- Ameya360 Component Supply Platform >

- Trade news >

- Share of TDDI In-Cell Solutions for Smartphones Will Double Since the Tight Supply is Gradually Eased

Share of TDDI In-Cell Solutions for Smartphones Will Double Since the Tight Supply is Gradually Eased

The share of In-Cell solutions in the global smartphone market is estimated to reach 27.1% in 2018, marginal up from 26.2% of last year, according to the latest research on touch display solutions by WitsView, a division of TrendForce. This is due to the rapid adoption by Android smartphones, despite the fact that the new iPhones this year will not adopt In-Cell solutions. Particularly, the share of TDDI (Touch with Display Driver Integration) In-Cell solutions is likely to grow significantly to 17.3%, although the IC products for TDDI In-Cell products experience a tight supply.

“Branded smartphone vendors are now more willing to adopt TDDI In-Cell solutions, thanks to the maturation of IC products for TDDI and more IC suppliers’ entrance into the market”, says Boyce Fan, research director of WitsView. Despite the tight supply of wafer in the first half of 2018, smartphone vendors have actively searched for alternatives from second-tier IC manufacturers or foundries, or switched to Out-Cell design, so the overall supply and demand of TDDI IC has returned to a rational level in the second half of the year. Although the new iPhone models this year will adopt Out-Cell solutions, the share of TDDI In-Cell solutions is likely to grow significantly to 17.3%, up from 8.9% of last year driven by the promotion of IC manufacturers and panel makers.

“Right now, smartphones makers have been constantly optimizing the design of full-screen models, while pursuing narrower borders, which will jointly drive the development of TDDI IC products,” says Fan. For example, the adoption of Dual Gate in HD+ products and MUX6 in FHD+ products is aimed to narrow the border at the side of IC Bonding. Moreover, in order to cope with the tight supply, IC design houses have been exploring new capacity of wafer supply and may also consider the transition into more advanced processes, smaller IC sizes and new specs.

WitsView notes that the demand remains strong, and the tight supply of TDDI IC will be gradually eased with the new capacity. Therefore, the share of TDDI In-Cell solutions in the global smartphone market would continue to grow to 24.3% in 2019.

Online messageinquiry

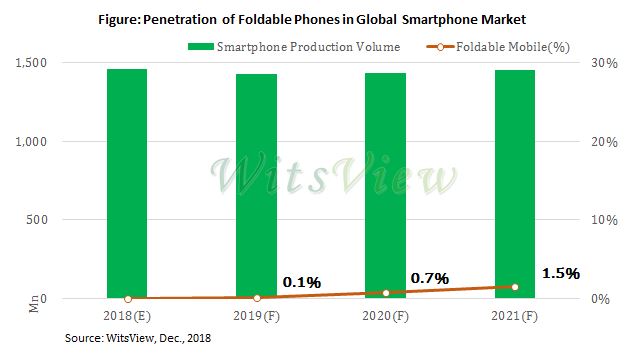

Growth Expected to Return to Smartphones

- Week of hot material

- Material in short supply seckilling

| model | brand | Quote |

|---|---|---|

| BD71847AMWV-E2 | ROHM Semiconductor | |

| RB751G-40T2R | ROHM Semiconductor | |

| TL431ACLPR | Texas Instruments | |

| MC33074DR2G | onsemi | |

| CDZVT2R20B | ROHM Semiconductor |

| model | brand | To snap up |

|---|---|---|

| ESR03EZPJ151 | ROHM Semiconductor | |

| TPS63050YFFR | Texas Instruments | |

| STM32F429IGT6 | STMicroelectronics | |

| BU33JA2MNVX-CTL | ROHM Semiconductor | |

| BP3621 | ROHM Semiconductor | |

| IPZ40N04S5L4R8ATMA1 | Infineon Technologies |

- Week of ranking

- Month ranking

Qr code of ameya360 official account

Identify TWO-DIMENSIONAL code, you can pay attention to

Please enter the verification code in the image below: