- Ameya360 Component Supply Platform >

- Trade news >

- Lithium Batteries for EVs: NMC or LFP?

Lithium Batteries for EVs: NMC or LFP?

Among the many commercial battery technologies, lithium-based batteries excel in the two primary energy-storage figures of merit, namely energy density by volume and weight. Of course, the term “lithium battery” really encompasses various chemistry and construction arrangements. Like all batteries, lithium-ion batteries have two electrodes: an anode and a cathode.

NMC VS. LFP

In electric vehicles (EVs), the dominant cathode chemistries are lithium nickel manganese cobalt (LiNixMnyCozO2, designated NMC) and lithium iron phosphate (LiFePO4 or LFP). Which is the better battery for EVs? As a general statement, NMC batteries offer higher energy capacity than LFP and so might seem to be preferred for EVs where range is a critical parameter, but they are also more expensive.

Cost comparison

How much more? That’s a difficult question to answer since the cost is highly dependent on the fluctuating prices of the underlying commodities which constitute the battery. (Note that “commodity” in this context does not mean “widely, easily available, with little price differentiation” such as light bulbs or even PCs; instead, it refers to a base material which rarely used in its raw form but which is used as a building block or key ingredient.) The iron-based battery cells cost less than the nickel-and-cobalt combination used widely in North America and Europe.

Along with energy density figures, another critical figure of merit for batteries is the cost per stored kilowatt-hour ($/kWh). Although the numbers fluctuate with the changes in commodity pricing, rough estimates are that LFP cells are in the ~$70/kWh range, a significant 30% less than NMC cells at ~$100/kWh.

As part of the effort to build a more affordable electric car, automakers are turning to that lower-cost battery type, but it also delivers less driving range, a major concern in some regions and a much smaller one in others. Several car companies plan to increasingly deploy LFP batteries in the U.S., and they are commonly used in China, the world’s largest market for electric cars.

Market forecast for EV batteries

LFP batteries already comprise 17% of the global EV market and represent a potential path for the mass market, according to the AlixPartners 2022 Global Automotive Outlook (Reference 1). Tesla announced in October 2021 that it was switching to LFP batteries for its standard-range models (Model 3 and Model Y), while retaining the NMC cells for longer-range models. Rivian Automotive, Inc., an emerging maker of smaller electric trucks that is getting lots of Wall Street and other attention will be using LFP batteries in their vehicles.

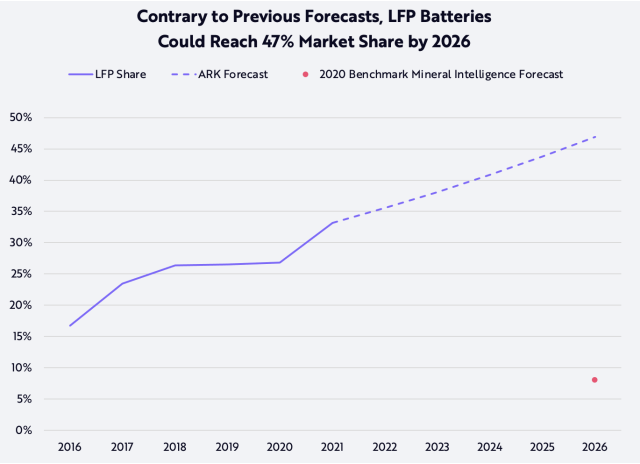

The forecast for the various battery types is hazy, typical of all such predictions. The conventional thinking was that the “better” NMC batteries would dominate the EV market, but that wisdom may be somewhat incorrect. A report from ARK Investment Management LLC indicates that continued cost declines, nickel supply constraints, and improving EV efficiency should propel the market share of LFP cells from roughly 33% in 2021 to ~47% by 2026, Figure and Reference 2. (Of course, there are countless such forecasts out there and you can undoubtedly find one which provides the answer you are seeking if you have an agenda!)

Among the many available forecasts, ARK Investment Management LLC projects that the market share of lower-cost LFP batteries will grow from roughly 33% in 2021 to about 47% by 2026.

Of course, all these forecasts have to be taken with a huge grain of salt, as the cliché goes. For example, the equity analyst who leads global EV battery research at UBS Group AG, now expects EVs equipped with LFP batteries to account for 40% of the global market by 2030, up from a previous forecast of 15% (Reference 3). (Incidentally, this is an excellent example of forecasters saying, “oh well, never mind what we said then”!)

If energy density and cost were the only issues, the decision of which battery chemistry to use in EVs or even non-vehicular situations would be tricky but have only a few variables. Reality is quite different, however, as there are many geopolitical, supply chain, and other technical factors that complicate the assessment:

• The supply chain for LFP cells is heavily concentrated in China, leaving automakers more dependent on Chinese battery supplies at a time when the industry is trying to wean itself from dependence on China for EV technology.

• Automakers are trying to limit the use of cobalt in response to environmental and human rights violations in cobalt mining in Congo, where the majority of the metal is produced.

• Russia is a large supplier of high-grade nickel used in batteries.

• LFP is well-suited to situations where the vehicle is frequently recharged and there is room for a physically larger pack; delivery vehicles are a good fit.

• LFPs have lower manufacturing costs and are easier to produce.

• LFPs can be charged to 100% without degrading battery life; in contrast, NMC cells should be limited to 80% to maximize life. This means that the actual effective range of an EV using LFP cells is close to one with NMC cells, but there’s greater weight penalty of the LFP negates that factor to a large extent. However, for applications such as tools or fixed-in-place machinery where weight is not as critical, LFPs can provide longer run time after a full charge.

• LFPs can operate effectively over a wide temperature range, especially on the low end. On the other side, they are slower to charge at lower temperatures.

• LFPs deliver nearly five times as many charge cycles as NMCs and suffer less degradation at higher temperatures and at faster charge/discharge rates, so they are better suited to handle high-performance driving and quick charging.

No doubt of it: There are a lot of cross-currents here and the entire NMC-versus-LFP situation is fluid and dynamic, with dependencies on many non-engineering factors as well as purely technical ones. Further, battery pricing is driven by short-term commodity pricing bumping into long-term contracts between supplies and customers.

Summary and conclusion

How you assess and quantify the battery technology and market situation depends to a large extent on where you are coming from. The forecasts and numbers are all over the place, partially due to the fact that different market analyses use a variety of criteria and metrics for various reasons.

Here’s what I wonder: given the uncertainties and importance of the battery pack to EV performance, perhaps in the near future manufacturers will list a suggested retail price for the EV itself without any battery at all, and then offer customers a choice between two or three battery-chemistries for a given vehicle – with the battery pack price being updated weekly or monthly. There is some historical precedent: back in the day, you could get some consumer products with lower-end carbon-zinc primary (non-rechargeable) battery packs or pay a modest premium for the better alkaline-battery packs.

When it comes to batteries, there is only one thing we all know for sure (except for some politicians, apparently, who believe they can legislate battery progress): battery technology is not guided by anything like Moore’s law which has defined semiconductor technology for 50+ years.

What’s your view on the mid- or long-term viability of LFP versus NMC-based batteries for EVs and even non-EV applications? Will the markets become highly fragmented, or will one type come to dominate?

Online messageinquiry

- Week of hot material

- Material in short supply seckilling

| model | brand | Quote |

|---|---|---|

| MC33074DR2G | onsemi | |

| RB751G-40T2R | ROHM Semiconductor | |

| CDZVT2R20B | ROHM Semiconductor | |

| BD71847AMWV-E2 | ROHM Semiconductor | |

| TL431ACLPR | Texas Instruments |

| model | brand | To snap up |

|---|---|---|

| BP3621 | ROHM Semiconductor | |

| STM32F429IGT6 | STMicroelectronics | |

| BU33JA2MNVX-CTL | ROHM Semiconductor | |

| IPZ40N04S5L4R8ATMA1 | Infineon Technologies | |

| ESR03EZPJ151 | ROHM Semiconductor | |

| TPS63050YFFR | Texas Instruments |

- Week of ranking

- Month ranking

Qr code of ameya360 official account

Identify TWO-DIMENSIONAL code, you can pay attention to

Please enter the verification code in the image below: