DRAM sales forecast to top $100B this year with 39% market growth

IC Insights recently released its Mid-Year Update to The McClean Report 2018. The update includes a revised forecast of the largest and fastest-growing IC product categories this year. Sales and unit growth rates are shown for each of the 33 IC product categories defined by the World Semiconductor Trade Statistics (WSTS) organization in the Mid-Year Update.

The five largest IC product categories in terms of sales revenue and unit shipments are shown in Figure 1. With forecast sales of $101.6 billion, (39% growth) the DRAM market is expected to be the largest of all IC product categories in 2018, repeating the ranking it held last year. If the sales level is achieved, it would mark the first time an individual IC product category has surpassed $100.0 billion in annual sales. The DRAM market is forecast to account for 24% of IC sales in 2018. The NAND flash market is expected to achieve the second-largest revenue level with total sales of $62.6 billion this year. Taken together, the two memory categories are forecast to account for 38% of the total $428.0 billion IC market in 2018.

For many years, the standard PC/server MPU category topped the list of largest IC product segments, but with ongoing increases in memory average selling prices, the MPU category is expected to slip to the third position in 2018. In the Mid-Year Update, IC Insights slightly raises its forecast for 2018 sales in the MPU category to show revenues increasing 5% to an all-time high of $50.8 billion, after a 6% increase in 2017 to the current record high of $48.5 billion. Helping drive sales this year are AI-controlled systems and data-sharing applications over the Internet of Things. Cloud computing, machine learning, and the expected tidal wave of data traffic coming from connected systems and sensors is also fueling MPU sales growth this year.

Two special purpose logic categories—computer and peripherals, and wireless communications—are forecast to round out the top five largest product categories for 2018.

Four of the five largest categories in terms of unit shipments are forecast to be some type of analog device. Total analog units are expected to account for 54% of the total 318.1 billion IC shipments forecast to ship this year. Power management analog devices are projected to account for 22% of total IC units and are forecast to exceed the combined unit shipment total of the next three categories on the list. As the name implies, power management analog ICs help regulate power usage and to keep ICs and systems running cooler, to manage power usage, and ultimately to help extend battery life—essential qualities for an increasingly mobile and battery-powered world of devices.

在线留言询价

DRAM Prices Forecast to Crash in Q1

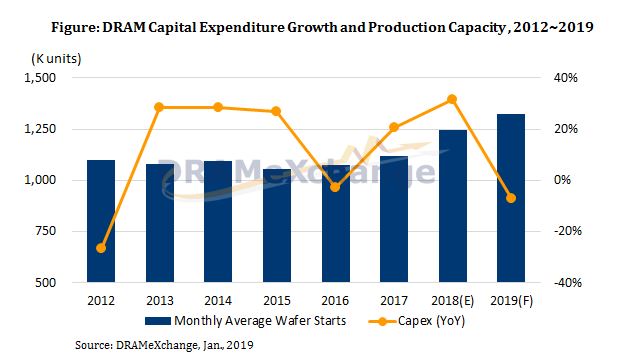

DRAM Market to See Lower Capital Expenditure and Moderated Bit Output in 2019 Due to Weak Demand

DRAM Outlook Dims for 2019

- 一周热料

- 紧缺物料秒杀

| 型号 | 品牌 | 询价 |

|---|---|---|

| RB751G-40T2R | ROHM Semiconductor | |

| MC33074DR2G | onsemi | |

| CDZVT2R20B | ROHM Semiconductor | |

| BD71847AMWV-E2 | ROHM Semiconductor | |

| TL431ACLPR | Texas Instruments |

| 型号 | 品牌 | 抢购 |

|---|---|---|

| BU33JA2MNVX-CTL | ROHM Semiconductor | |

| ESR03EZPJ151 | ROHM Semiconductor | |

| IPZ40N04S5L4R8ATMA1 | Infineon Technologies | |

| STM32F429IGT6 | STMicroelectronics | |

| BP3621 | ROHM Semiconductor | |

| TPS63050YFFR | Texas Instruments |

- 周排行榜

- 月排行榜

AMEYA360公众号二维码

识别二维码,即可关注

请输入下方图片中的验证码: