- Ameya360 Component Supply Platform >

- Trade news >

- Foxconn May Use Sharp to Roll out First Chip Fab

Foxconn May Use Sharp to Roll out First Chip Fab

Foxconn, the main assembler of Apple’s iPhones and iPads, is expected to flex its majority stake in Japan’s Sharp to build its first chip fab, according to analysts.

The world’s largest electronics contract manufacturer, also known as Hon Hai Precision, aims to launch a $9 billion fab near southern China’s Zhuhai city, Nikkei reported in late December, following earlier media reports. The total amount of the investment in the project could add up to around 60 billion yuan, or $9 billion, with most of the investment coming from the Zhuhai government. Foxconn did not answer queries from EE Times.

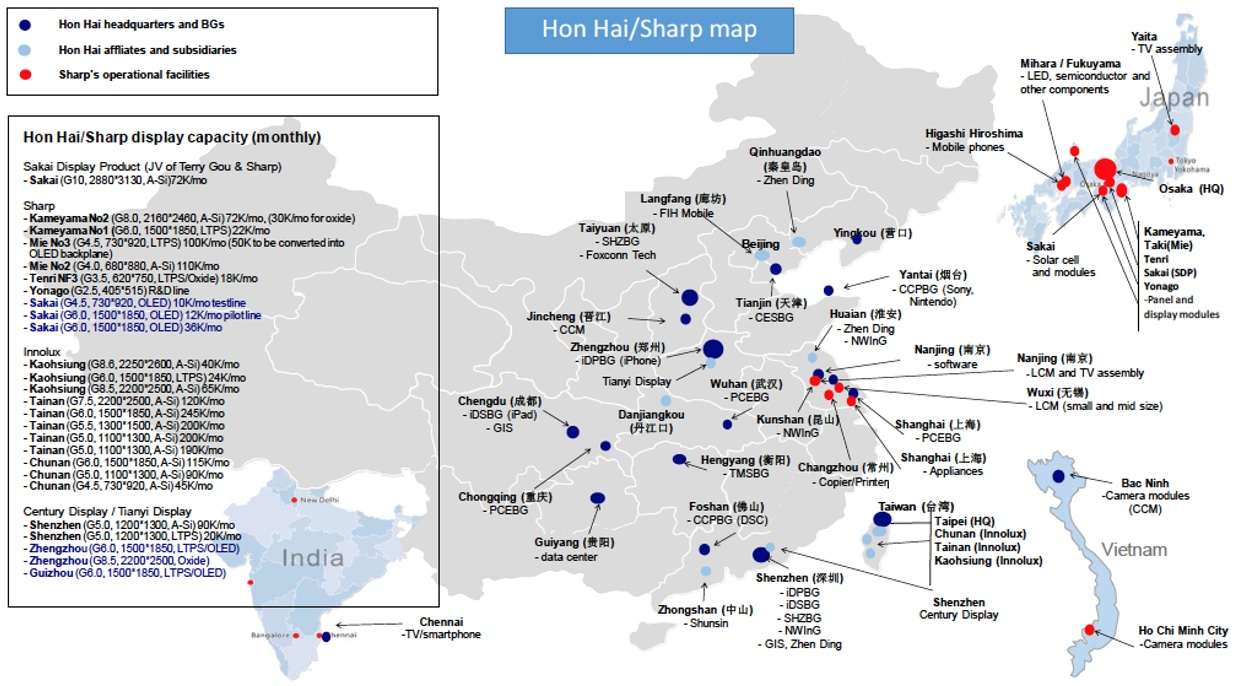

Initially, Foxconn is expected to draw on Sharp, which has experience making CCD/CMOS sensors, LCD drivers, game console CPUs and other logic. Japan’s leading LCD TV maker has operated an 8-inch fab in Fukuyama at the 0.13μm process node. Foxconn’s 2016 takeover of Sharp provides the ability to design and produce semiconductors for the first time in Foxconn’s history as it shifts from electronics assembly to higher margin chip production.

“One of the Hon Hai group’s goals when acquiring Sharp was to gain semiconductor technology,” Tokyo-based Mizuho Securities analyst Yasuo Nakane told EE Times. “If the overall investment totaled ¥1 trillion ($9 billion), we would expect Hon Hai group and Sharp to pay ¥200 billion and ¥100 billion, respectively.”

The plan comes as Foxconn is building a 10.5G LCD plant (90,000/month capacity for a-SI substrates) in the southern Chinese city of Guangzhou, with installation of equipment starting from early 2019 and production starting in the fourth quarter. Foxconn will shoulder about 30% of that investment, according to Nakane. The company will probably use a similar arrangement with China’s central government for the investment in the China fab, he said.

Unlike LCD operations, in which local governments are the main investors, chip projects are financed partly by China’s central government, which sees semiconductors as a more important field, Nakane said.

After decades of effort, China, with the world’s largest market for semiconductors, still depends on imports for most of its supply. Beijing’s more recent Made in China 2025 industrial policy, aimed at making the nation dominant in high-technology, faces opposition from the U.S. on issues of intellectual property theft.

Possible Downgrade of Wisconsin Project

The plan to build the fab in China may also signal a downgrading in Foxconn’s project to produce LCDs in the U.S. state of Wisconsin, according to Nakane.

“For Sharp, ¥100 billion would be a major investment, but the company looks less likely to invest in a 6G LCD plant Wisconsin (60,000/month capacity for IGZO ‘oxide’ substrates), so we can envision it diverting such funds to semiconductor facilities,” he said.

The main hurdle for the China fab project is likely to focus on securing intellectual property and engineers.

“If Sharp were to invest in a 12-inch wafer plant in China, we doubt it would begin operations using processes several generations old, and we think it currently lacks enough engineers for the task,” Nakane said.

Apple

Foxconn may use the project to reduce its reliance on Apple, which accounts for half of its annual revenue of NT$4.7 trillion ($152.65 billion), as the global smartphone market slows, the Nikkei report said.

The new fab will initially make chips for ultra high-definition 8K televisions and camera image sensors, as well as various sensors for industrial use and connected devices, the report said. The aim is eventually to expand the 12-inch chip facility in Zhuhai to make more advanced chips for robotics and autonomous vehicles, according to Nikkei.

Step by Step

Foxconn has made gradual steps into the semiconductor industry in recent years, mainly in the backend assembly and test segment.

In 2003, the company acquired the wireless IC module division of Ambit, which was part of the Acer group. The Ambit unit, renamed as Shunsin, now focuses on system in packaging for smartphone power amplifier modules with Apple and Samsung as the two major customers.

Over the long term, Foxconn may seek tie-ups with second- or lower-tier foundries as part of the chip fab plan, according to Nakane. One possibility would be Taiwan’s UMC Group, but such an alliance seems unlikely anytime soon, as the U.S. government has charged Taiwan’s second-largest foundry with illegally obtaining DRAM intellectual property, he said. Sharp also faces intellectual property-related constraints as its own library is limited to finished-product knowhow, he added.

Foxconn may be swimming upstream with the fab project. Global chip equipment spending in 2019 is projected to drop 8%, a sharp reversal from the previously forecast increase of 7%, according to the latest edition of the World Fab Forecast Report published by SEMI.

Plunging memory prices and a sudden shift in companies’ strategies in response to trade tensions are driving rapid drops in capital expenditures, especially among leading-edge memory manufacturers, fabs in China and projects for mature nodes such as 28nm, according to SEMI. Industry sectors expecting record-breaking growth in 2019, such as memory and China, are now leading the decline, the report said.

Online messageinquiry

Foxconn Reportedly Readies Chip Fab in China

- Week of hot material

- Material in short supply seckilling

| model | brand | Quote |

|---|---|---|

| CDZVT2R20B | ROHM Semiconductor | |

| RB751G-40T2R | ROHM Semiconductor | |

| BD71847AMWV-E2 | ROHM Semiconductor | |

| TL431ACLPR | Texas Instruments | |

| MC33074DR2G | onsemi |

| model | brand | To snap up |

|---|---|---|

| BU33JA2MNVX-CTL | ROHM Semiconductor | |

| BP3621 | ROHM Semiconductor | |

| STM32F429IGT6 | STMicroelectronics | |

| ESR03EZPJ151 | ROHM Semiconductor | |

| IPZ40N04S5L4R8ATMA1 | Infineon Technologies | |

| TPS63050YFFR | Texas Instruments |

- Week of ranking

- Month ranking

Qr code of ameya360 official account

Identify TWO-DIMENSIONAL code, you can pay attention to

Please enter the verification code in the image below: