand | To snap up |

|---|---|---|

| TPS63050YFFR | Texas Instruments | |

| BP3621 | ROHM Semiconductor | |

| BU33JA2MNVX-CTL | ROHM Semiconductor | |

| IPZ40N04S5L4R8ATMA1 | Infineon Technologies | |

| ESR03EZPJ151 | ROHM Semiconductor | |

| STM32F429IGT6 | STMicroelectronics |

- Week of ranking

- Month ranking

Qr code of ameya360 official account

Identify TWO-DIMENSIONAL code, you can pay attention to

Please enter the verification code in the image below: