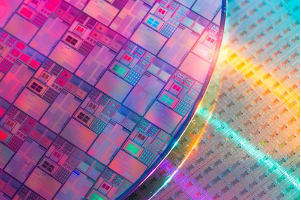

Ameya360:TrendForce Forecasts 4% YoY Drop in Foundry Revenue This Year

As demand continues to slide for all types of mature and advanced nodes, major IC design houses have cut wafer input for the first quarter of 2023 (1Q 2023) and will likely scale back further for 2Q 2023, according to TrendForce’s recent analysis of the foundry market.

Currently, foundries are expected to maintain a lower-than-ideal level of capacity utilization rate in the first two quarters of this year. Some nodes could experience a steeper demand drop in 2Q 2023 as there are still no signs of a significant rebound in wafer orders. Looking ahead to the second half of this year, orders will likely pick up for some components that underwent an inventory correction at an earlier time. However, the state of the global economy will remain the largest variable that affect demand, and the recovery of individual foundries’ capacity utilization rates will not occur as quickly as expected.

Taking these factors into account, TrendForce currently forecasts that global foundry revenue will drop by around 4% year-on-year (YoY) for 2023. The projected decline for 2023 is more severe when compared with the one that was recorded for 2019.

TrendForce also points out that the latest geopolitical risks have led to a geographical realignment across the supply chain. In the case of IC design houses, they are preparing to lower the share of chip production based in China, and the effect of this reallocation of foundry orders will be increasingly noticeable in 2H 2023 and become quite obvious by 2024. The supply and demand conditions of the foundry market will gradually become regionalized as well. This, in turn, will cause divergences among foundries with respect to capacity utilization. Hence, the recovery of the whole foundry industry’s capacity utilization will be influenced by not only seasonal patterns and clients’ inventory levels but also geographical distribution of orders within the supply chain. This last factor warrants greater attention as well.

Now, entering 1Q 2023, sales of consumer electronics including smartphones, notebook (laptop) computers, and TVs are in a slump because of the traditional low season. Moreover, the sluggish pace of inventory consumption will affect foundry orders from IC design houses for components such as consumer-grade PMICs and MOSFETs, to name a few. Due to these developments, 8-inch wafer foundries still suffer an ongoing decline in capacity utilization rate. On the other hand, the 8-inch wafer orders for 2Q 2023 show a slight demand rebound. This is mainly attributed to some orders involving special industrial computers and a few clients adjusting order allocation among foundry partners. Nevertheless, the contribution from these sources of demand to the utilization of the overall 8-inch wafer foundry capacity is limited. TrendForce’s latest investigation indicates that 8-inch wafer foundries’ capacity utilization rates will remain mostly constant between 1Q 2023 and 2Q 2023. For now, TrendForce does not believe a substantial recovery will occur in the near future.

Turning to 12-inch wafer foundries operating with the advanced nodes, TSMC is expected to keep a lower-than-ideal level of capacity utilization rate in 1H 2023. Then, TSMC should be able to raise the rate of its 7nm node in 2H 2023, though the increase will still be limited. As for TSMC’s 5nm node, its rate will eventually return to the optimal level in 2H 2023 thanks to stock-up activities related to the releases of new devices during the traditional peak season. Looking at Samsung, capacity utilization rate will stay low for its ≤8nm nodes through 2023 chiefly because its main clients Qualcomm and NVIDIA have opted to reallocate orders to other foundries.

Regarding 12-inch wafer foundries operating with the mature nodes, they will mostly retain a capacity utilization rate of 75~85% in 1H 2023. These foundries, which include TSMC, UMC, and GlobalFoundries, are actively expanding into application segments that offer a more stable level of demand. Examples include automotive electronics, industrial equipment, and medical devices. Thus, the mature nodes are able to maintain a relatively high capacity utilization rate. TrendForce has also observed that the 28nm node has a higher rate compared with the 55/40nm nodes. Furthermore, foundries that have a higher proportion of consumer-grade chips in the product mix have experienced a larger rate drop. Their rates have mostly dipped to around 65~75%.

In 2H 2023, significant geopolitical risks will likely persist. Furthermore, some major OEMs have initiated a review of supply partners so that they can meet the requirements of the tenders released by the US government. Therefore, they are going to continue with their efforts to relocate their supply chains. Also, IC design houses have successively moved portions of their orders to foundries based outside China. Most of these reallocated orders are for 8-inch wafer foundry. Therefore, non-Chinese foundries such as UMC and Vanguard will likely see a slightly above-average hike in the utilization rate of 8-inch wafer foundry capacity during the second half of the year.

The market for end products as a whole has gone through about a year of inventory corrections. Therefore, the momentum of stock-up activities will get stronger for certain consumer-grade chips later in 2023 as OEMs prepares for the traditional peak season. TrendForce says some urgent orders and a few other orders involving products with special specifications will arrive and slightly boost foundry demand in 2Q 2023. Then, starting in 3Q 2023, capacity utilization rate will climb more noticeably in both the 8- and 12-inch wafer segments. However, this rise in foundries’ capacity utilization rates could be constrained by the uncertain economic outlook. Thus, foundries are not expected to return to the fully-loaded status within the short term.

More than 20 new wafer fabs to be built

In the medium to long term, the foundry market will become more fragmented because the building and diversification of production capacity will take place across different regions. TrendForce’s research finds that plans for a total of more than 20 new wafer fabs have been initiated in recent years. Regarding the geographical distribution of these new fabs, Taiwan will have five, the US will have five, China will have six, Europe will have four, and another four will be located among South Korea, Japan, and Singapore.

Governments worldwide are now much more aware of the importance of local manufacturing due to recent geopolitical events, and semiconductor chips have gradually emerged as a strategic resource. Therefore, apart from commercial interests and cost structure, foundries now have to give a greater consideration to certain countries’ subsidy policies and their clients’ need for local content. At the same time, they will still need to maintain a healthy supply-demand balance for the whole market. TrendForce believes a diverse range of offerings and an effective pricing strategy are the key factors that will enable foundries to maintain a successful operation in the future.

在线留言询价

- 一周热料

- 紧缺物料秒杀

| 型号 | 品牌 | 询价 |

|---|---|---|

| MC33074DR2G | onsemi | |

| CDZVT2R20B | ROHM Semiconductor | |

| RB751G-40T2R | ROHM Semiconductor | |

| TL431ACLPR | Texas Instruments | |

| BD71847AMWV-E2 | ROHM Semiconductor |

| 型号 | 品牌 | 抢购 |

|---|---|---|

| BP3621 | ROHM Semiconductor | |

| BU33JA2MNVX-CTL | ROHM Semiconductor | |

| IPZ40N04S5L4R8ATMA1 | Infineon Technologies | |

| STM32F429IGT6 | STMicroelectronics | |

| TPS63050YFFR | Texas Instruments | |

| ESR03EZPJ151 | ROHM Semiconductor |

- 周排行榜

- 月排行榜

AMEYA360公众号二维码

识别二维码,即可关注

请输入下方图片中的验证码: