- Ameya360 Component Supply Platform >

- Trade news >

- Infineon to Invest $1.9 Billion in New Austrian Chip Factory

Infineon to Invest $1.9 Billion in New Austrian Chip Factory

Infineon Technologies AG will spend 1.6 billion euros ($1.9 billion) over six years to build a new factory in Austria, in a bet on rising demand for semiconductors that go in everything from electric cars to wind turbines.

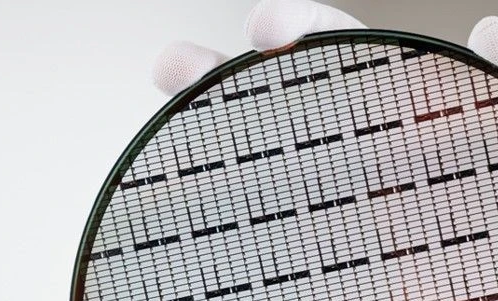

Infineon will create 400 new jobs at the new site in Villach in southern Austria, where the production of 300-millimeter thin wafers is due to start in 2021. The factory is next to an existing company facility and has the potential to generate 1.8 billion euros in yearly sales, the company said.

“Customers around the world are rushing through our doors to place orders,” said Infineon Chief Executive Officer Reinhard Ploss at an event in Vienna Friday. “Growth is underpinned by global megatrends such as climate change, demographic change and increasing digitization,” and the investment will allow the company to hold its technological leadership in the industry, he said.

The company is seeking to hire staff from around the world, and the Austrian government has agreed to expand education and research facilities in the Carinthia region to help Infineon’s growth plans. Austrian Chancellor Sebastian Kurz at the event in Vienna called the investment a “historic one and the biggest in a long long time” in the country. The government is in talks with other “major international companies” to support a re-industrialization in Europe, he said, without giving details.

Infineon, which competes with NXP Semiconductors NV and STMicroelectronics NV, is pushing into the growing market for electric cars and renewable energy that provides fresh revenue streams as demand for semiconductors used in smartphones and tablets slows. It’s part of Ploss’s bet on trends such as energy efficiency, connectivity and mobility.

In March Infineon and SAIC Motor Corp Ltd., China’s largest automaker by sales volume, revealed a new joint company to produce power modules for Chinese manufacturers of electric cars and plug-in hybrids, jointly investing at least 100 million euros ($122 million) and hiring 250 people to expand Infineon’s chip factory in Wuxi.

Online messageinquiry

- Week of hot material

- Material in short supply seckilling

| model | brand | Quote |

|---|---|---|

| CDZVT2R20B | ROHM Semiconductor | |

| RB751G-40T2R | ROHM Semiconductor | |

| MC33074DR2G | onsemi | |

| TL431ACLPR | Texas Instruments | |

| BD71847AMWV-E2 | ROHM Semiconductor |

| model | brand | To snap up |

|---|---|---|

| BU33JA2MNVX-CTL | ROHM Semiconductor | |

| ESR03EZPJ151 | ROHM Semiconductor | |

| TPS63050YFFR | Texas Instruments | |

| STM32F429IGT6 | STMicroelectronics | |

| BP3621 | ROHM Semiconductor | |

| IPZ40N04S5L4R8ATMA1 | Infineon Technologies |

- Week of ranking

- Month ranking

Qr code of ameya360 official account

Identify TWO-DIMENSIONAL code, you can pay attention to

Please enter the verification code in the image below: