- Ameya360 Component Supply Platform >

- Trade news >

- Ongoing Commercial Renewals Maintain Stability in The EMEA Traditional PC Market

Ongoing Commercial Renewals Maintain Stability in The EMEA Traditional PC Market

The Europe, Middle East, and Africa (EMEA) traditional PC market (desktops, notebooks, and workstations) came in stable in the third quarter of 2018, with the market turning positive (+0.5% YoY) and totaling 18.1 million units, according to International Data Corporation (IDC). The commercial space grew 4.9% YoY as ongoing device renewals continued and the adoption of Windows 10 picked up, while the consumer space remained negative (-4.1% YoY), recording a decrease in both desktops and notebooks. Desktops declined for the first time this year (-2.4% YoY), but continued to grow in the commercial space. A stable notebook performance (+1.4% YoY) kept the market in positive territory, as mobility adoption and renewals continue to drive demand in the commercial space.

The Western European traditional PC market registered overall growth of 2.0% YoY, with the commercial segment continuing to show strong growth (+8.3% YoY), offsetting the impact of the consumer decline (-5.5% YoY). The overall consumer decline can be attributed primarily to desktop, where erosion persisted, while notebook also continued to decline, albeit at a softer rate. On the commercial side, ongoing device renewals in the midmarket space, as well as growing Windows 10 adoption, continued to drive growth in this segment. Being a back-to-school quarter, education undoubtedly contributed to this growth. From a sub-regional perspective, the Nordics, DACH, and UKI were strong performers this quarter, but Benelux recorded the strongest results, boosted by strong double-digit growth in the commercial space.

"In WE, renewals continued to affect the commercial space positively, despite the impact of the component shortage, especially on the CPU side," said Laura Llames, research analyst, IDC Western Europe Personal Computing. "All the subregions performed well in this space, with Benelux and DACH leading the rally."

Despite the negative performance in the consumer PC market in Western Europe, ultramobile, thin and light, and 2-in-1 devices continue to elicit consumer interest, softening the overall notebook decline as the holiday season approaches. Gaming, while not substantial in volume, persists in providing a strong pocket of growth in this segment.

"The third quarter of the year reported surprising results given the different dynamics in the CEE and MEA regions,” said Stefania Lorenz Associate VP CEMA. “The traditional PC market in the CEMA region reported a contraction of 2.4% YoY. The MEA dragged the overall region to negative results due to the worst decline recorded in Turkey as the market dropped by nearly 60% YoY. The country is facing major challenges with currency fluctuation as well as economic uncertainty affecting all commercial sectors.”

“Contrary to the strong decline in MEA, the CEE region reported better than expected results, increasing 7.1% YoY,” said Nikolina Jurisic, product manager, IDC CEMA. “Behind the overall success is Russia reporting double-digit growth. Despite all the uncertainty about sanctions and fluctuation of the ruble, the country’s economy remained stable with low inflation during the quarter. Demand continued to be strong thanks to few large deals in the corporate and public sector and with retailers already purchasing for the Christmas season.”

Vendor Highlights

Traditional PC market consolidation persisted, and the top 3 vendors' share continued to grow in 2018Q3. The top 3 players accounted for 64.2% of total market volume, compared with 61.3% in 2017Q3.

HP Inc held on to no. 1 position in EMEA, gaining 0.5% YoY to reach 28.4% market share. Solid results across both segments helped maintain the company’s leadership position.

Lenovo (including Fujitsu) once again secured the second spot, reporting 23.9% market share (an increase of 1.0% YoY). Particularly strong notebook performance in the commercial space supported its overall results.

Dell Inc. retained third place with a market share of 13.0% (up 1.5% YoY). Dell had an exceptional quarter, with double-digit growth across both segments attributing to their strong growth in market share.

Acer came fourth in the overall ranking with 9.0% market share (up 0.8% YoY). A solid performance in the shrinking consumer market, and an exceptional commercial performance, aided by back to school, drove this growth.

Apple crept into fifth with 7.3% market share (down 0.6% YoY). Despite a decline, Apple outperformed ASUS, which continued to erode in the EMEA market.

Online messageinquiry

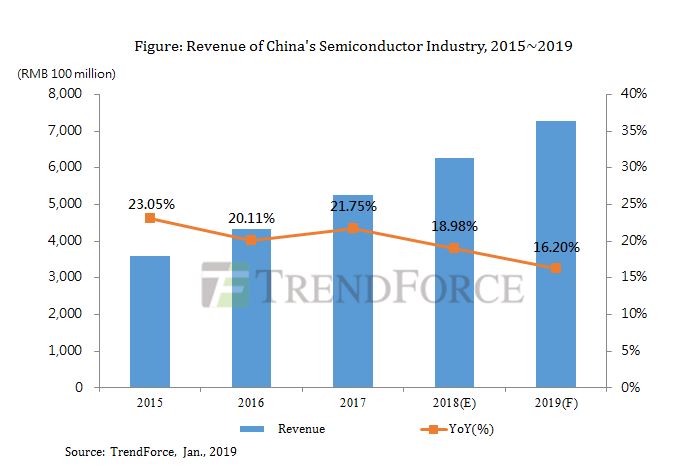

Revenue Growth in China's Semiconductor Industry Would Slow Down to 16.2% in 2019 due to Pessimistic

- Week of hot material

- Material in short supply seckilling

| model | brand | Quote |

|---|---|---|

| BD71847AMWV-E2 | ROHM Semiconductor | |

| RB751G-40T2R | ROHM Semiconductor | |

| TL431ACLPR | Texas Instruments | |

| CDZVT2R20B | ROHM Semiconductor | |

| MC33074DR2G | onsemi |

| model | brand | To snap up |

|---|---|---|

| TPS63050YFFR | Texas Instruments | |

| BU33JA2MNVX-CTL | ROHM Semiconductor | |

| IPZ40N04S5L4R8ATMA1 | Infineon Technologies | |

| STM32F429IGT6 | STMicroelectronics | |

| BP3621 | ROHM Semiconductor | |

| ESR03EZPJ151 | ROHM Semiconductor |

- Week of ranking

- Month ranking

Qr code of ameya360 official account

Identify TWO-DIMENSIONAL code, you can pay attention to

Please enter the verification code in the image below: