- Ameya360 Component Supply Platform >

- Trade news >

- AMEYA360:Next-Gen EVs Need Battery and Powertrain Innovations

AMEYA360:Next-Gen EVs Need Battery and Powertrain Innovations

At the recent Advanced Automotive Technology Forum 2023, from EE Times, industry experts discussed some of the battery and powertrain innovations needed for the next generation of electric vehicles (EVs), and challenges the industry faces to implement them.

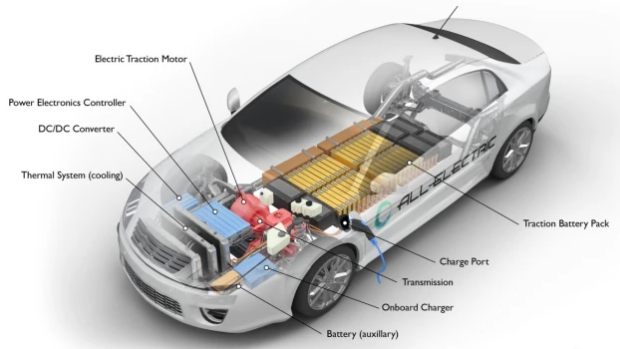

An all-electric vehicle. (Source: U.S. Department of Energy)

EVs have been around for well over a decade. But while their adoption is growing, it will take some time before they capture a sizeable share of the market. For example, out of approximately 80.6 million new cars sold globally last year, less than 10% (7.8 million) were electric, according to a slide presented by Patrick Le Fèvre, chief marketing and communications officer at Powerbox.

Meanwhile, sales of cars are increasing and the number of vehicles on the road is growing, too. If today there are around 1.6 billion vehicles worldwide, by 2035 that number will grow to nearly two billion, according to the slide from Powerbox. In the EU, 2035 will be the year when sales of new cars with internal combustion engines (ICEs) will be banned. So, by that time, most automakers will have introduced top-to-bottom EV lineups.

There are many reasons why the adoption rate of EVs is relatively slow, and perhaps the best way to speed it up is to make EVs more attractive in general. There are several ways to do so, but many innovations are required.

For example, batteries and power electronics are among the major challenges. Specifically, as EVs require up to 20× more power compared with traditional automobiles, they present a considerable challenge for power experts in terms of building energy-efficient power conversion solutions, powertrain development and battery technology.

Converters and inverters need work

Today, most hybrid/plug-in hybrid electric vehicles (HEV/PHEV), as well as EVs, use converters and DC-AC invertors that comprise of silicon-based insulated gate bipolar transistors (IGBTs). These components are, in many cases, not compact and are not very efficient, yet they are cheap as they have been around for decades, according to a slide demonstrated by Pietro Scalia, director of automotive traction solutions at Onsemi.

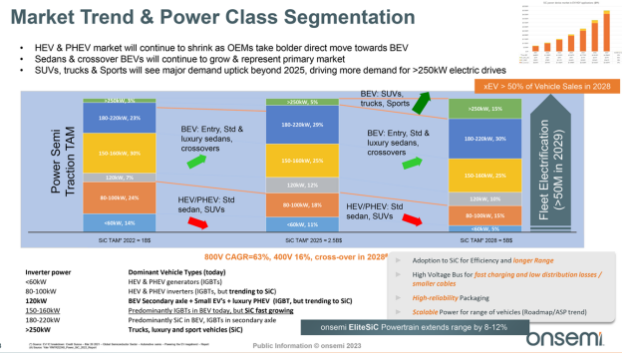

For now, IGBTs may be good enough for most mass market applications. But the HEV/PHEV market will decrease as car manufacturers focus on battery-powered EVs (or BEVs), so higher-performance converters and inverters will get more widespread as EVs tend to feature higher performance traction motors.

Furthermore, while sedans and crossover EVs will remain the most popular types of vehicles with the highest market shares, SUVs, trucks and sports cars will see increased demand after 2025, which will rise demand for >250kW electric drives, according to Onsemi’s slide. This will increase demand for higher performance, higher efficiency, and smaller converters and invertors.

EV, HEV, and PHEV market trends and power class segmentation. (Source: Onsemi)

Building compact and efficient power-conversion solutions requires using wide-bandgap (WBG) semiconductor materials, such as gallium nitride (GaN) and silicon carbide (SiC). When compared with silicon, they offer higher power density (high electron mobility and breakdown voltage allows to build smaller and lighter PSUs), high efficiency (less power loss and lower temperatures, which lead to reduced cooling requirements and lower costs), fast switching speeds (leads to improved power conversion efficiency and reduced electromagnetic interference), and wide temperature ranges (higher reliability and durability).

While both GaN and SiC offer tangible advantages in power conversion applications, they are not interchangeable in all use cases, and the choice between the two depends on the specific requirements. For example, GaN has a higher electron mobility and can achieve higher power densities, which makes it more suitable for in-vehicle applications and chargers.

Actually, usage of GaN for in-car electronics like LiDAR, infotainment and headlights has been increasing and will keep increasing in the future. Furthermore, some traction motors now also use GaN converters, said Alex Lidow, CEO and co-founder of EPC, a supplier of GaN-based devices.

“Today, if you have a LiDAR system on a car, whether it be autonomous or just a level two or level three, that has GaN devices in it,” he said. “We have been on headlights with GaN for almost 10 years, infotainment systems, wireless charging, other than for the car, but wireless charging inside the car, and all sorts of advanced things like augmented reality heads up displays. These are all homes for GaN. As sure as the sun comes up in the morning, [GaN] will replace silicon, and everything that is in the 48-V range. We will see whether or not it moves to the traction [motors], and the onboard charging in the future, as well.”

Uses of GaN in cards. (Source: EPC)

On the other hand, SiC can handle higher voltages and offer better thermal performance, making it a suitable choice for high-power and high-temperature applications, such as traction inverters in EVs. Also, SiC technology is more mature and is sometimes cheaper to implement. Some SiC-based inverters may be cheaper than IGBT-based inverters.

“Finding the sweet spot of the performance versus the cost of the material [is important], I had a sweet spot at 250kW, where I can easily demonstrate that SiC is cheaper than IGBT in terms of area given the delta cost, calculating the extra need the you have to put in place for dissipating, you can have a much cheaper solution with silicon carbide,” Onsemi’s Scalia said.

It goes without saying that with higher efficiency comes miniaturization and weight loss on components levels, which in turn allows us to build more comfortable cars with longer range or make cheaper cars with sufficient range for everyday needs. Cost-efficient SiC MOSFETs along with innovative packaging opens doors to lower-cost EVs with decent motors.

“One part of our strategy at Qorvo [is addressing the] explosion of lower powered cars that are going to come,” said Anup Bhalla, chief engineer of power devices at Qorvo.

There is a persistent need in “getting the cost out of the solution for the people who want to build EV traction inverters and to make the [EV] technology more accessible,” he added.

Finding the right balance between an inverter or converter cost, efficiency, and reliability is a challenge that makers of SiC and GaN components, as well as EVs, must address whenever they build a new car, converter or inverter.

“When we tackle an inverter design with a customer, there is a lot of back and forth how they can extract the maximum benefit [as there are] regular tensions between efficiency they want to get the cost they are willing to pay,” Bhalla said. “This cost is always tied in with the reliability impact of trying to go too cheap. This system has to in the end be very reliable. And everybody has their own take on how they need to build the inverter to define their own advantage.”

Bhalla demonstrated a compact dual side cooled 150kW (12ohm/1200V) inventor comprising of three SiC MOSFETs in a top cool discrete package, as well as another invertor solution featuring top-cooled SiC MOSFETs that could be used for such applications.

“People will need to put traction inverters designed differently, maybe designed right around the motor, needing different form-factors,” he said. “Then they need different kinds of packaging solutions. The great thing is that these devices have become so efficient, that we can consider putting them into a top-cooled package getting a moderate amount of heat out and then build a traction inverter out of it.”

Onsemi’s slide claimed that usage of its EliteSiC Powertrain extends range by 8 to 12% due to higher efficiency compared with IGBT-based solutions. Furthermore, for high performance inverters, SiC is preferrable for many reasons, so its adoption is set to grow.

Online messageinquiry

- Week of hot material

- Material in short supply seckilling

| model | brand | Quote |

|---|---|---|

| MC33074DR2G | onsemi | |

| TL431ACLPR | Texas Instruments | |

| RB751G-40T2R | ROHM Semiconductor | |

| BD71847AMWV-E2 | ROHM Semiconductor | |

| CDZVT2R20B | ROHM Semiconductor |

| model | brand | To snap up |

|---|---|---|

| TPS63050YFFR | Texas Instruments | |

| BU33JA2MNVX-CTL | ROHM Semiconductor | |

| ESR03EZPJ151 | ROHM Semiconductor | |

| BP3621 | ROHM Semiconductor | |

| IPZ40N04S5L4R8ATMA1 | Infineon Technologies | |

| STM32F429IGT6 | STMicroelectronics |

- Week of ranking

- Month ranking

Qr code of ameya360 official account

Identify TWO-DIMENSIONAL code, you can pay attention to

Please enter the verification code in the image below: