- Ameya360 Component Supply Platform >

- Trade news >

- China Meets With Micron Over DRAM Price Increases

China Meets With Micron Over DRAM Price Increases

It's certainly not news to enthusiasts that sky-high RAM pricing continues, but luckily government agencies and law firms are taking notice.

China is ratcheting up the pressure on DRAM vendors as the memory shortage, and resulting price hikes, continue. The country is also fostering its own domestic DRAM production to head off future supply shortages.

According to a new report from TrendForce's analyst outfit DRAMeXchange, Micron has met with China's Anti-Monopoly Bureau of Commerce to answer questions regarding the continued increase in DRAM pricing. These same concerns are at the heart of a looming class-action lawsuit from the U.S.-based Hagens Berman firm, which contends that the leading memory producers are engaging in DRAM price fixing.

China is the world's largest consumer of memory chips, currently absorbing roughly 20% of the world's NAND and DRAM, which it then turns into products that it primarily exports to the rest of the world. As such, the continuing price hikes for DRAM have a profound impact on many of its bread and butter segments, such as smartphone production.

China has taken notice of the other DRAM players, too. The Micron meetings come after China's meetings with Samsung in December, which was precipitated by requests from smartphone makers to investigate the company for monopolistic practices pertaining to memory pricing. Samsung later signed a new Memorandum of Agreement (MOU) with China, which finds the company investing and cooperating in developing next-gen technologies with the country. Many analysts have speculated the extension of the existing agreement, which had expired, was meant to assuage China's regulatory agencies.

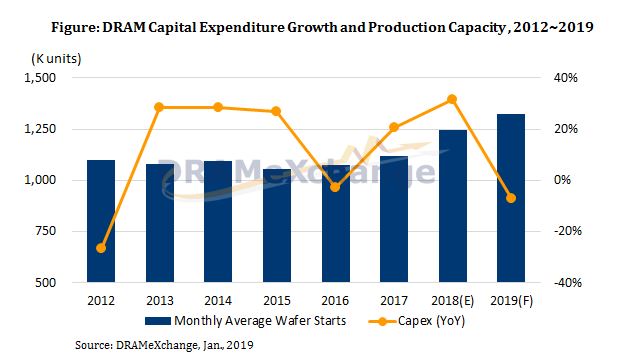

According to DRAMeXchange, China's meetings with Samsung earlier this year should lead to some moderation in increasing prices for DRAM, and the country's intervention may result in increased production.

Micron is the smallest player in the DRAM market, accounting for 22.6% of global supply, while Samsung and SK Hynix both hold larger shares. There haven't been any reports of meetings with South Korean chipmaker SK Hynix, but given the current climate, we expect China will soon aim its pointed questions at that company, too.

DRAM production is a capital- and time-intensive exercise, so it could be nearly a year before any changes to the dominant players’ production plans have an impact on inflated pricing.

Meanwhile, China's own domestic memory production is beginning to take flight. Fujian Jinhua Integrated Circuit Co. (JHICC) is one of the emerging Chinese memory producers. China is also concerned that Micron is blocking the supply of equipment to JHICC, which has been targeted by Micron in the past for infringing on its patents. Given the country's government-backed initiatives to bolster indigenous chip production, China is taking a keen interest in the dispute.

Most of China's domestic DRAM production is expected to be sold in-country, as it might not pass muster for the international market due to possible patent violations. As a result, we might not see some of the familiar Chinese tactics, such as price dumping in international markets. In either case, the government-backed production is expected to offset some of China's memory imports, which would eventually result in cheaper chips for everyone.

Online messageinquiry

DRAM Prices Forecast to Crash in Q1

DRAM Market to See Lower Capital Expenditure and Moderated Bit Output in 2019 Due to Weak Demand

DRAM Outlook Dims for 2019

- Week of hot material

- Material in short supply seckilling

| model | brand | Quote |

|---|---|---|

| BD71847AMWV-E2 | ROHM Semiconductor | |

| CDZVT2R20B | ROHM Semiconductor | |

| MC33074DR2G | onsemi | |

| RB751G-40T2R | ROHM Semiconductor | |

| TL431ACLPR | Texas Instruments |

| model | brand | To snap up |

|---|---|---|

| STM32F429IGT6 | STMicroelectronics | |

| TPS63050YFFR | Texas Instruments | |

| BP3621 | ROHM Semiconductor | |

| IPZ40N04S5L4R8ATMA1 | Infineon Technologies | |

| ESR03EZPJ151 | ROHM Semiconductor | |

| BU33JA2MNVX-CTL | ROHM Semiconductor |

- Week of ranking

- Month ranking

Qr code of ameya360 official account

Identify TWO-DIMENSIONAL code, you can pay attention to

Please enter the verification code in the image below: