- Ameya360 Component Supply Platform >

- Trade news >

- Server DRAM Contract Prices to Fall by Over 20% QoQ in 1Q19 Due to Difficulties in Reducing Inventory

Server DRAM Contract Prices to Fall by Over 20% QoQ in 1Q19 Due to Difficulties in Reducing Inventory

Contract prices of server DRAM are expected to fall by more than 20% QoQ in 1Q19, steeper than the previous forecast of 15%, reports DRAMeXchange, a division of TrendForce. The demand outlook remains weak due to high inventory levels and seasonal headwinds. Moreover, uncertainties brought by the China-U.S. trade war would also lead to conservative demand.

According to Mark Liu, senior analyst at DRAMeXchange, the main reason for steeper price fall lies in the difficulties in reducing inventory. The DRAM suppliers’ fulfillment rate has improved from 90% in 4Q18 to 120% in 1Q19, indicating an oversupply in the market. Currently, the major operators of data centers in North America are holding fairly high levels of server memory inventory that can cover the usage for at least 5 to 6 weeks, while OEMs’ current inventory can cover around 4 weeks. Based on the previous production plans of the companies, their inventory levels have apparently doubled the normal levels or even higher.

In terms of demand, after enjoying two years of strong demand growth for server systems, the server DRAM market is now seeing a tapering of its own demand growth. Demand from the upgrade to Intel’s Purley platform has started to wear off; memory component orders have also been fulfilled; a pessimistic economic outlook and uncertainties brought by China-U.S. trade war may also affect the DRAM market. As the general demand outlook becomes more conservative in the first half of this year, data centers and other server DRAM clients are anticipating falling prices in the future and are thus less keen on stocking up on memory components.

On the supply front, major DRAM suppliers plan not to expand their production capacity actively this year in the fear of worsening market outlook. They also slow down the migration to advanced processes and high-density chips (eg., 16Gb mono die), trying to offset the oversupply.

In order to reduce the inventory faster, suppliers have started to negotiate DRAM contracts as monthly deals since 4Q18, instead of quarterly ones. The quarterly lock-in deals have changed into quantity-based bargains, due to capacity expansion and increasing pressure from sales. With the emerging trend of build to order and low price, contract prices of DRAM products would continue to slide.

On the whole, DRAMeXchange believes that the demand for servers will recover since 2Q19, with increased shipments to Chinese data centers and branded server makers worldwide. If the inventory problems are properly solved, server DRAM price decline may be moderated in 3Q19 and 4Q19, bringing the annual price fall to almost 50%.

Online messageinquiry

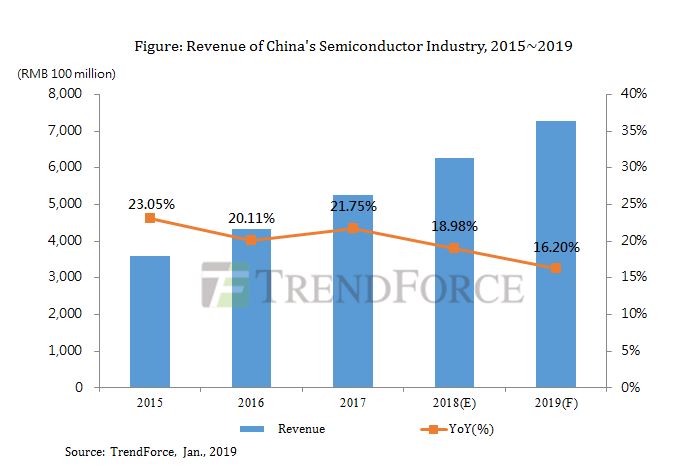

Revenue Growth in China's Semiconductor Industry Would Slow Down to 16.2% in 2019 due to Pessimistic

- Week of hot material

- Material in short supply seckilling

| model | brand | Quote |

|---|---|---|

| RB751G-40T2R | ROHM Semiconductor | |

| CDZVT2R20B | ROHM Semiconductor | |

| BD71847AMWV-E2 | ROHM Semiconductor | |

| TL431ACLPR | Texas Instruments | |

| MC33074DR2G | onsemi |

| model | brand | To snap up |

|---|---|---|

| TPS63050YFFR | Texas Instruments | |

| ESR03EZPJ151 | ROHM Semiconductor | |

| BU33JA2MNVX-CTL | ROHM Semiconductor | |

| BP3621 | ROHM Semiconductor | |

| STM32F429IGT6 | STMicroelectronics | |

| IPZ40N04S5L4R8ATMA1 | Infineon Technologies |

- Week of ranking

- Month ranking

Qr code of ameya360 official account

Identify TWO-DIMENSIONAL code, you can pay attention to

Please enter the verification code in the image below: