Global Cellular IoT Module Market Ekes Out Growth in 3Q 2022

The global cellular IoT module shipments grew by only 2% YoY in the third quarter of 2022, according to Counterpoint Research.

The global cellular IoT module shipments grew by only 2% year-on-year (YoY) in the third quarter of 2022 (Q3 2022), according to the latest research from Counterpoint Technology Market Research’s Global Cellular IoT Module and Chipset Tracker by Application.

China led the market followed by North America and Europe. China’s shipments decreased by 8% YoY in this quarter due to a resurgence of COVID-19 cases. However, some of this demand decline was offset by an increase in the residential, smart door lock, patient monitoring, registrar device, smoke detector, drone, smart meter and automotive applications. Other markets such as North America, Western Europe, India, Japan, Latin America, and Middle East and Africa witnessed healthy growth.

“Quectel is leading the cellular IoT module market, followed by Fibocom, Sunsea AIoT, China Mobile and MeiG. China is dominating this market with all the top five IoT module vendors being from the country. In the past few months, we have seen some consolidation among international players, like Telit taking over Thales’ IoT business and Semtech acquiring Sierra Wireless in the IoT module space to remain resilient against Chinese module vendors. With the increasing adoption of IoT technologies in various sectors, many players will consolidate to get bigger value from this fragmented value chain,” Associate Director Ethan Qi said.

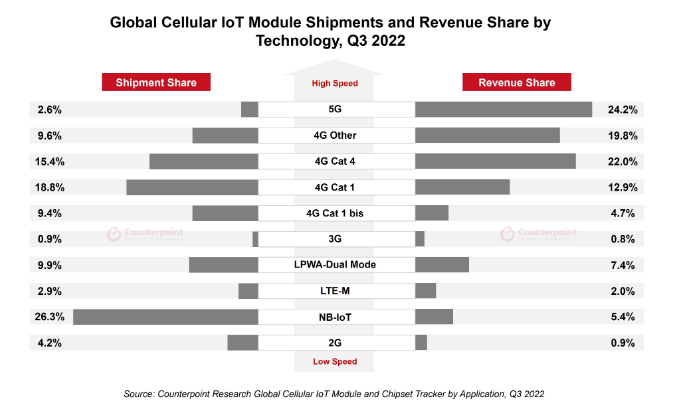

“The IoT module market is undergoing changes as demand for low-end technologies like 2G and 3G declines and shifts towards 4G Cat 1 and 4G Cat 1 bis, where higher-end applications are upgrading from 4G to 5G. In this quarter, the top three technologies in terms of shipments – NB-IoT, 4G Cat 1 and 4G Cat 4 – accounted for over 60% of the total shipments. However, in terms of revenue share, 5G, 4G Cat 4 and 4G Other were the top three technologies and held nearly two-thirds of the total revenue. The lower-end technologies such as NB-IoT, 4G Cat 1 and 4G Cat 1 bis are helping connect a greater number of IoT devices, while higher-end technologies like 4G Cat 4, 4G Other and 5G are adding more value to the IoT ecosystem. This is why the automotive, router/CPE, PC and industrial segments, which rely mostly on higher-end technologies, are generating more revenue,” said Senior Research Analyst Soumen Mandal.

During this quarter, Counterpoint Research saw some 4G Cat 1 and 4G Cat 1 bis-based applications being replaced with NB-IoT. Chinese NB-IoT chipset companies Eignecomm and Xinyi have improved their partnerships with module players, particularly in the domestic market.

“Besides, there were few options available for 4G Cat 1 bis chipsets in international markets, with Sequans being the exception. Last week, Qualcomm entered the 4G Cat 1 bis market by launching the QCX216 chipset in partnership with Quectel, Cavli Wireless and MoMAGIC. We believe that 4G Cat 1 bis technology will start to gain traction as leading IoT module and chipset players focus on it for use in massive IoT applications,” Mandal said. “Despite slower growth in IoT module shipments, IoT module revenue increased by 12% YoY in Q3 2022 due to a higher mix of 5G and 4G Cat 4 modules. The average selling price (ASP) of all types of 4G technologies and LTE-M continued to rise, while the ASP for 2G, 3G, 5G and NB-IoT technologies decreased. It is believed that 2023 will be a breakthrough year for 5G, and the ASP may decrease to below $100, which will help facilitate wider adoption.”

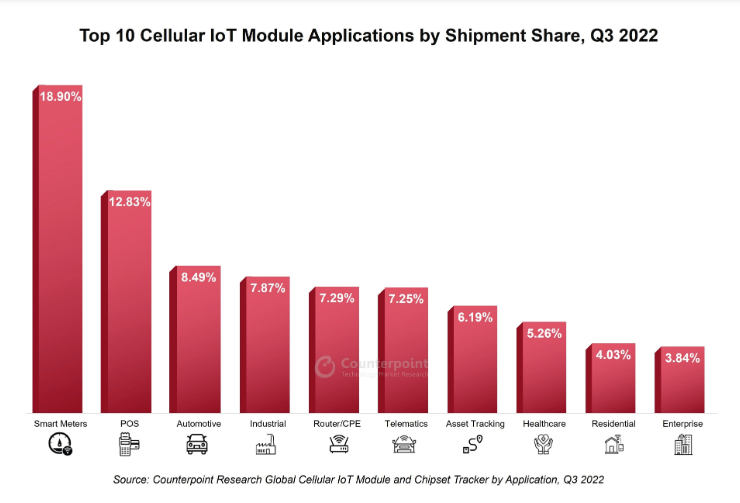

“The top 10 applications in the market captured more than 80% of shipments this quarter, with the top five being smart meters, POS, automotive, industrial and router/CPE. Smoke detectors saw the fastest growth, followed by residential applications and drones. China was a driving force in the growth of all three of these fast-growing segments, fueled by a resurgence of COVID-19 cases in the country,” Associate Director Mohit Agrawal said. “Among the top five applications, industrial and router/CPE applications saw a decrease in shipments both on a sequential and yearly basis. However, the industrial segment still presents a large opportunity due to the number of companies embarking on digital transformation projects.”

在线留言询价

Energy-efficient encryption for the IoT

- 一周热料

- 紧缺物料秒杀

| 型号 | 品牌 | 询价 |

|---|---|---|

| RB751G-40T2R | ROHM Semiconductor | |

| BD71847AMWV-E2 | ROHM Semiconductor | |

| CDZVT2R20B | ROHM Semiconductor | |

| MC33074DR2G | onsemi | |

| TL431ACLPR | Texas Instruments |

| 型号 | 品牌 | 抢购 |

|---|---|---|

| IPZ40N04S5L4R8ATMA1 | Infineon Technologies | |

| STM32F429IGT6 | STMicroelectronics | |

| ESR03EZPJ151 | ROHM Semiconductor | |

| BU33JA2MNVX-CTL | ROHM Semiconductor | |

| TPS63050YFFR | Texas Instruments | |

| BP3621 | ROHM Semiconductor |

- 周排行榜

- 月排行榜

AMEYA360公众号二维码

识别二维码,即可关注

请输入下方图片中的验证码: