WFE semiconductor equipment billings to drop 24% in second half of 2018

On the heels of a 37.3% growth in wafer front end (WFE) semiconductor equipment growth in 2017, the market will grow only 10% in 2018 to $62.3 billion, according to the report “The Global Semiconductor Equipment: Markets, Market Shares, Market Forecasts,” recently published by The Information Network, a New Tripoli, PA-based market research company.

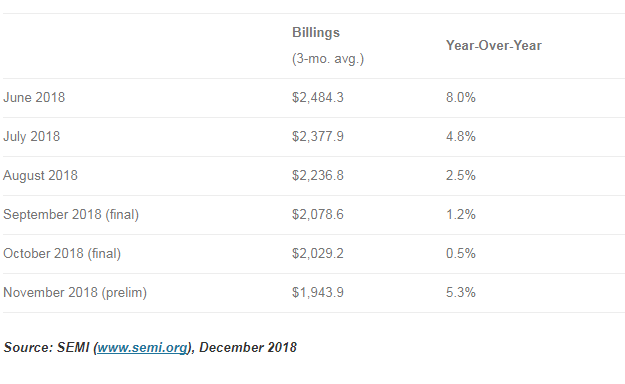

For the first six months of 2018, WFE billings were $35.3 billion, meaning billings of $27.0 billion will be registered in the second half of 2018 if the sector as a whole grows 10% in CY 2018.

This means a drop of 24% between 1H 2018 and 2H 2018.

The chart below shows that U.S. equipment companies held a 48.8% share of the total sector in 1H 2018 followed by Japan with a 30.3% share and ROW (primarily Europe) with a 26.9% share. For 2H 2018, the weak Japanese Yen means Japan will have a 29.1% share, but stronger EUV sales by ASML will mean Europe’s share will grow to 28.0%.

The memory market is moving into a period of oversupply: NAND oversupply started six months ago and has resulted in device price drops, while DRAMs will reach an oversupply situation in the next few months. As a result, market leader Samsung Electronics has pushed out purchases. Foundry leader TSMC has reduced its estimate for sales revenue growth in 2018 and its capital expenditure budget.

在线留言询价

$62.7B semiconductor equipment forecast: Top previous record, Korea at top but China closes the gap

Semiconductor Equipment Sales Rise Again

- 一周热料

- 紧缺物料秒杀

| 型号 | 品牌 | 询价 |

|---|---|---|

| RB751G-40T2R | ROHM Semiconductor | |

| MC33074DR2G | onsemi | |

| BD71847AMWV-E2 | ROHM Semiconductor | |

| CDZVT2R20B | ROHM Semiconductor | |

| TL431ACLPR | Texas Instruments |

| 型号 | 品牌 | 抢购 |

|---|---|---|

| TPS63050YFFR | Texas Instruments | |

| STM32F429IGT6 | STMicroelectronics | |

| ESR03EZPJ151 | ROHM Semiconductor | |

| BU33JA2MNVX-CTL | ROHM Semiconductor | |

| IPZ40N04S5L4R8ATMA1 | Infineon Technologies | |

| BP3621 | ROHM Semiconductor |

- 周排行榜

- 月排行榜

AMEYA360公众号二维码

识别二维码,即可关注

请输入下方图片中的验证码: