STMicroelectronics to Invest EUR 5 Billion in New SiC Wafer Fab

STMicroelectronics, following its EUR 7.5 billion wafer fab project with GlobalFoundries in Crolles, France. is set to invest EUR 5 billion in building a new SiC super semiconductor wafer fab in Catania, Sicily, Italy. The fab in Italy will specialize in producing SiC chips, a pivotal technology for electric vehicles with substantial growth potential, according to French media L’Usine Nouvelle on November 26th,

STMicroelectronics competitively plans to transition to 8-inch wafers starting from 2024. The company will integrate Soitec’s SmartSiC technology to enhance efficiency and reduce carbon emissions. Simultaneously, STMicroelectronics aims to increase capacity, achieve internal manufacturing, and collaborate with Chinese firm Sanan Optoelectronics to raise SiC chip-related revenue from the expected USD 1.2 billion in 2023 to USD 5 billion by 2030.

On June 7th earlier this year, STMicroelectronics and Sanan Optoelectronics announced a joint venture to establish a new 8-inch SiC device fab in Chongqing, China, with an anticipated total investment of USD 3.2 billion.

To ensure the successful implementation of this extensive investment plan, Sanan Optoelectronics said to utilize its self-developed SiC substrate process to construct and operate a new 8-inch SiC substrate fab independently.

TrendForce: over 90% SiC market share by major global players

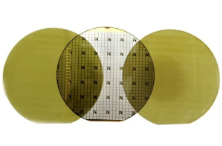

According to TrendForce, the SiC industry is currently dominated by 6-inch substrates, holding up to 80% market share, while 8-inch substrates only account for 1%. Transitioning to larger 8-inch substrates is a key strategy for further reducing SiC device costs.

8-inch SiC substrates offer significant cost advantages than 6-inch substrates. The industry’s major players in China, including SEMISiC, Jingsheng Mechanical & Electrical Co., Ltd. (JSG), Summit Crystal, Synlight Semiconductor, KY Semiconductor, and IV-SemiteC, are advancing the development of 8-inch SiC substrates. This shift from the approximately 45% of total production costs associated with substrates is expected to facilitate the broader adoption of SiC devices and create a positive cycle for major companies.

Not only Chinese companies but also international semiconductor giants like Infineon Technologies and Onsemi are actively vying for a share of the market. Infineon has already prepared the first batch of 8-inch wafer samples in its fab and plans to convert them into electronic samples soon, with mass production applications scheduled before 2030. International device companies like Onsemi and ROHM have also outlined development plans for 8-inch SiC wafers.

Currently, major companies hold over 90% of the market share, intensifying competition. A slowdown in progress could provide opportunities for followers. According to TrendForce, the market share of the top 5 SiC power semiconductor players in 2022 was dominated by STMicroelectronics (36.5%), Infineon (17.9%), Wolfspeed (16.3%), Onsemi (11.6%), and ROHM (8.1%), leaving the remaining companies with only 9.6%.

在线留言询价

Embedded AI Solutions Ease ML Development

STMicroelectronics and eYs3D Microelectronics to Highlight 3D Stereo-vision Camera at CES 2023

- 一周热料

- 紧缺物料秒杀

| 型号 | 品牌 | 询价 |

|---|---|---|

| RB751G-40T2R | ROHM Semiconductor | |

| MC33074DR2G | onsemi | |

| BD71847AMWV-E2 | ROHM Semiconductor | |

| TL431ACLPR | Texas Instruments | |

| CDZVT2R20B | ROHM Semiconductor |

| 型号 | 品牌 | 抢购 |

|---|---|---|

| TPS63050YFFR | Texas Instruments | |

| STM32F429IGT6 | STMicroelectronics | |

| BU33JA2MNVX-CTL | ROHM Semiconductor | |

| IPZ40N04S5L4R8ATMA1 | Infineon Technologies | |

| BP3621 | ROHM Semiconductor | |

| ESR03EZPJ151 | ROHM Semiconductor |

- 周排行榜

- 月排行榜

AMEYA360公众号二维码

识别二维码,即可关注

请输入下方图片中的验证码: