- Ameya360 Component Supply Platform >

- Trade news >

- Foxconn profits hit by rising operating costs

Foxconn profits hit by rising operating costs

The world's largest contract manufacturer, Foxconn, saw second quarter net profit come in well below expectations, due to a rise in component costs and unsold inventory.

Foxconn reported net profit of T$17.49billion (£444.4million), 20 percent short of analyst expectations and slightly below the year-earlier results.

According to analysts the weak results reflected concerns about a loss of momentum in global smartphone sales. Foxconn unit FIH Mobile saw a wider first-half loss - it reported last week - and said that it faced a high risk of saturation in the smartphone market.

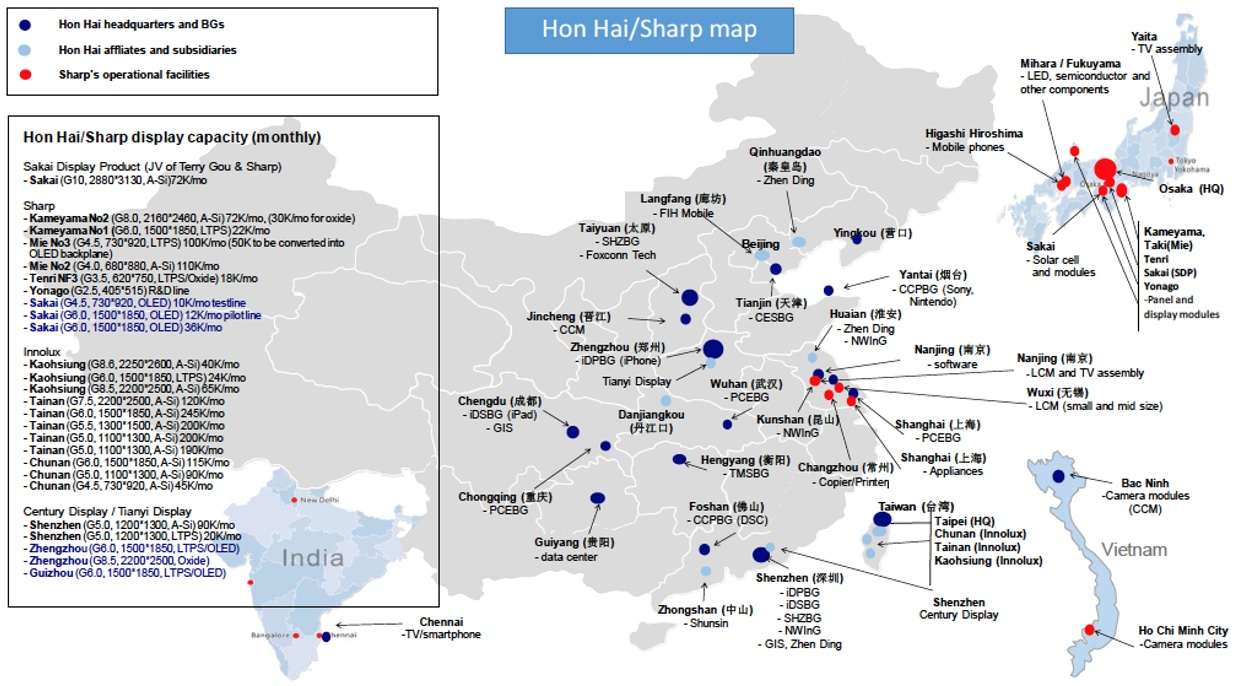

Despite trying to diversify into other areas, such as displays and autonomous vehicle start-ups, most of the company's profits still come from manufacturing phones for the likes of Apple and other leading mobile phone companies.

Rising component costs and investment in plant saw operating costs jump by 18 percent.

Online messageinquiry

Foxconn Reportedly Readies Chip Fab in China

- Week of hot material

- Material in short supply seckilling

| model | brand | Quote |

|---|---|---|

| CDZVT2R20B | ROHM Semiconductor | |

| RB751G-40T2R | ROHM Semiconductor | |

| MC33074DR2G | onsemi | |

| BD71847AMWV-E2 | ROHM Semiconductor | |

| TL431ACLPR | Texas Instruments |

| model | brand | To snap up |

|---|---|---|

| BP3621 | ROHM Semiconductor | |

| IPZ40N04S5L4R8ATMA1 | Infineon Technologies | |

| STM32F429IGT6 | STMicroelectronics | |

| BU33JA2MNVX-CTL | ROHM Semiconductor | |

| ESR03EZPJ151 | ROHM Semiconductor | |

| TPS63050YFFR | Texas Instruments |

- Week of ranking

- Month ranking

Qr code of ameya360 official account

Identify TWO-DIMENSIONAL code, you can pay attention to

Please enter the verification code in the image below: