- Ameya360 Component Supply Platform >

- Trade news >

- Xiaomi wants to tempt Chinese buyers with more high-end smartphones

Xiaomi wants to tempt Chinese buyers with more high-end smartphones

Smartphone maker Xiaomi plans to sell more premium mobile phones in China because consumers are willing to pay for them, according to a senior company executive.

The company made that decision a year ago and there are indications it was a good move, Xiaomi's Chief Financial Officer, Chew Shou Zi, told CNBC's "Squawk Box' on Thursday.

"We believe that for this year, our strategic focus is to strengthen our position in the mid and high-tier market," Chew said.

Xiaomi started off by making high-end smartphones at substantially lower price points compared to other device makers. But increasingly, the company has faced intense competition from other low-cost Chinese rivals like OPPO and vivo.

"For this quarter, the reflection of the success of our strategy was an increase in our average selling price by 25 percent of our smartphones in China," Chew said.

He added that the shifting focus, along with expansion into offline channels, will "lay a very good groundwork for growth in 2019 and beyond."

Xiaomi shares rose 1.36 percent on Thursday morning in Hong Kong.

No. 4 smartphone maker in China

Xiaomi is the fourth-largest smartphone maker in China with about 13.8 percent of the market share, behind its rivals Huawei, OPPO and vivo, according to the International Data Corporation. The Chinese smartphone market has struggled for growth in recent years due to a high smartphone penetration rate.

In the second quarter of 2018, preliminary IDC data suggested that 105 million smartphones were shipped in China. That translates to a 5.9 percent drop from a year ago, but the pace of that decline narrowed compared to the first quarter, IDC said.

An employee, left, hands a Xiaomi Corp. branded shopping bag to a customer inside a Xiaomi store.

Anthony Kwan | Bloomberg | Getty Images

An employee, left, hands a Xiaomi Corp. branded shopping bag to a customer inside a Xiaomi store.

"The market's average selling price increased 15 [percent on-year] in the second quarter," Xi Wang, a senior market analyst at IDC China, wrote in a report. "This suggests that consumers are willing to pay more for a phone targeted for their needs, including not just better cameras but also emerging categories such as gaming."

Wang added that Chinese users continue to spend more and more time on mobile phones, and therefore, smartphone makers should emphasize things like "design, quality, and brand image" to drive replacements in China.

Internationally, Xiaomi's focus depends on various markets that it operates in, according to Chew.

"For the Indian market, in particular, because of where it is in terms of its [gross domestic product] growth overall, and its level of consumption spend, the consumers are actually demanding more entry-to-mid-tier level phones," he said, adding that users in Western Europe preferred more mid-to-high range devices.

Still, analysts have said that a notable part of Xiaomi's growth comes from the robust Indian smartphone market, which returned to double-digit growth in the second quarter. There, Xiaomi is battling the world's largest smartphone-maker Samsung for pole position.

Data from IDC said that Xiaomi had 29.7 percent of the market in the second quarter, compared to Samsung's 23.9 percent. However, technology market research firm Counterpoint Research, said the South Korean tech giant had a 1 percentage point lead over its Chinese rival.

On Wednesday, Xiaomi reported second-quarter earnings that beat expectations despite questions looming over its long-term business model. Smartphones contributed to the majority of the revenue, followed by its internet of things and lifestyle business and then internet services.

Chew said he was "very optimistic" about the future of the global internet services business that includes mobile games and video and music streaming services. Xiaomi said most of the internet services revenue for the second-quarter was generated in mainland China.

"We believe that if you provide a very good service to them, then monetization is a lot easier further down the road," he said.

"The priority today is to make sure that we acquire a lot of international users and then provide them with a very good service," Chew said.

Online messageinquiry

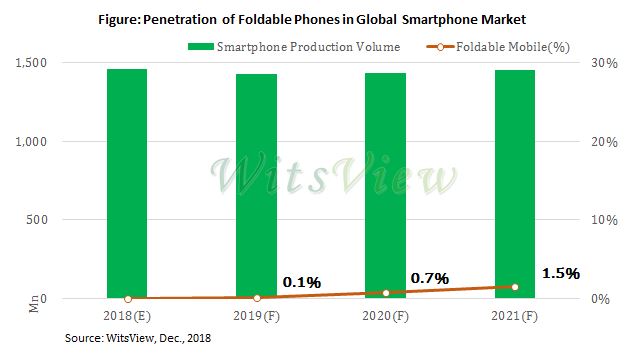

Growth Expected to Return to Smartphones

- Week of hot material

- Material in short supply seckilling

| model | brand | Quote |

|---|---|---|

| MC33074DR2G | onsemi | |

| BD71847AMWV-E2 | ROHM Semiconductor | |

| TL431ACLPR | Texas Instruments | |

| CDZVT2R20B | ROHM Semiconductor | |

| RB751G-40T2R | ROHM Semiconductor |

| model | brand | To snap up |

|---|---|---|

| STM32F429IGT6 | STMicroelectronics | |

| IPZ40N04S5L4R8ATMA1 | Infineon Technologies | |

| ESR03EZPJ151 | ROHM Semiconductor | |

| BP3621 | ROHM Semiconductor | |

| BU33JA2MNVX-CTL | ROHM Semiconductor | |

| TPS63050YFFR | Texas Instruments |

- Week of ranking

- Month ranking

Qr code of ameya360 official account

Identify TWO-DIMENSIONAL code, you can pay attention to

Please enter the verification code in the image below: