- Ameya360 Component Supply Platform >

- Trade news >

- Ameya360:Infineon’s WBG catch-up with GAN Systems acquisition

Ameya360:Infineon’s WBG catch-up with GAN Systems acquisition

At a dinner held during CES 2023 in January, I had the opportunity to talk to a senior Infineon executive sitting next to me about the company’s widely talked about acquisition ambitions for this year expressed in a statement. The rationale was that while the semiconductor industry is going through a downward cycle, it’s a good window of opportunity to acquire strategic assets at a good price.

A few days later, when I sat with GAN Systems CEO Jim Witham to get a sense of what’s new and latest in gallium nitride (GaN) semiconductor technology, what I found most striking was his remark about how quickly this market has emerged over the past decade or so. “If you go back five years, people were asking when GaN will happen, and now while GaN devices has established themselves in the market, it’s a little late to join the GaN party,” Witham said. Now it’s really about market penetration, he added.

At that moment, I instantly began thinking about large power semiconductor players and what they will do to address this market reality. One company that came to mind was Microchip, which acquired Microsemi in 2018 to get hold of silicon carbide (SiC) assets. Very good timing, indeed.

Another supplier of wide bandgap (WBG) semiconductors, UnitedSiC, was acquired by Qorvo in 2021. But what about other big analog and power semiconductor suppliers? What also came to mind was Infineon’s failed attempt to acquire Cree’s SiC business, Wolfspeed, back in 2017. Cree later named itself on its most successful brand, Wolfspeed, and its SiC business has rapidly grown since then.

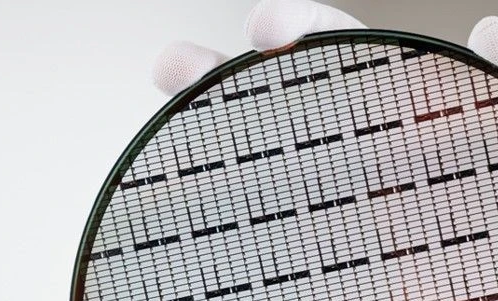

Figure 1 GaN semiconductors facilitate higher power density, higher energy efficiency, and smaller device form factor. Source: Infineon Technologies

Well, Infineon Technologies has answered the call by snapping GAN Systems for $830 million. Industry watchers believe this could trigger a consolidation wave around the emerging WBG semiconductor industry. Besides Ottawa, Canada-based GAN Systems, other GaN semiconductor specialists include Cambridge GaN Devices, Efficient Power Conversion (EPC), Navitas Semiconductor, Transphorm, and Vanguard International Semiconductor.

Acquisition merits

While we’ve seen several SiC-centric acquisitions in recent years, Infineon’s deal marks the first major GaN asset purchase. And, given GaN’s crucial significance in power electronics, it’s very likely that it won’t be the last.

For Infineon, the number one power semiconductors business in terms of market share, it’s also critical that it fills the GaN missing link in its power semiconductors portfolio. Though not a prolific acquisition player, Infineon has made two highly successful deals in recent years. First, in 2014, it bought power semiconductor pioneer International Rectifier to bolster its automotive offerings. The acquisition also brought Infineon some GaN technology assets as an add-on to this deal.

Next, in 2019, Infineon acquired Cypress Semiconductor to further boost its portfolio for the automotive markets. Both deals—International Rectifier and Cypress—have gone well for Infineon. So, given Infineon’s track record and prevailing market conditions, the GAN Systems purchase looks like a timely call.

Figure 2 GaN semiconductors have been incorporated into Canoo’s on-board charger (OBC) to convert AC power from the wall receptacle into the DC power that charges the EV battery. Source: GAN Systems

Besides strengthening Infineon’s GaN technology roadmap, it provides the German chipmaker timely access to applications such as mobile charging, data center power supplies, residential solar inverters, and on-board chargers (OBCs) for electric vehicles (EVs). As GAN Systems chief Witham points out, the deal will also combine Infineon’s in-house manufacturing with GaN Systems’ foundry corridors. TSMC is GAN Systems’ manufacturing partner.

Here, it’s important to note that in February 2022, Infineon announced to double down on WBG manufacturing by investing more than €2 billion in a new front-end fab in Kulim, Malaysia. The first wafers will leave the fab in the second half of 2024, complementing Infineon’s existing WBG manufacturing capacities in its fab at Villach, Austria.

End of another chip startup story

It’s the end of the road for the Canadian startup founded in Ottawa in 2006. Girvan Patterson and John Roberts co-founded GaN Systems after seeing GaN as an opportunity and growth venue in the power industry, especially in data centers, industrial motors, and mobile chargers. Ottawa, the Canadian capital, had a research facility, National Research Council (NRC), which gave the upstart a small GaN fab to acquire fast learning cycles. “That’s why we could develop working GaN transistors fast enough,” Witham told EDN at CES 2023.

Figure 3 GaN Systems, based in Ottawa, has more than 200 employees.

GaN Systems has been a success story in the rapidly emerging WBG semiconductors arena. GaN semiconductors are now being targeted at a wide range of power applications due to their smaller form factor and energy-saving credentials enabled by higher power density and energy efficiency. According to market research firm Yole, the GaN revenue for power applications is expected to grow by 56% CAGR to approximately $2 billion by 2027.

GaN Systems claims it’s the only GaN semiconductors company with a production program for automotive. At CES 2023, it displayed an OBC from Canoo and a DC-DC converter from Vitesco for EVs. The adoption of GaN devices in EVs is at a tipping point, as Infineon CEO Jochen Hanebeck acknowledged in the press release announcing this acquisition.

Online messageinquiry

- Week of hot material

- Material in short supply seckilling

| model | brand | Quote |

|---|---|---|

| TL431ACLPR | Texas Instruments | |

| CDZVT2R20B | ROHM Semiconductor | |

| RB751G-40T2R | ROHM Semiconductor | |

| BD71847AMWV-E2 | ROHM Semiconductor | |

| MC33074DR2G | onsemi |

| model | brand | To snap up |

|---|---|---|

| IPZ40N04S5L4R8ATMA1 | Infineon Technologies | |

| ESR03EZPJ151 | ROHM Semiconductor | |

| STM32F429IGT6 | STMicroelectronics | |

| BP3621 | ROHM Semiconductor | |

| TPS63050YFFR | Texas Instruments | |

| BU33JA2MNVX-CTL | ROHM Semiconductor |

- Week of ranking

- Month ranking

Qr code of ameya360 official account

Identify TWO-DIMENSIONAL code, you can pay attention to

Please enter the verification code in the image below: