- Ameya360 Component Supply Platform >

- Trade news >

- Global Mobile DRAM Revenue Reached a New Record High in 1Q18

Global Mobile DRAM Revenue Reached a New Record High in 1Q18

DRAMeXchange, a division of TrendForce, reports that smartphone brands had then spent three months adjusting their inventories before they again started to stock up on components toward the end of February 2018, when the end demand also began to bounce back. Much of the stock-up demand has been related to high-density memory components for new flagship smartphones that are to be released in 1H18. Revenue-wise, mobile DRAM suppliers in 1Q18 benefitted from new product releases, demand recovery in the smartphone market (since the middle of the quarter), and the increase in quotes. As a result, the global mobile DRAM revenue rose by 5.3% QoQ against seasonal headwinds to a new record high of US$8.435 billion.

The mobile DRAM market will be seeing a moderation of the price upswing in 2Q18. Nevertheless, demand from major Chinese smartphone brands, Huawei, Xiaomi, OPPO and Vivo, remains strong. Apple will raise the memory densities of iPhone models for 2018. Android phone makers, too, will do the same for their devices that are set for release this year. DRAMeXchange thus forecasts that the global mobile DRAM revenue will maintain QoQ growth in 2Q18 and again achieve a new record high.

Samsung was still the overall revenue leader in 1Q18. However, Samsung’s quoting has become more conservative during 1Q18 and 2Q18 compared with the prior quarters due to the investigation by China’s National Development and Reform Commission. To get around the constraints that are imposed on its pricing strategy, Samsung has been aggressively promoting high-density products together with its advanced manufacturing technology.

Samsung was again at the top of the mobile DRAM revenue ranking for 1Q18 with a total of US$4.766 billion, as the company was successful in winning orders for high-density products. On the technology front, Samsung’s deployment of its 18nm process now extends to almost all of its mobile DRAM product lines. Only a few LPDDR3 eMCP lines are still produced on the older 20nm process.

SK Hynix’s mobile DRAM revenue for 1Q18 increased by just 2.2% QoQ despite the general upswing in contract prices. The marginal growth was attributed to the issues with raising the yield rate and production capacity of the 18nm process, which is still at the initial stage of development. Because of the challenges with the 18nm, SK Hynix could not increase its shipments of high-density LPDDR4 components for flagship smartphones in 1Q18.

Currently, the 21nm process and the 25nm shrink process are still the main technologies that SK Hynix use for manufacturing LPDDR4 and LPDDR3 series, respectively. The portion of 18nm products in SK Hynix’s mobile DRAM portfolio (including discrete and eMCP) is not expected to increase noticeably until 3Q18. Also, the penetration rate of the 18nm technology in the manufacturing of the supplier’s mobile DRAM for the entire 2018 may be less than 10%.

Micron’s mobile DRAM revenue for 1Q18 went up by 10.2% QoQ to US$1.408 billion, showing the largest increase among the top three suppliers. Micron’s impressive result was based on the strong overall demand and the persistent price upswing. In terms of technology development of Micron’s subsidiaries, Micron Memory Taiwan (formerly Rexchip) in 2Q18 will continue to increase the share of 17nm process in its mobile DRAM production.

On the other hand, Micron Technology Taiwan (formerly Inotera) mainly produces mobile DRAM on the 20nm process for now. As for product planning, Micron’s mainstream offerings for the mobile application will soon make the switch from the LPDDR3 series to the LPDDR4 series, which is projected to represent more than 50% of the supplier’s total mobile DRAM output (including the output of both subsidiaries) for the whole 2018.

Regarding Taiwan-based suppliers, Nanya’s mobile DRAM revenue for 1Q18 advanced significantly by 19.1% QoQ to US$96 million. Nanya expanded shipments of its LPDDR3 4Gb chips in 1Q18 because many IDHs (independent design houses) have chosen discrete packages (i.e. discrete DRAM plus discrete NAND Flash) over eMCPs due to considerations over BOM (bill of materials) costs. This in turn contributed to the strong revenue growth. In terms of technological development, Nanya is still mainly using the 30nm shrink process for the manufacturing of its mobile DRAM products.

However, the company will expand the deployment its 20nm process in the mobile DRAM production in order to increase the profit margin. Winbond’s revenue performance was fairly stable in1Q18, registering a quarterly increase by 1.2% from 4Q17 to a total of US$44 million. Winbond’s mobile DRAM offerings are more limited in their application scopes, so the demand for them have not risen sharply.

Online messageinquiry

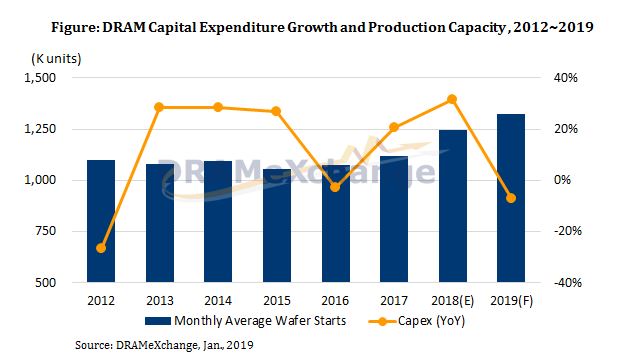

DRAM Prices Forecast to Crash in Q1

DRAM Market to See Lower Capital Expenditure and Moderated Bit Output in 2019 Due to Weak Demand

DRAM Outlook Dims for 2019

- Week of hot material

- Material in short supply seckilling

| model | brand | Quote |

|---|---|---|

| RB751G-40T2R | ROHM Semiconductor | |

| TL431ACLPR | Texas Instruments | |

| MC33074DR2G | onsemi | |

| BD71847AMWV-E2 | ROHM Semiconductor | |

| CDZVT2R20B | ROHM Semiconductor |

| model | brand | To snap up |

|---|---|---|

| BU33JA2MNVX-CTL | ROHM Semiconductor | |

| TPS63050YFFR | Texas Instruments | |

| BP3621 | ROHM Semiconductor | |

| ESR03EZPJ151 | ROHM Semiconductor | |

| STM32F429IGT6 | STMicroelectronics | |

| IPZ40N04S5L4R8ATMA1 | Infineon Technologies |

- Week of ranking

- Month ranking

Qr code of ameya360 official account

Identify TWO-DIMENSIONAL code, you can pay attention to

Please enter the verification code in the image below: