Shipments of Large-Size Panels to Grow by 1% YoY in 2019 Driven by Specs Improvement

According to the latest report by WitsView, a division of TrendForce, shipments of large-size panels reached 804.06 million pieces in 2018, a YoY growth of 2.5%. Among all the large-size display panel applications, only tablet panel recorded decreasing shipments last year, while other categories registered noticeable growth. The segment of TV panel was driven by new production capacity in the industry and special deal projects, while the LCD monitor segment grew due to the increased production volume of borderless monitors and momentum from global sports events. As for notebook panels, notebook manufacturers started their stock-ups earlier than previous years, in fear of the shortage of components like driver ICs. As a result, the notebook panel shipments for 2018 increased as well.

“Looking ahead to 2019, shipments of large-size panels are expected to reach 811.77 million pieces, an annual grow of 1%, driven by specs upgrades”, says Iris Hu, the research manager of WitsView. Shipments of notebook panels are expected to grow by 1.6% YoY to reach 190.12 million pieces, as high resolution and narrow-border models will still be popular in the market. The growth of borderless models and the gaming market will bring more replacement demand for peripherals, pushing monitor shipments to a new high of 158.03 million pieces, a YoY growth of 4.4%. In addition, three new fabs will enter the operation this year, with a focus on producing large-size TV panels. Thus, TV panel shipments are expected to reach 285.98 million, an annual growth of 1%. This will mark the third consecutive years for TV panel shipments to grow.

As for the specs of TV panels, panel makers have been making UHD a standard feature for large-size TV panel products and narrowing the price gap between and UHD and FHD products in recent years, boosting the penetration rate of UHD models to 39% in 2018. Looking ahead to 2019, two gen 10.5 fabs will focus on producing 65-inch and 75-inch panels, while gen 8.5 fab will shift to production of 55-inch ones in order to consume the capacity. Meanwhile, the production volume of 32-inch panels will be cut. The adjustments in product mixes would drive the penetration rate of UHD models up to 50%. Particularly, most of 55-inch or larger products will feature UHD. For 50-inch models, the penetration rate of UHD models has reached 88% this year after the gen 8.6 fab adopted economic cut. In 2019, the rate will continue to grow and 96% of 50-inch TV panels would feature UHD if the capacity expansion is completed.

IT panel makers will continue to focus on reducing border size. Both borderless PC monitor panels and narrow-border notebook panels recorded impressive shipments in 2018. With panel makers’ active capacity expansion for borderless PC monitor panels and promotion of PC brands, the penetration rate of borderless panels reached 31% in 2018, and has a chance to reach 45% this year as the demand continues to increase and capacity to expand.

As for notebook panels, the market not only focuses on increasing viewing angle and resolution, but also tries to increase the screen to body ratio inspired by the trends in the smartphone market. Notebook panel makers have been tried to place 14-inch narrow border panels in 13.3-inch case, making the products thinner and lighter, together with a new selling point. This trend drove the shipments of narrow-border notebook panels to increase by 347% in 2018, and the penetration rate to 25%, 19 percentage points higher than in 2017. As the price gap between narrow border models and panels with VESA standard gradually reduces, the penetration rate of the narrow border panels will exceed 40% in 2019.

在线留言询价

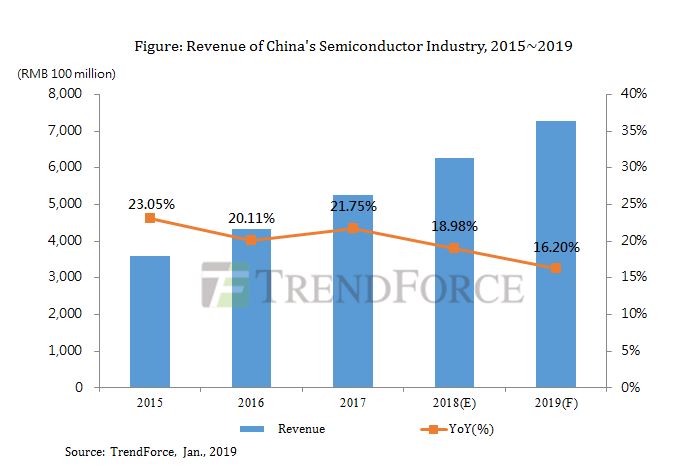

Revenue Growth in China's Semiconductor Industry Would Slow Down to 16.2% in 2019 due to Pessimistic

- 一周热料

- 紧缺物料秒杀

| 型号 | 品牌 | 询价 |

|---|---|---|

| CDZVT2R20B | ROHM Semiconductor | |

| MC33074DR2G | onsemi | |

| RB751G-40T2R | ROHM Semiconductor | |

| TL431ACLPR | Texas Instruments | |

| BD71847AMWV-E2 | ROHM Semiconductor |

| 型号 | 品牌 | 抢购 |

|---|---|---|

| BP3621 | ROHM Semiconductor | |

| STM32F429IGT6 | STMicroelectronics | |

| ESR03EZPJ151 | ROHM Semiconductor | |

| BU33JA2MNVX-CTL | ROHM Semiconductor | |

| TPS63050YFFR | Texas Instruments | |

| IPZ40N04S5L4R8ATMA1 | Infineon Technologies |

- 周排行榜

- 月排行榜

AMEYA360公众号二维码

识别二维码,即可关注

请输入下方图片中的验证码: