- Ameya360 Component Supply Platform >

- Trade news >

- The next phase of semiconductor growth will not depend on smartphone sales

The next phase of semiconductor growth will not depend on smartphone sales

The so-called Internet of Things (IoT) and big data will drive demand in the semiconductor space and the growth cycle will be very different from previous phases, according to the CEO of Tokyo Electron.

The Japanese company makes the equipment needed to produce semiconductors, and boasts a market cap of about $23.83 billion.

"As we look to the future, we believe IoT will be at the core of everything. The big data that comes out of that would determine the semiconductor demand," Toshiki Kawai told CNBC's Akiko Fujita in a Japanese-language interview. He added that new technologies such as artificial intelligence (AI), augmented and virtual reality and the fifth-generation of mobile networks will also influence the demand for semiconductors.

"IoT" basically describes millions of physical devices, such as smart televisions, home appliances and cars, that are connected to the internet and can be synced so that users are able to control everything at once.

"It's no longer like the past when the so-called silicon cycle began and ended with the number of smartphones sold. We're looking at a different phase of growth," Kawai said.

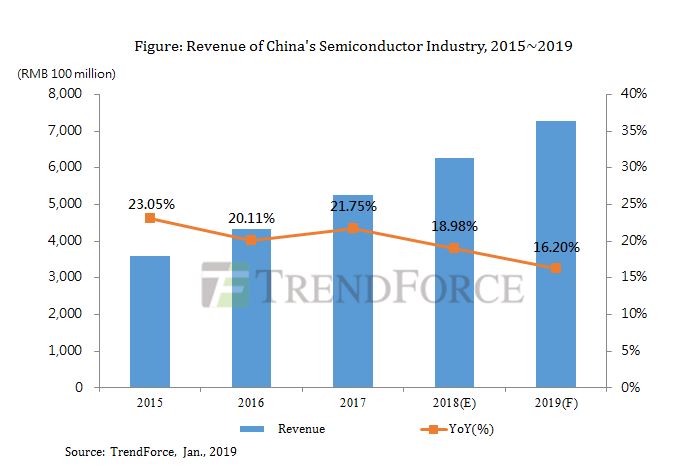

Global semiconductor revenue in 2017 came in at $420.4 billion, registering 21.6 percent growth from a year ago, according to research firm Gartner. That growth came mostly from the memory chip market, where insufficient supply drove prices higher.

But analysts and investors have predicted that the semiconductor sector is due for a significant decline because of falling memory chip prices, a build-up in inventory levels and a slowdown in demand from high-growth industries. The major drivers of demand for memory chips are smartphones, computers and data centers. Recently, one analyst noted that demand in each of those segments had worsened substantially and, as a result, led to a build up of inventories for suppliers.

The so-called Internet of Things (IoT) and big data will drive demand in the semiconductor space and the growth cycle will be very different from previous phases, according to the CEO of Tokyo Electron.

The Japanese company makes the equipment needed to produce semiconductors, and boasts a market cap of about $23.83 billion.

"As we look to the future, we believe IoT will be at the core of everything. The big data that comes out of that would determine the semiconductor demand," Toshiki Kawai told CNBC's Akiko Fujita in a Japanese-language interview. He added that new technologies such as artificial intelligence (AI), augmented and virtual reality and the fifth-generation of mobile networks will also influence the demand for semiconductors.

"IoT" basically describes millions of physical devices, such as smart televisions, home appliances and cars, that are connected to the internet and can be synced so that users are able to control everything at once.

"It's no longer like the past when the so-called silicon cycle began and ended with the number of smartphones sold. We're looking at a different phase of growth," Kawai said.

Global semiconductor revenue in 2017 came in at $420.4 billion, registering 21.6 percent growth from a year ago, according to research firm Gartner. That growth came mostly from the memory chip market, where insufficient supply drove prices higher.

But analysts and investors have predicted that the semiconductor sector is due for a significant decline because of falling memory chip prices, a build-up in inventory levels and a slowdown in demand from high-growth industries. The major drivers of demand for memory chips are smartphones, computers and data centers. Recently, one analyst noted that demand in each of those segments had worsened substantially and, as a result, led to a build up of inventories for suppliers.

There's also some concern about the ongoing trade war between the United States and China. Kawai said that there hasn't been any impact yet on Tokyo Electron as a result of the trade conflict, but the company will continue to monitor developments, especially those that could affect it in the short-term.

Another worry for major chip makers is that a number of technology companies are already working on making their own processors that can run artificial intelligence software. Those include the likes of Alphabet, Facebook, Apple and Alibaba.

For Tokyo Electron, which produces the equipment and technology those companies would need to build their own chips, the opportunity is attractive, according to Kawai.

"We believe AI will grow on average 67 percent between 2017 and 2022," he said, adding that artificial intelligence is "ripe with areas for innovation where our production equipment and semiconductor-producing technology will be utilized."

Online messageinquiry

Revenue Growth in China's Semiconductor Industry Would Slow Down to 16.2% in 2019 due to Pessimistic

- Week of hot material

- Material in short supply seckilling

| model | brand | Quote |

|---|---|---|

| RB751G-40T2R | ROHM Semiconductor | |

| CDZVT2R20B | ROHM Semiconductor | |

| MC33074DR2G | onsemi | |

| BD71847AMWV-E2 | ROHM Semiconductor | |

| TL431ACLPR | Texas Instruments |

| model | brand | To snap up |

|---|---|---|

| TPS63050YFFR | Texas Instruments | |

| IPZ40N04S5L4R8ATMA1 | Infineon Technologies | |

| STM32F429IGT6 | STMicroelectronics | |

| BU33JA2MNVX-CTL | ROHM Semiconductor | |

| BP3621 | ROHM Semiconductor | |

| ESR03EZPJ151 | ROHM Semiconductor |

- Week of ranking

- Month ranking

Qr code of ameya360 official account

Identify TWO-DIMENSIONAL code, you can pay attention to

Please enter the verification code in the image below: