Mostly Upbeat Outlook For Chips

2019 has started with cautious optimism for the semiconductor industry, despite dark clouds that dot the horizon.

Market segments such as cryptocurrencies and virtual reality are not living up to expectations, the market for smart phones appears to be saturated, and DRAM prices are dropping, leading to cut-backs in capital expenditures. EDA companies are talking about sales to China being put on hold in the shadow of a trade war between the United States and China. And there appears to be a slowdown in consumer electronics, as evidenced by Apple’s recent earnings and guidance.

Alongside all of that, there are several areas to be excited about. The rapid adoption of, artificial intelligence (AI) is fueling advancements in fields such as automotive and IoT. 5G, another important enabler, is being readied for significant deployment. Plus, the number of design starts is growing, spurring a resurgence in ASICs and the emergence of embedded FPGA structures.

Source: IC Insights

The Disappointments

Most cryptocurrencies dropped about 75% during 2018, and they still show no signs of stabilizing. “Bitcoin continues a downward spiral and may not recover in 2019,” warns Tom Wong, director of marketing, design IP at Cadence. “This will have a major impact on the wafer foundry business because crypto chips consume so many bleeding-edge wafers. Because the cost of mining now exceeds the value of bitcoin, many miners have exited the market. This is not limited to individual miners. I predict that enterprise miners will have an even larger problem because of their huge overhead (electricity bills, server infrastructure, buildings, etc.). I expect some of them may have to shut down completely.”

Another disappointment for 2018 was augmented and virtual reality. “The challenge to AR and VR adoption is that it’s still not immersive enough,” says Simon Forrest, director of Connectivity & Connected Home for Imagination Technologies. “It’s not the graphics resolution or quality of the visuals that are letting the technology down, but rather the overall experience that is still somewhat lacking.”

Thomas Uhrmann, director of business development at EV Group agrees. “Getting content is another problem,” he says. “Its usage will be restricted until the video rates are high enough and we reach acceptable latency so that you don’t get motion sickness. It could be a replacement for the screen of a computer, but to see wide adoption of AR, we will have to wait until 5G is ready and that will take more time.”

Those may not be the only problems to overcome. “While 360° video and immersive spatial audio show promise in extending the market beyond hardcore gamers, we need a set of video and audio standards that broadcasters and content providers can coalesce around,” adds Forrest. “In addition, we need standards targeting additional human senses such as touch and smell. That would differentiate VR among other less immersive content formats. Until then, VR will remain niche and restricted in application.”

Artificial Intelligence takes the lead

There are some bright spots in the semiconductor market that should provide accelerated growth, helping to offset average selling price declines for memory. “In particular, the dramatic increase in investment in new domain specific processors, principally for artificial intelligence and machine learning, is very encouraging,” says Wally Rhines, CEO Emeritus, Mentor, a Siemens Business. “For many applications in pattern recognition and data analytics, traditional chip architectures are not providing adequate performance and the reduced power needed to execute the newest machine learning algorithms. As a result, there is a major acceleration in the design of new custom chips. This has also stimulated development of new chip design methodologies, many of which involve the use of artificial intelligence to improve the design process.”

But we should beware of putting too much faith in AI to fuel the industry. “It’s likely that AI will enter Gartner’s famed ‘trough of disillusionment’ for many companies,” warns Forrest. “The industry will quickly realize that AI isn’t the answer to everything and the hype will disappear somewhat. Others will quickly shift focus, ensuring that useful elements of AI that augment systems capabilities are retained, but AI will not necessarily remain central to the operation of those systems.”

Expectations have to be set. “While we all dream of AI devices or robotics that can perform loosely defined tasks like ‘do the dishes’, ‘paint the fence’ or ‘drive to Mom’s house’, the AI growth that I’m seeing for 2019 will be for simplifying routine tasks that can be automated with the addition of AI, and in particular with voice or image recognition,” says Marc Greenberg, group director of product marketing for the IP Group at Cadence. “For example, if you hate punching in the cooking time into the keypad of your microwave, then voice recognition – either standalone or through the digital assistant portal – will allow you to tell your microwave to heat your toaster pastry. We’ll see more office security systems that use facial recognition to open doors and possibly alert security if there’s an unauthorized tailgater behind an authorized user.”

AI is still in its infancy, despite all the rapid advancements. “There’s a lot of talk about the danger of AI, but that seems to be based on rather science-fictional concepts about singularity and ethics,” points out David Harold, vice president of marketing communications for Imagination. “Today, the application of AI is very much in the hands of people—and it is people, especially those with legislative powers, to whom we need to turn our attention to make sure AI is a benefit to society, not a burden.”

There are two significantly different domains for AI: learning and inferencing. Inferencing can happen either in the data center or at the edge.

AI in the data center is beginning to see significant change. “Nvidia’s GPUs and Intel Xeons have dominated most data center neural network processing to date,” says Geoff Tate, CEO for Flex Logix. “Nvidia’s Tesla T4 has been the only mass volume data center training card. Habana’s Goya is the first product to ship with price/performance characteristics markedly better than Tesla T4. In 2019 more optimized inference engines will debut and their collective penetration in the data center will accelerate, sharply reducing Nvidia’s market share. Cloud company’s home-grown inferencing accelerators, like Amazon’s Inferentia, will add to this trend.”

This trend is likely to continue. “Intel’s data center dominance will begin to recede,” adds Tate. “Dedicated training and inferencing engines will move significant shares of neural network processing off of Xeons. Intel’s own neural network acquisitions have yet to gain any significant traction. This is critical because neural networks are a rapidly growing share of data center processing workloads, and processors are not competitive with optimized neural network chips.”

The drive toward optimized architectures also will enable inferencing at the edge. “In the next year, we will see significant progress in the development of truly adaptive, learning systems for use in the cloud and in embedded, low power, autonomous applications at the edge,” says David White, senior group director for R&D in Cadence’s Custom IC & PCB Group. “This will require a more effective combination of machine and deep learning with optimization-driven adaptation. It will also increase the focus on the verification of AI-enabled systems for industrial and transportation-related systems and environments. It is not as large of a concern for cloud-based marketing applications or image processing benchmarks, but as we integrate AI and deep learning into transportation, manufacturing, IoT or other safety critical environments, it becomes more of a concern.”

The migration to the edge will take a while. “For true AI at the edge we need to consider innovative methods of improving the packing density of transistors onto silicon chips,” points out Forrest. “We expect to see entirely new ways of constructing SoCs that have both the capacity to acquire knowledge through learning alongside the necessary reasoning skills to adapt. This is several years away.”

5G

The combination of AI and 5G will become a big enabler for the industry. “Both AI and 5G are essential technologies for realizing autonomous driving cars,” says Lauro Rizzatti, a verification consultant. “Both will also drive the creation of new IoT gadgets to address a plethora of applications, some more useful than others. Even more so than 2018, AI and 5G will create new opportunities for business and new jobs openings for engineers.”

We can expect to see networks built out. “In 2019, 5G will be offered as an upgrade to current services,” says Forrest. “It will inevitably start in cities first before being rolled out more widely over the next few years, as smartphones also integrate 5G wireless technologies. Companies will experiment with 5G for backhaul of AI data to the cloud, IoT devices will likely include 5G modems for communication, and there may be a push for low-power 5G modems to help the technology proliferate across IoT products.”

Some may be rushing too fast to get there. “Tokyo pushed 5G, but it was a pre-standard,” says Uhrmann. “We will see a lot of additions. It was executed way too fast. That is really a story for 2020 or 2021, and then AR will hit the market. But the technology has to be ready now for high-volume manufacturing in three years. For AR you need to not be physically connected, you need the centers, you need to be able to display the rooms—content will be key.”

Automotive

The technology used in autonomous vehicles will not only change the way cars and trucks are driven, but also the financial landscape of how vehicles are bought, operated and insured just as radically as the technology under the bonnet or behind the dashboard. “It is honestly too early to say who is winning the race to deliver the first autonomous vehicle, but it is fair to say that all major car manufacturers and new entrants are investing heavily and making a play for to be early to market,” says Bryce Johnston, director of the automotive segment for Imagination. “But I’ll put my money on the first significant commercial deployments being in the robo-taxi arena and the area that really catches the public attention will be lorry convoys—there’s something quite uncanny about that technology when it really works.”

Others want self driving cars for themselves. “In 2019, we’ll see the autonomous industry kick into high gear as more self-driving pilot tests take place around the world,” says Jun Pei, CEO & Co-Founder of Cepton Technologies. “Consumers will be able to start enjoying Level 3 active safety features as soon as government regulations permit, which could be as soon as 2019. These features will support assistance with accelerating, steering and braking, making driving even safer. As automakers and OEMs start placing bigger orders for sensors, LiDAR companies will be put to the test. We’ll see the LiDAR market undergo significant consolidation as many companies aren’t yet ready to produce solutions at a mass scale that meet the rigorous requirements of the automotive industry. As a result, a handful of companies will flourish while many others are sold to bigger players, merge with other companies or even fold.”

Advances in automotive are placing new pressures on chip design. “Automotive OEMs are pushing their suppliers to achieve 0 defective-parts-per-million in order to assure the increasing electronic content of a car does not increase the number of cars with defects,” says Art Schaldenbrand, senior product manager at Cadence. “Based on data about field returns, somewhere between 80% to 95% of the field returns, or test escapes, are due to the analog elements of the design. As a result, the semiconductor IDMs that supply the automotive industry need tools to analyze the coverage of their tests. Coming in 2019 is IEEE P2427, A Standard for Analog Defect Modeling and Coverage, which will define how to model faults and calculate test coverage.”

2019 also will see updated requirements from ISO 26262. “The next generation of the ISO 26262 standard was released in December 2018,” adds Schaldenbrand. “The ISO 26262-11:2018, Guidelines on application of ISO26262 to semiconductor, standard has provided the first definitive guidelines for analyzing the safety of semiconductor designs.”

Automotive is driving the need for an increasing array of safety related tools. “Functional safety has become a major concern for semiconductor and system design, with autonomous vehicles as the highest-profile application,” says Sergio Marchese, technical marketing manager at OneSpin Solutions. “2019 will see the expansion of safety concerns into other fields. Home and business owners don’t want a missed bug, or an alpha particle to disable alarms and sensors, leaving them vulnerable to intrusion.”

IoT

Penetration has quietly continued over the past couple of years. “This coming year will be focused on simplifying development and deployments at scale with vertically integrated solutions specifically using IoTtechnology,” says Vivek Mohan, director of IoT for Semtech. “An example is the retail industry which will continue to make significant investment in IoT technology, both online and in physical stores, allowing players to take more market shares. These networks will be leveraged to improve efficiency in areas such as energy savings and compliance, such as food safety, data privacy, worker safety etc.”

Many levels of society will be affected. “2019 will see a major uptick in smart home products adding IoT intelligent control in areas such as home lighting, irrigation and heating/cooling – increasing the automation and efficiency of everyday tasks,” predicts Arm. “However, the rise of machine learning and computer vision will mean smart city guardians will look beyond cost reduction (e.g. intelligent LED street lighting) to citizen engagement and stronger revenue flows from areas such as red-light violation detection, Wi-Fi hotspot, 5G services, smart towers, crime detection/analysis and information broadcast.”

Power is a big concern for many IoT applications. “The focus for 2019 will be creating sustainable power that enables the industry’s vision of widespread IoT implementation,” says David Su, CEO for Atmosic Technologies. “To lower power consumption in IoT devices, the industry will look to enhanced design techniques, process technology scaling and improvement, and design optimization and customization. “The result will be better battery life. Improved architectural design will leverage functions like on-demand wakeup to refine a device’s wake and sleep cycles, further reducing power consumption. The end goal of reduced power is ultimately forever battery-life. In 2019, we will see portable devices in which the batteries last the duration of a products’ life.”

Another big issue for IoT is security. “While we saw the beginning of collaboration in 2018 around the growing challenge of securing connected semiconductors, more companies will work together and provide stronger and easier to deploy products and solutions in 2019,” says Martin Scott, CTO and senior vice president and general manager of Cryptography at Rambus. “One avenue for such collaboration will be the use of Open Source hardware and software. The Open Source nature of the RISC-V ISA can encourage innovation and widespread use, and result in the sharing of best practices. We can’t stop at hardware though, as there is a real and present need to improve software security and connectivity solutions to help provide end-to-end solutions.”

There is a lot of work to do to make an SoC secure. “The design must not leak confidential information and it must be secure from hacking and other external attacks,” says Marchese. “Hardware Trojans, such as maliciously inserted kill switches or backdoors, are becoming a major concern. Most SoC integrators and IP companies are not taking this risk seriously. In 2019, we expect that many companies will start familiarization with this topic, with a few exploring new tools and processes that detect Trojans.”

在线留言询价

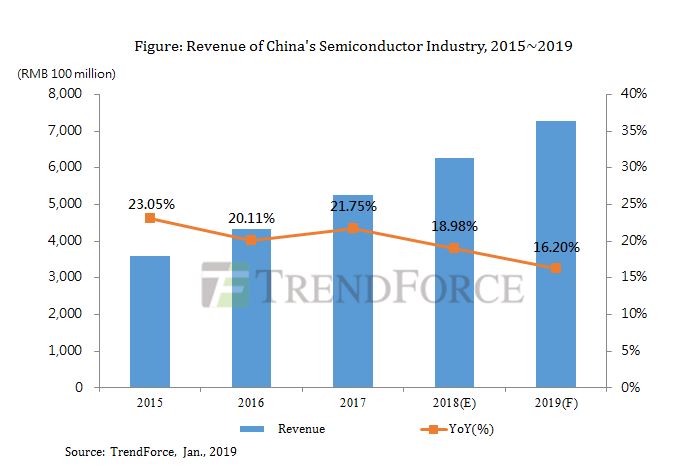

Revenue Growth in China's Semiconductor Industry Would Slow Down to 16.2% in 2019 due to Pessimistic

- 一周热料

- 紧缺物料秒杀

| 型号 | 品牌 | 询价 |

|---|---|---|

| RB751G-40T2R | ROHM Semiconductor | |

| CDZVT2R20B | ROHM Semiconductor | |

| BD71847AMWV-E2 | ROHM Semiconductor | |

| MC33074DR2G | onsemi | |

| TL431ACLPR | Texas Instruments |

| 型号 | 品牌 | 抢购 |

|---|---|---|

| BP3621 | ROHM Semiconductor | |

| STM32F429IGT6 | STMicroelectronics | |

| IPZ40N04S5L4R8ATMA1 | Infineon Technologies | |

| BU33JA2MNVX-CTL | ROHM Semiconductor | |

| ESR03EZPJ151 | ROHM Semiconductor | |

| TPS63050YFFR | Texas Instruments |

- 周排行榜

- 月排行榜

AMEYA360公众号二维码

识别二维码,即可关注

请输入下方图片中的验证码: