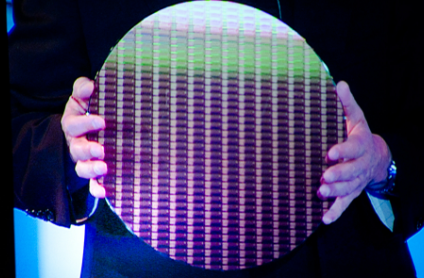

2018 total wafer demand expected to reach 115.1 million 300mm wafer equivalents

Semiconductor revenues are expected to increase 12.8% in 2018 as a result of continued strong memory prices. Units are expected to grow 7.2%. The forecast is based on moderate smartphone sales with a possible return to lower memory prices in the second half of the year. This, among other market issues, will push 2018 wafer demand to over 115 million units in 300mm equivalents according to Semico Research’s newest report, Semico Wafer Demand Update Q2 2018 (MA111-18).

“Semiconductor manufacturers are rolling out new products targeted at artificial intelligence applications. Products require both the most advanced technologies for AI training functions as well as potentially high-volume products for edge devices,” says Joanne Itow, Manager Manufacturing Research for Semico. “On the other side of the technology spectrum, mature processes for sensors and analog products such as biometric sensors, RF and power management continue to be in high demand aided by growth in Internet of Things (IoT) applications along with more ‘smart devices’ that are beginning to build in algorithms that are the precursor to full-fledged AI devices.”

Key findings include:

2018 NAND revenues are expected to increase 18.9%.

MCU revenues are expected to exceed $17 billion in 2018.

Total Communication MOS Logic wafer demand is expected to increase 4.0% in 2018.

Sensor units are expected to grow 20.4% in 2018.

在线留言询价

- 一周热料

- 紧缺物料秒杀

| 型号 | 品牌 | 询价 |

|---|---|---|

| RB751G-40T2R | ROHM Semiconductor | |

| TL431ACLPR | Texas Instruments | |

| CDZVT2R20B | ROHM Semiconductor | |

| MC33074DR2G | onsemi | |

| BD71847AMWV-E2 | ROHM Semiconductor |

| 型号 | 品牌 | 抢购 |

|---|---|---|

| IPZ40N04S5L4R8ATMA1 | Infineon Technologies | |

| STM32F429IGT6 | STMicroelectronics | |

| ESR03EZPJ151 | ROHM Semiconductor | |

| BU33JA2MNVX-CTL | ROHM Semiconductor | |

| TPS63050YFFR | Texas Instruments | |

| BP3621 | ROHM Semiconductor |

- 周排行榜

- 月排行榜

AMEYA360公众号二维码

识别二维码,即可关注

请输入下方图片中的验证码: