- Ameya360 Component Supply Platform >

- Trade news >

- STMicro Sees Strong Demand for Silicon Carbide

STMicro Sees Strong Demand for Silicon Carbide

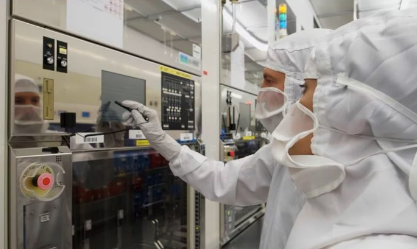

As STMicroelectronics reported its first quarterly results since President and CEO Jean-Marc Chery took the helm, the company was bullish about its automotive market pipeline, and especially for its silicon carbide (SiC) products from which it expects revenues of $100 million in 2018.

“We have more than 25 automotive projects in discussion, and 85% of these are in SiC," Chery said. "We are preparing our capital expenditure next quarter to support this, as SiC will be an important game changer for the industry.”

Asked by analysts about his confidence level in growth in the automotive and industrial sector for ST, he said, “We don’t see any weak signals, we are really confident as demand is really strong.”

Chery said that the second quarter saw design wins for its third generation SiC MOSFETS and SiC diodes for car electrification in Asia and Europe, plus a custom galvanic isolation gate driver for an electric vehicle, a chipset for braking applications in Europe, ICs for engine management for Japanese and Korean customers, and an SP58 32-bit microcontroller win for a body control module for a European tier one supplying a U.S. car maker.

He also said that in the personal electronics sector, while sales to its lead customer for smartphones (Apple) will see growth as it launches its new models in September, a key highlight was a design win for its STM32F7 in a high-end 4K TV at a key Japanese OEM. “This was previously a difficult market for us to penetrate,” Chery said.

Second quarter net revenues and gross margin were above the mid-point of the company’s outlook. ST reported second quarter net revenues of $2.27 billion, gross margin of 40.2%, operating margin of 12.7%, and net income of $261 million or $0.29 diluted earnings per share.

Asked about the potential impact of the trade war between the U.S. and China, Chery said, “At this moment, the direct impact is negligible. But we are monitoring the situation. If the trade war escalates, we are more concerned about the macro level impact on the industry, but we have nothing more to add at this stage.”

Responding to questions about ST’s M&A strategy, he said that the company is continuing it strategy of organic growth for 2018, supported my small acquisitions to support areas like its STM32 products, such as its recent acquisition of Draupner Graphics. He added that the company would update the market on its M&A strategy towards the end of the year, though it may potentially make small IP company acquisitions to improve its portfolio.

Online messageinquiry

Embedded AI Solutions Ease ML Development

STMicroelectronics and eYs3D Microelectronics to Highlight 3D Stereo-vision Camera at CES 2023

- Week of hot material

- Material in short supply seckilling

| model | brand | Quote |

|---|---|---|

| BD71847AMWV-E2 | ROHM Semiconductor | |

| TL431ACLPR | Texas Instruments | |

| RB751G-40T2R | ROHM Semiconductor | |

| CDZVT2R20B | ROHM Semiconductor | |

| MC33074DR2G | onsemi |

| model | brand | To snap up |

|---|---|---|

| BP3621 | ROHM Semiconductor | |

| ESR03EZPJ151 | ROHM Semiconductor | |

| STM32F429IGT6 | STMicroelectronics | |

| TPS63050YFFR | Texas Instruments | |

| BU33JA2MNVX-CTL | ROHM Semiconductor | |

| IPZ40N04S5L4R8ATMA1 | Infineon Technologies |

- Week of ranking

- Month ranking

Qr code of ameya360 official account

Identify TWO-DIMENSIONAL code, you can pay attention to

Please enter the verification code in the image below: