- Ameya360 Component Supply Platform >

- Trade news >

- Ameya360:LCD Monitor Shipments Forecast to Return to Pre-Pandemic Level for 2023

Ameya360:LCD Monitor Shipments Forecast to Return to Pre-Pandemic Level for 2023

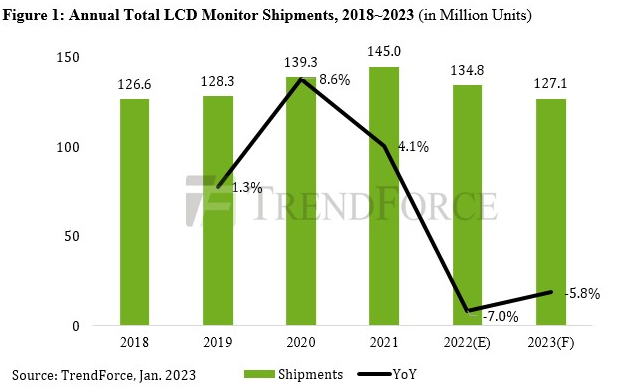

LCD monitor shipments are estimated to reach around 135 million units for 2022, showing a year-on-year (YoY) drop of 7%, according to TrendForce. Even though shipments on the whole were relatively stable during the first half of 2022 (1H 2022), the demand from the commercial segment of the LCD monitor market slowed down significantly in 2H 2022 as enterprises were scaling back their budgets.

Furthermore, the effects of the ongoing inflation and rising interest rates became more prominent over time, and the demand for consumer electronics fell considerably as a result. This development thus impacted the consumer segment of the LCD monitor market during 2H 2022. Regarding 2023, the pandemic-related demand has subsided, and there are still a lot of uncertainties with respect to the course of the global economy and politics. Given this situation, TrendForce projects that LCD monitor shipments will return to the pre-pandemic level, coming to around 127 million units and registering a YoY decline of about 5.8%.

TrendForce states that LCD monitor shipments on the whole were relatively stable during 1H 2022. In 2Q 2022, the demand for LCD monitors did experience a freeze because of the Russia-Ukraine military conflict. The ongoing global inflation was exacerbated by this geopolitical event, thereby compelling consumers to allocate a greater share of their budgets to daily necessities and reduce their spending on consumer electronics.

However, commercial customers in Europe and North America still had some leftover portions of earlier orders that were originally scheduled to be fulfilled in 2021. The release of this deferred demand not only helped prop up LCD monitor shipments for the entire 2022 but also enabled HP to climb back to second place in the global ranking of LCD monitor brands by annual shipments.

The annual total shipments of the global top 10 LCD monitor brands are forecasted rise by about 1% YoY for 2023. This projection is based on the top 10 brands’ respective shipment targets for the year. Now, with the arrival of 2023, orders from commercial customers are showing a substantial shrinkage. Therefore, Dell and HP have lowered their annual shipment targets.

The target that Dell has set for 2023 is 11.4% lower than its shipment result for 2022. As for HP, the target it has set for 2023 is 3.1% lower than its shipment result for 2022. Turning to Chinese commercial monitor brand Lenovo, its target for 2023 is almost on par with its shipment result for 2022.

Conversely, consumer monitor brands have significantly raised their annual shipment targets for 2023 because most of them posted a weak shipment result for 2022. Nevertheless, the scale of the entire LCD monitor market is expected to keep shrinking during 2023, so raising shipments is going to be a fairly challenging endeavor.

TrendForce believes that maintaining profitability by upgrading specifications may be more important for monitor brands than simply increasing unit shipments. For instance, monitor brands could introduce more high-end OLED monitors, or they could follow the two major brands Dell and Acer in replacing the existing 60Hz or 75Hz products with 100Hz ones. These are some of the specification upgrades that could help retain a healthy profit margin.

Online messageinquiry

- Week of hot material

- Material in short supply seckilling

| model | brand | Quote |

|---|---|---|

| TL431ACLPR | Texas Instruments | |

| BD71847AMWV-E2 | ROHM Semiconductor | |

| MC33074DR2G | onsemi | |

| RB751G-40T2R | ROHM Semiconductor | |

| CDZVT2R20B | ROHM Semiconductor |

| model | brand | To snap up |

|---|---|---|

| ESR03EZPJ151 | ROHM Semiconductor | |

| BP3621 | ROHM Semiconductor | |

| TPS63050YFFR | Texas Instruments | |

| IPZ40N04S5L4R8ATMA1 | Infineon Technologies | |

| STM32F429IGT6 | STMicroelectronics | |

| BU33JA2MNVX-CTL | ROHM Semiconductor |

- Week of ranking

- Month ranking

Qr code of ameya360 official account

Identify TWO-DIMENSIONAL code, you can pay attention to

Please enter the verification code in the image below: