ST Focuses MEMS Strategy on Industrial IoT

STMicroelectronics is making a big push into the Industrial IoT space with the announcement of a range of high-accuracy MEMS sensors and components designed to last for at least 10 years, serving the needs of advanced automation environments in which machines can be expected to perform for many years.

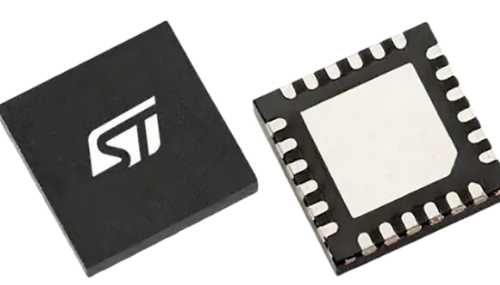

As part of this strategy, the company has launched its first product, the IIS3DHHC low-noise three-axis accelerometer, which is optimized for high measurement resolution and stability to ensure accuracy over time and temperature. The MEMS sensor targets precision inclinometers in antenna-positioning mechanisms for communication systems, structural health monitoring (SHM) equipment for keeping buildings and bridges safe, and stabilizers or levelers for a wide variety of industrial platforms. Its long-term accuracy and robustness are also ideal for high-sensitivity tilt and security sensors, as well as image stabilization in high-end digital still cameras (DSCs).

This will be part of a range of MEMS sensors for smart factories and industrial automation. STMicro says that its 10-year longevity commitment assures long-term availability of a wide range of high-performing components used in industrial equipment, helping vendors handle the typically long in-market lifetimes of their products and extended operation in challenging environmental conditions. In addition to industrial sensors, the program covers STM32 microcontrollers, motor drivers, analog components, power converters, LEDs, and existing MEMS sensors that will be supported for at least 10 years.

In a briefing with EE Times, Andrea Onetti, group VP and general manager, MEMS Sensors Division, STMicroelectronics, said, “There are big opportunities for MEMS sensors in the industrial environment. In the past five to six years, the adoption of MEMS has been limited and mostly driven by smartphones. But as we enter the age of automation, smart industry, and smart driving, the demand for sensors will grow at a consumer pace here, too. However, there will be a requirement for a completely new generation of MEMS in terms of accuracy, performance, and longevity.”

The differences in characteristics required for MEMS sensors in consumer, automotive, and industrial markets.Source: STMicroelectronics.

Onetti emphasized that MEMS sensors used in the mobile industry to date didn’t need to address accuracy and precision — for example, they might have needed to do basic measurements like portrait and landscape detection. However, in smart manufacturing, accuracy and longevity would be paramount. “The fourth industrial revolution, or Industrie 4.0, is here, and this implies you’ll need a lot of sensors," Onetti said. "A machine that can detect and analyze its own functions, such as noise, vibration, and temperature, will need its own hardware ecosystem to make the machine smart.”

He said that the sensors would not be limited to human interaction but would involve machine-to-machine interaction and intelligence, and that would require new types of sensors with wider performance characteristics. An example would be the leakage of a pipe; a normal microphone sensor would probably have a bandwidth just sufficient for the human ear, around 20 kHz, but for the industrial environment in which machines need to listen, this might need more like 80-kHz bandwidth.

Onetti also echoed what we’ve been hearing a lot of in recent months in terms of more intelligence at the edge in Industrial IoT. “For monitoring, if you can play in a smart way with some local intelligence, you can save a lot of mobile data costs that would be incurred in constantly sending data to the cloud.”

The new STMicro focus on Industrial IoT is clearly based on a recognition that growth in MEMS sales for smartphones is flattening, as its first-quarter results have shown. Onetti said, “The number of units of smartphones being shipped annually, which has been a primary driver of the MEMS sensors market, has been relatively flat at around 1.6 billion. However, the new growth market for MEMS sensors is high-accuracy devices, both in the industrial market as well as for new advanced features in the smartphone market.” He says that the key market for this growth will be Europe, but the U.S. and China are not to be neglected.

Commenting on the introduction of the new IIS3DHHCinclinometers, he added, “These high-quality industrial sensors leverage our investments in MEMS design and high-yield fabrication processes to deliver superior performance with low ownership costs for applications where the highest precision, repeatability, and robustness are critical. We will continue to introduce new types of precision sensors for industrial applications in the coming months, covered by our 10-year longevity commitment, including combination sensors, specialized sensors, and complete inertial modules.”

With full-scale range of ±2.5 g, the IIS3DHHC three-axis accelerometer is optimized for fine-positioning mechanisms and detecting small movements such as in advanced security sensors. Among key differences between this and typical consumer-oriented accelerometers, its ultra-low noise of 45 μg/√Hz (micro-g per root Hz) allows very high resolution.

STMicro says that extreme stability ensures minimal drift of sensor characteristics over time or wide temperature variations. Sensitivity changes by less than 0.7% from –40°C and 85°C. Offset drift is below 0.4 mg/°C. This enables equipment to deliver consistent performance in various environments, including outdoors in cold or warm climates, or in industrial equipment, industrial robots, and drones, with minimal calibration or recalibration required.

In addition, the inclinometer integrates analog-digital conversion, as well as digital circuitry including FIFO data storage and interrupt control. This saves external conversion components and simplifies power management to reduce energy demand and to enable longer run times for battery-powered equipment.

The IIS3DHHC is in production now in a high-quality 16-lead 5 x 5 x 1.7-mm ceramic LGA package, priced from $4.50 for orders of 1,000 pieces.

在线留言询价

- 一周热料

- 紧缺物料秒杀

| 型号 | 品牌 | 询价 |

|---|---|---|

| MC33074DR2G | onsemi | |

| CDZVT2R20B | ROHM Semiconductor | |

| RB751G-40T2R | ROHM Semiconductor | |

| BD71847AMWV-E2 | ROHM Semiconductor | |

| TL431ACLPR | Texas Instruments |

| 型号 | 品牌 | 抢购 |

|---|---|---|

| IPZ40N04S5L4R8ATMA1 | Infineon Technologies | |

| ESR03EZPJ151 | ROHM Semiconductor | |

| BU33JA2MNVX-CTL | ROHM Semiconductor | |

| BP3621 | ROHM Semiconductor | |

| TPS63050YFFR | Texas Instruments | |

| STM32F429IGT6 | STMicroelectronics |

- 周排行榜

- 月排行榜

AMEYA360公众号二维码

识别二维码,即可关注

请输入下方图片中的验证码: