iPhone在华不好卖,苹果引爆股市2019年“第一颗雷”

2019年1月2日,金融市场出现极为“罕见的一幕”。科技巨头苹果公司在今年首个交易日盘后,意外宣布下调第一财季营收展望:第1季营收至840亿美元,随后引爆苹果盘后股价大跌8%。

苹果业绩“爆雷”引发市场“巨震”。美股各大芯片公司及期指SP500均大幅下跌,原本上涨的许多公司盘后纷纷下跌。1月3日(周四)亚股开盘,台股苹概股应声重挫,截至早盘10时许,大立光、半导体龙头台积电皆下跌近 1%,鸿海下跌逾1%,可成则重挫逾 3%、嘉联益更破底大跌逾 5%。苹果韩国供货商亦随之下跌,如 LG Innotek、SK 海力士、三星 SDI 以及三星电机分别低开 3.6%、3.6%、1.9%、2.3%;苹果美国供货商 Skyworks Solution 以及 Broadcom 股价也受到拖累。

苹果公司宣布的消息主要内容为:中美贸易战引发压力,下调了其本季度营收预测,理由是iPhone更新次数减少,中国销售疲软。

根据Refinitiv的IBES数据,该公司预计第一季度营收将达到840亿美元,低于分析师预计的915亿美元。而苹果公司最初预计本季度的收入将在890亿至930亿美元之间。该公司将毛利率从38%至38.5%之间,降至38%左右。这意味着自 2011 年库克上任苹果执行长以来,苹果首次出现旺季营收不旺。

在近日公布的“致投资者的信”中,苹果公司CEO首席执行官蒂姆•库克(Tim Cook)表示:“虽然我们预计主要新兴市场将面临一些挑战,但没有预料到经济减速的程度,特别是在大中华地区。”

他表示,苹果的大部分收入低于预期,而且全球收入同比下降了100%以上,主要是因为大中华地区的iPhone、Mac和iPad的销售疲软。其他国家对新款iPhone的升级“并不像我们想象的那么强劲”。

库克指出,虽然苹果的其他部门的收入比去年增长了近19%,但长期以来,iPhone一直是苹果的核心业务,如果苹果不能卖出足够的手机,整个公司都会陷入困境。

不过,库克在信中承认,中国市场并不是iPhone销售的唯一问题。

他表示:“虽然一些市场的宏观经济挑战是造成这一趋势的一个关键因素,但我们认为还有其他因素会对我们的iphone表现产生广泛影响,包括消费者适应运营商补贴减少、美元强势相关的价格上涨,以及一些用户利用降价显著的iPhone电池更换项目。”

“如果你看看我们的结果,我们的差距超过100%来自iPhone,而且主要是在大中华区,”库克接受采访时表示。 “很明显,下半年经济开始放缓,我认为美国和中国之间的贸易紧张局势给经济增加了压力。”

白宫发言人没有立即回应库克对美中贸易紧张局势的评论。

苹果CEO库克在这封信件的最后表示:“尽管2019财年Q1是充满挑战的季度,我们自信公司的竞争力强劲,也会在逆境中重新调整,会利用企业文化的灵活性、适应力和创造性。最重要的是,我们有信心并对即将推出的产品与服务组合感到激动,苹果的创新是地球最佳,我们不会把脚从踩油门的模式抬起来。”

值得注意,苹果在“预警信”中强调了“净现金流在长期处于中性水平”的目标,可能暗示会利用股息分红或股票回购等方式,来增加股东回馈的力度,进而帮助提振股价。

公开信摘要如下:

苹果投资者们:

今天,我们重新修订了苹果2019年第一财季的业绩展望,本财年将于2019年12月29日结束。我们现在的预期包括:

——营收约为840亿美元

——毛利率约为38%

——营运开支约87亿美元

——其他收入/(费用)约5.5亿美元

——分立项目前税率约为16.5%

——我们预计用于计算摊薄每股收益的股票数量约为47.7亿股

基于这些估算,我们的营收将低于本季度最初的业绩展望,其他项目仍大致符合我们此前预期。虽然我们需要几个星期才能完成并报告最终业绩,但我们现在想要得到些初步的信息。我们的最终业绩可能与这些初步估计有所不同。

大约60天前,当我们与你们讨论第一季度的业绩展望时,我们知道第一季度将受到宏观经济和苹果特有因素的双重影响。根据我们对这些情况的最佳估计,我们预计本季度营收将同比略有增长。你可能还记得,我们讨论了四个因素:

第一,我们知道iPhone的不同发布时间会影响我们的数据对比。我们的顶级机型(iPhone XS和iPhone XS Max)在2018年第四季度出货,而iPhone X于2018年第一季度出货。我们知道这将为2019年第一财季创造出比较困难的局面,这与我们的预期大致相符。

第二,我们知道美元走强会造成不利影响,并预计这将使我们的营收同比增长减少约200个基点(大约2%)。这也大致符合我们的预期。

第三,我们知道本季度新产品数量将达到前所未有的水平,并预计供应紧张将影响我们在第一财季销售某些产品。同样,这也符合我们的预期。在整个季度,苹果智能手表Apple Watch Series 4、iPad Pro、AirPods以及MacBook Air的销量都会受到很大影响。

第四,我们预期某些新兴市场将进入经济增速趋稳状态。结果证明,这比我们预期的影响要大得多。

此外,这些因素和其他因素导致用户升级iPhone的比例比我们预期的要少。最后两点导致我们降低了业绩展望,我想在这两个问题上再深入阐述下。

新兴市场挑战

我们在中国的零售店和渠道合作伙伴客流量正在下降。市场数据显示,大中华区智能手机市场的萎缩尤为明显。

尽管面临这些挑战,我们相信我们在中国的业务有着光明的前景。中国的iOS开发者社区是世界上最具创新性、创造性和活力的社区之一。我们的产品在客户中拥有强大的拥护者,具有很高的参与度和满意度。我们在中国的业绩包括服务收入创下新纪录,我们的设备安装基数在过去一年有所增长。我们为能参与中国市场而自豪。

iPhone

iPhone的收入低于预期,主要是在大中华区,这是导致我们的收入低于预期的主要原因。事实上,iPhone以外的类别(服务、Mac、iPad、可穿戴设备/家居产品/配件)同比增长了近19%。

虽然大中华区和其他新兴市场是iPhone收入同比下降的主要原因,但在一些发达市场,iPhone的升级也没有我们预期的那么强劲。尽管在某些市场宏观经济挑战是导致这一趋势的一个关键因素,但我们认为还有其他因素广泛影响iPhone的业绩,包括运营商补贴减少、美元走强导致的价格上涨以及用户更多利用显著降价的iPhone电池更换项目。

积极业绩指标

尽管修改我们的业绩展望令人感到失望,但我们在许多领域的表现都显示出了非凡的实力。我们的活跃设备安装基数在12个月内增长了1亿多部,创历史新高。现在被使用的苹果设备比以往任何时候都多,这证明了我们客户的忠诚度、满意度和参与度。

此外,如前所述,iPhone业务以外的收入同比增长了近19%,包括来自服务、可穿戴设备以及Mac的创纪录收入。我们的非iPhone业务更少出现在新兴市场,而绝大多数的服务业务收入于安装基数有关,与当前销售关系不大。

本季度服务收入超过108亿美元,在每个地理区域都创下了新的季度纪录,我们正在努力实现从2016年到2020年将该业务规模扩大一倍的目标。随着Apple Watch和AirPods在假日购物者中广受欢迎,可穿戴设备同比增长近50%。MacBook Air和Mac mini的推出也推动了Mac电脑的营收同比增长,而新款iPad Pro的推出则推动iPad实现了两位数的营收同比增长。

我们还希望在美国、加拿大、德国、意大利、西班牙、荷兰和韩国等几个发达国家创造最高收入纪录。尽管我们在某些新兴市场看到了挑战,但墨西哥、波兰、马来西亚和越南等其他国家也创下了新的纪录。最后,我们还预计苹果每股收益将创下历史新高。

展望未来

我们的盈利能力和现金流创造能力都很强,我们预计在本季度结束时将拥有大约1300亿美元的净现金。正如我们之前所说,我们计划在一段时间内实现净现金中性。

在我们走出这个充满挑战的季度之际,我们对我们业务的根本实力一如既往地充满信心。我们习惯以实现长期目标的方式来管理苹果,苹果总是在逆境中重新审视我们的方法,利用我们文化的灵活性、适应性和创造性,并因此变得更好。

最重要的是,我们对未来的产品和服务充满信心和激情。苹果的创新是地球上其他公司所不具备的,我们也没有松懈。

我们不能改变宏观经济状况,但我们正在采取措施来改善我们的业绩。其中一项举措是让在我们的门店中购买手机变得更简单,随着时间的推移为购买提供资金,并帮助将数据从当前手机传输到新手机上。这不仅对环境有益,对客户也有好处,因为他们的现有手机可以作为购买新手机的补贴。此外,开发者也能从中受益,因为这可以帮助我们增加安装基础。

这是我们正在采取的一系列应对措施之一。我们之所以能做出这些调整,是因为苹果具有许多优势,包括我们的韧性、我们团队的天赋和创造力,以及对我们每天工作的热爱。人们对苹果的期望很高,因为他们理应如此。我们每天都致力于超越这些期望。这一直是苹果的一贯做法,而且将永远如此。

以下为原文:

Letter from Tim Cook to Apple investors

January 2, 2019

To Apple investors:

Today we are revising our guidance for Apple’s fiscal 2019 first quarter, which ended on December 29. We now expect the following:

Revenue of approximately $84 billion

Gross margin of approximately 38 percent

Operating expenses of approximately $8.7 billion

Other income/(expense) of approximately $550 million

Tax rate of approximately 16.5 percent before discrete items

We expect the number of shares used in computing diluted EPS to be approximately 4.77 billion.

Based on these estimates, our revenue will be lower than our original guidance for the quarter, with other items remaining broadly in line with our guidance.

While it will be a number of weeks before we complete and report our final results, we wanted to get some preliminary information to you now. Our final results may differ somewhat from these preliminary estimates.

When we discussed our Q1 guidance with you about 60 days ago, we knew the first quarter would be impacted by both macroeconomic and Apple-specific factors. Based on our best estimates of how these would play out, we predicted that we would report slight revenue growth year-over-year for the quarter. As you may recall, we discussed four factors:

First, we knew the different timing of our iPhone launches would affect our year-over-year compares. Our top models, iPhone XS and iPhone XS Max, shipped in Q4’18—placing the channel fill and early sales in that quarter, whereas last year iPhone X shipped in Q1’18, placing the channel fill and early sales in the December quarter. We knew this would create a difficult compare for Q1’19, and this played out broadly in line with our expectations.

Second, we knew the strong US dollar would create foreign exchange headwinds and forecasted this would reduce our revenue growth by about 200 basis points as compared to the previous year. This also played out broadly in line with our expectations.

Third, we knew we had an unprecedented number of new products to ramp during the quarter and predicted that supply constraints would gate our sales of certain products during Q1. Again, this also played out broadly in line with our expectations. Sales of Apple Watch Series 4 and iPad Pro were constrained much or all of the quarter. AirPods and MacBook Air were also constrained.

Fourth, we expected economic weakness in some emerging markets. This turned out to have a significantly greater impact than we had projected.

In addition, these and other factors resulted in fewer iPhone upgrades than we had anticipated.

These last two points have led us to reduce our revenue guidance. I’d like to go a bit deeper on both.

Emerging Market Challenges

While we anticipated some challenges in key emerging markets, we did not foresee the magnitude of the economic deceleration, particularly in Greater China. In fact, most of our revenue shortfall to our guidance, and over 100 percent of our year-over-year worldwide revenue decline, occurred in Greater China across iPhone, Mac and iPad.

China’s economy began to slow in the second half of 2018. The government-reported GDP growth during the September quarter was the second lowest in the last 25 years. We believe the economic environment in China has been further impacted by rising trade tensions with the United States. As the climate of mounting uncertainty weighed on financial markets, the effects appeared to reach consumers as well, with traffic to our retail stores and our channel partners in China declining as the quarter progressed. And market data has shown that the contraction in Greater China’s smartphone market has been particularly sharp.

Despite these challenges, we believe that our business in China has a bright future. The iOS developer community in China is among the most innovative, creative and vibrant in the world. Our products enjoy a strong following among customers, with a very high level of engagement and satisfaction. Our results in China include a new record for Services revenue, and our installed base of devices grew over the last year. We are proud to participate in the Chinese marketplace.

iPhone

Lower than anticipated iPhone revenue, primarily in Greater China, accounts for all of our revenue shortfall to our guidance and for much more than our entire year-over-year revenue decline. In fact, categories outside of iPhone (Services, Mac, iPad, Wearables/Home/Accessories) combined to grow almost 19 percent year-over-year.

While Greater China and other emerging markets accounted for the vast majority of the year-over-year iPhone revenue decline, in some developed markets, iPhone upgrades also were not as strong as we thought they would be. While macroeconomic challenges in some markets were a key contributor to this trend, we believe there are other factors broadly impacting our iPhone performance, including consumers adapting to a world with fewer carrier subsidies, US dollar strength-related price increases, and some customers taking advantage of significantly reduced pricing for iPhone battery replacements.

Many Positive Results in the December Quarter

While it’s disappointing to revise our guidance, our performance in many areas showed remarkable strength in spite of these challenges.

Our installed base of active devices hit a new all-time high—growing by more than 100 million units in 12 months. There are more Apple devices being used than ever before, and it’s a testament to the ongoing loyalty, satisfaction and engagement of our customers.

Also, as I mentioned earlier, revenue outside of our iPhone business grew by almost 19 percent year-over-year, including all-time record revenue from Services, Wearables and Mac. Our non-iPhone businesses have less exposure to emerging markets, and the vast majority of Services revenue is related to the size of the installed base, not current period sales.

Services generated over $10.8 billion in revenue during the quarter, growing to a new quarterly record in every geographic segment, and we are on track to achieve our goal of doubling the size of this business from 2016 to 2020.

Wearables grew by almost 50 percent year-over-year, as Apple Watch and AirPods were wildly popular among holiday shoppers; launches of MacBook Air and Mac mini powered the Mac to year-over-year revenue growth and the launch of the new iPad Pro drove iPad to year-over-year double-digit revenue growth.

We also expect to set all-time revenue records in several developed countries, including the United States, Canada, Germany, Italy, Spain, the Netherlands and Korea. And, while we saw challenges in some emerging markets, others set records, including Mexico, Poland, Malaysia and Vietnam.

Finally, we also expect to report a new all-time record for Apple’s earnings per share.

Looking Ahead

Our profitability and cash flow generation are strong, and we expect to exit the quarter with approximately $130 billion in net cash. As we have stated before, we plan to become net-cash neutral over time.

As we exit a challenging quarter, we are as confident as ever in the fundamental strength of our business. We manage Apple for the long term, and Apple has always used periods of adversity to re-examine our approach, to take advantage of our culture of flexibility, adaptability and creativity, and to emerge better as a result.

Most importantly, we are confident and excited about our pipeline of future products and services. Apple innovates like no other company on earth, and we are not taking our foot off the gas.

We can’t change macroeconomic conditions, but we are undertaking and accelerating other initiatives to improve our results. One such initiative is making it simple to trade in a phone in our stores, finance the purchase over time, and get help transferring data from the current to the new phone. This is not only great for the environment, it is great for the customer, as their existing phone acts as a subsidy for their new phone, and it is great for developers, as it can help grow our installed base.

This is one of a number of steps we are taking to respond. We can make these adjustments because Apple’s strength is in our resilience, the talent and creativity of our team, and the deeply held passion for the work we do every day.

Expectations are high for Apple because they should be. We are committed to exceeding those expectations every day.

That has always been the Apple way, and it always will be.

Tim

The information presented in this letter is preliminary and our actual results may differ. Apple plans to discuss final results during our first quarter conference call on Tuesday, January 29, 2019 at 2:00 p.m. PST / 5:00 p.m. EST.

This letter contains forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include without limitation those about Apple’s estimated revenue, gross margin, operating expenses, other income/(expense), tax rate, net cash, share count and plans for return of capital. These statements involve risks and uncertainties, and actual results may differ. Risks and uncertainties include without limitation: the effect of global and regional economic conditions on Apple’s business, including effects on purchasing decisions by consumers and businesses; the ability of Apple to compete in markets that are highly competitive and subject to rapid technological change; the ability of Apple to manage frequent introductions and transitions of products and services, including delivering to the marketplace, and stimulating customer demand for, new products, services and technological innovations on a timely basis; the effect that shifts in the mix of products and services and in the geographic, currency or channel mix, component cost increases, price competition, or the introduction of new products, including new products with higher cost structures, could have on Apple’s gross margin; the dependency of Apple on the performance of distributors of Apple’s products, including cellular network carriers and other resellers; the inventory and other asset risks associated with Apple’s need to order, or commit to order, product components in advance of customer orders; the continued availability on acceptable terms, or at all, of certain components, services and new technologies essential to Apple’s business, including components and technologies that may only be available from single or limited sources; the dependency of Apple on manufacturing and logistics services provided by third parties, many of which are located outside of the US and which may affect the quality, quantity or cost of products manufactured or services rendered to Apple; the effect of product and services design and manufacturing defects on Apple’s financial performance and reputation; the dependency of Apple on third-party intellectual property and digital content, which may not be available to Apple on commercially reasonable terms or at all; the dependency of Apple on support from third-party software developers to develop and maintain software applications and services for Apple’s products; the impact of unfavorable legal proceedings, such as a potential finding that Apple has infringed on the intellectual property rights of others; the impact of changes to laws and regulations that affect Apple’s activities, including Apple’s ability to offer products or services to customers in different regions; the ability of Apple to manage risks associated with its international activities, including complying with laws and regulations affecting Apple’s international operations; the ability of Apple to manage risks associated with Apple’s retail stores; the ability of Apple to manage risks associated with Apple’s investments in new business strategies and acquisitions; the impact on Apple’s business and reputation from information technology system failures, network disruptions or losses or unauthorized access to, or release of, confidential information; the ability of Apple to comply with laws and regulations regarding data protection; the continued service and availability of key executives and employees; political events, international trade disputes, war, terrorism, natural disasters, public health issues, and other business interruptions that could disrupt supply or delivery of, or demand for, Apple’s products; financial risks, including risks relating to currency fluctuations, credit risks and fluctuations in the market value of Apple’s investment portfolio; and changes in tax rates and exposure to additional tax liabilities. More information on these risks and other potential factors that could affect Apple’s financial results is included in Apple’s filings with the SEC, including in the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of Apple’s most recently filed periodic reports on Form 10-K and Form 10-Q and subsequent filings. Apple assumes no obligation to update any forward-looking statements or information, which speak as of their respective dates.

Apple revolutionized personal technology with the introduction of the Macintosh in 1984. Today, Apple leads the world in innovation with iPhone, iPad, Mac, Apple Watch and Apple TV. Apple’s four software platforms — iOS, macOS, watchOS and tvOS — provide seamless experiences across all Apple devices and empower people with breakthrough services including the App Store, Apple Music, Apple Pay and iCloud. Apple’s more than 100,000 employees are dedicated to making the best products on earth, and to leaving the world better than we found it.

在线留言询价

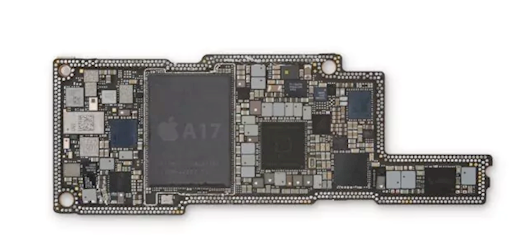

苹果或放弃自主研发5G调制解调器芯片

苹果A17处理器性能单核提升59%

- 一周热料

- 紧缺物料秒杀

| 型号 | 品牌 | 询价 |

|---|---|---|

| TL431ACLPR | Texas Instruments | |

| BD71847AMWV-E2 | ROHM Semiconductor | |

| MC33074DR2G | onsemi | |

| RB751G-40T2R | ROHM Semiconductor | |

| CDZVT2R20B | ROHM Semiconductor |

| 型号 | 品牌 | 抢购 |

|---|---|---|

| BU33JA2MNVX-CTL | ROHM Semiconductor | |

| BP3621 | ROHM Semiconductor | |

| TPS63050YFFR | Texas Instruments | |

| ESR03EZPJ151 | ROHM Semiconductor | |

| STM32F429IGT6 | STMicroelectronics | |

| IPZ40N04S5L4R8ATMA1 | Infineon Technologies |

AMEYA360公众号二维码

识别二维码,即可关注

请输入下方图片中的验证码: