- Ameya360 Component Supply Platform >

- Trade news >

- Industry Upswing: End of Cycles?

Industry Upswing: End of Cycles?

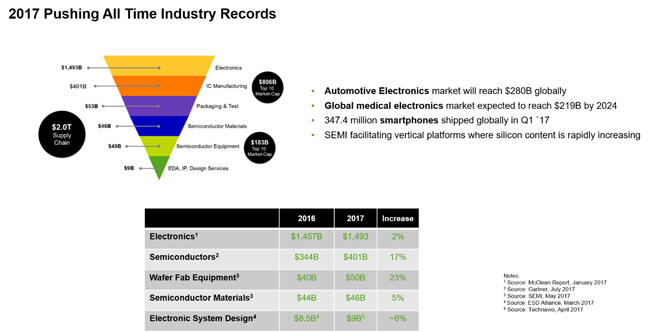

This is an exciting year to be in the semiconductor industry as Ajit Manocha, president and CEO of SEMI highlighted at SEMICON West; semiconductor-related companies are trading at all-time highs, and record device shipments and revenues as well as equipment revenues are expected (see Figure 1). This growth is primarily fueled by demand drivers such as Automotive Electronics, Medical Electronics, Mobile Phones, and Industrial Electronics. With this recent growth spurt and the proliferation of end-market applications that consume ever increasing numbers of semiconductors, it is tempting to conclude that the industry has seen the end of cycles.

At the annual SEMI/Gartner, Bulls & Bears Industry Outlook symposium, Stifel’s Patrick Ho, asserted that “Gone are the days of your grandfather's cycles.” Robert Marie of Semiconductor Advisors, maintained that “Cycle shape has changed due to demand drivers, consolidation, maturation and other factors.”

However, Gartner’s Bob Johnson was quick to assert, “Whenever people say that cycles are over and that the industry is going to grow forever ─ the industry is at a peak.” He noted that Gartner expects semiconductor revenues to surpass $400 billion this year, increase two percent next year, but decline in 2019. He indicated that Memory is driving this year’s market expansion but will drag down market growth next year as pricing gains achieved will be lost beginning in the fourth quarter of this year. The softness in 2018 is expected to have a detrimental impact on the industry’s spending plans. Gartner predicts that capital spending will shrink to just under one percent next year and contract 7 percent in 2019.

In addition to softer memory pricing in the near term, Gartner does not anticipate that China will invest significant amounts until 2020/2021. SEMI on the other hand is currently modeling an increase of 9 percent in fab equipment expenditures in 2018, which is largely driven by China. China is expected to have an even greater impact on global fab capital expenditures, claiming the top position in 2019, according to SEMI.

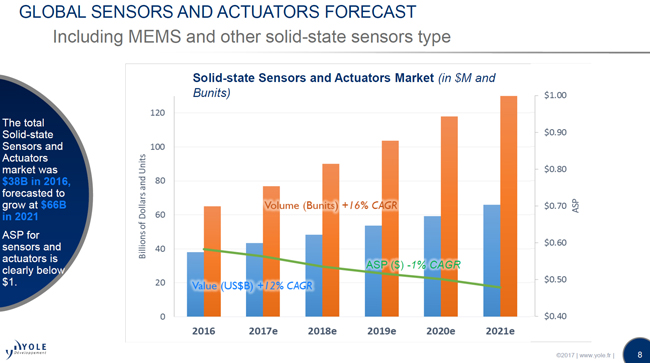

Looking at demand drivers, more specifically the “Internet of Things”, it is clear that the explosion of connected “things” is fundamentally reshaping our industry. The fragmented nature of these markets require niche applications and device architectures with the majority of these devices being commoditized MEMS and other solid-state sensors. Growing market revenue does not necessarily translate into industry profitability as the declining average selling price in Figure 2 shows.

So how can the industry benefit from all of this connectivity? Dr. Sam Wang from Gartner discussed how the Internet of Things has made AI practical, and how artificial intelligence brings out the value of IoT. He noted that AI:

Drives the demand for advanced wafer process technologies

Encourages the adoption of HMC, HBM, eDRAM, ReRAM, PCM, STT-MRAM, memristors processing in memory

Incorporates ADC within sensors and computing in sensors

Increases the use of 2.5D, 3D, TSV and SiP technologies

Enables chip design flow optimization in EDA

Fuels the need of new ATE testers for testing complex AI chips

Prompts more start-ups and M&A opportunities

The overwhelming majority of semiconductor devices used in IoT are commodities, creating a renaissance for smaller wafer diameter fabs (200mm and smaller; see related 200mm article). The value of the IoT will come from the ecosystem that supports it, such as data centers and networks that enable connectivity. There are also opportunities for the adoption of new processor technologies, as Gartner’s Werner Goertz pointed out. He stated that the current processors used in IoT processing were designed for very different use cases, and that conditions are now ripe for a disruptive processor supply chain to optimize edge-based AI.

2017 is indeed going to be a great year for the semiconductor industry: device average selling prices have improved dramatically, device manufacturers are investing in new capacity, while stock prices of suppliers throughout the supply chain are trading at elevated levels. 2018 is anticipated by many industry pundits to be another growth year, albeit at more conservative growth levels. Although the Internet of Things literally offers the industry billions of applications, its full impact on the industry remains to be seen. And we’ll definitely keep a close eye on developments in China.

Online messageinquiry

- Week of hot material

- Material in short supply seckilling

| model | brand | Quote |

|---|---|---|

| CDZVT2R20B | ROHM Semiconductor | |

| TL431ACLPR | Texas Instruments | |

| RB751G-40T2R | ROHM Semiconductor | |

| MC33074DR2G | onsemi | |

| BD71847AMWV-E2 | ROHM Semiconductor |

| model | brand | To snap up |

|---|---|---|

| STM32F429IGT6 | STMicroelectronics | |

| IPZ40N04S5L4R8ATMA1 | Infineon Technologies | |

| ESR03EZPJ151 | ROHM Semiconductor | |

| BU33JA2MNVX-CTL | ROHM Semiconductor | |

| BP3621 | ROHM Semiconductor | |

| TPS63050YFFR | Texas Instruments |

- Week of ranking

- Month ranking

Qr code of ameya360 official account

Identify TWO-DIMENSIONAL code, you can pay attention to

Please enter the verification code in the image below: