- Ameya360 Component Supply Platform >

- Trade news >

- WSTS Bumps Up Chip Sales Forecast

WSTS Bumps Up Chip Sales Forecast

The World Semiconductor Trade Statistics (WSTS) organization revised upward its forecast for 2018 revenue after sales again grew on both a sequential and annual basis in October.

WSTS now expects chip sales to reach $478 billion this year, an increase of 15.9% from 2017. The organization — which is comprised of 42 semiconductor companies that pool sales data — predicts that chip sales will grow by a much more modest 2.6% next year.

The adjustment brings the WSTS forecast more in line with third party market research firms who have been estimating more aggressive growth rates for the semiconductor industry this year. The WSTS said in June it expected chip sales to grow 12.4% this year, but later revised the forecast upward to 15.7%. IC Insights, for example, has been forecasting 15-16% growth for the industry this year since March.

WSTS forecasts that sales will grow across all regions and all major product categories, led by an increase of 33% in memory chip sales, 12% in discretes and 11% in optoelectronics.

Meanwhile, growth rates for October chip sales continued to trend toward much more modest growth than earlier this year. The three-month rolling average of chip sales hit $41.8 billion in October, up 1% from September and up 12.7% compared to October 2017, according to WSTS.

“Although strong sales of DRAM products continue to boost overall market growth, sales in all other major product categories also increased year-to-year in October, and all major regional markets posted year-to-year gains," said said John Neuffer, president and CEO of the Semiconductor Industry Association (SIA), in a press statement.

In a separate statement, the SIA also welcomed what it called a de-excalation of trade tensions between the U.S. and China following a meeting between U.S. President Donald Trump and Chinese President Xi Jinping at the G20 summit in Buenos Aires.

Neuffer said the SIA would be monitoring progress progress on China's trade practices that were flagged by the U.S. government earlier this year, particularly around subsidies, intellectual property protection and forced technology transfers.

The White House said following the meeting between Trump and Xi that the two agreed to begin structural changes with respect to forced technology transfers, intellectual property protection, non-tariff trade barriers and other issues and that the two sides would aim to have an agreement on this issues in the next 90 days.

Trump agreed not to raise tariffs from 10% to 25% on $200 billion worth of Chinese products on Jan. 1, as had previously been planned, the White House said.

"Much is at stake as the two sides endeavor to set U.S.-China trade relations on a more productive path," Neuffer said. "SIA remains committed to working with both governments to support their efforts to achieve a successful negotiated outcome in the short term, and towards a more constructive and open economic relationship in the long term.”

Also, China said during the meeting that it would be willing to re-examine Qualcomm's $44 billion proposed acquisition of NXP, which was not consummated after the two sides failed to gain the approval of China's Ministry of Commerce, according to the White House. But Qualcomm said Monday that it would not revive the transaction and that the company considers it a dead issue.

Online messageinquiry

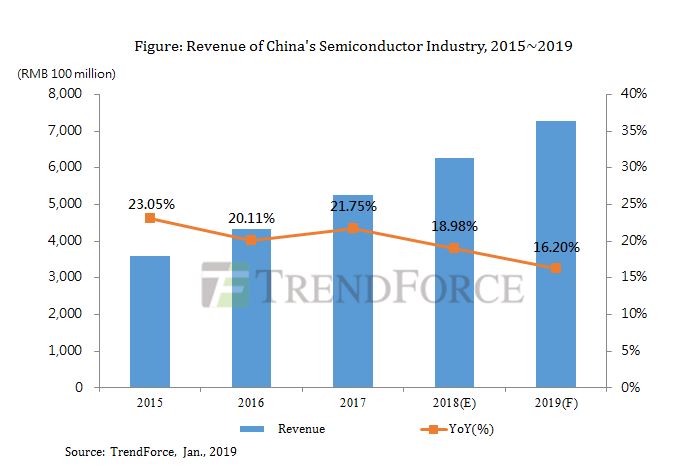

Revenue Growth in China's Semiconductor Industry Would Slow Down to 16.2% in 2019 due to Pessimistic

- Week of hot material

- Material in short supply seckilling

| model | brand | Quote |

|---|---|---|

| TL431ACLPR | Texas Instruments | |

| CDZVT2R20B | ROHM Semiconductor | |

| RB751G-40T2R | ROHM Semiconductor | |

| BD71847AMWV-E2 | ROHM Semiconductor | |

| MC33074DR2G | onsemi |

| model | brand | To snap up |

|---|---|---|

| BP3621 | ROHM Semiconductor | |

| STM32F429IGT6 | STMicroelectronics | |

| BU33JA2MNVX-CTL | ROHM Semiconductor | |

| TPS63050YFFR | Texas Instruments | |

| IPZ40N04S5L4R8ATMA1 | Infineon Technologies | |

| ESR03EZPJ151 | ROHM Semiconductor |

- Week of ranking

- Month ranking

Qr code of ameya360 official account

Identify TWO-DIMENSIONAL code, you can pay attention to

Please enter the verification code in the image below: