- Ameya360 Component Supply Platform >

- Trade news >

- Current Situation and Prospect Analysis of Electronic Components Market in 2023

Current Situation and Prospect Analysis of Electronic Components Market in 2023

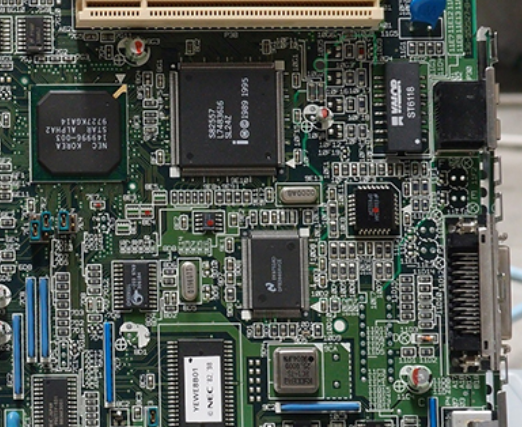

According to data, the scale of China’s electronic components market has increased from 1.831 billion RMB in 2017 to 2.2095 billion RMB in 2021, with a compound annual growth rate of 4.8%. It is expected to reach 2.3769 billion RMB in 2023. The global electronic components market will grow from US$2.5 trillion in 2017 to US$2.9 trillion in 2021, with a compound annual growth rate of 3.8%. It is expected to reach US$3.1 trillion in 2023. The proportion of China’s electronic components market in the global market has increased from 23.2% in 2017 to 24.1% in 2021, and is expected to reach 24.6% in 2023.

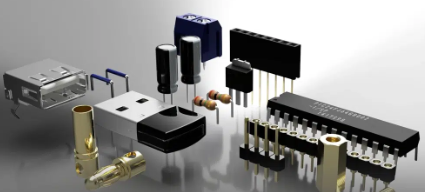

From the perspective of different types of electronic components, semiconductor devices are the largest market segment, accounting for nearly half of the global electronic components market, followed by passive devices and optoelectronic devices. Among semiconductor devices, memory chips are the largest single category, accounting for more than 20% of the global semiconductor market. Among passive devices, capacitors are the largest single category, accounting for more than 30% of the global passive device market. Among optoelectronic devices, LED is the largest single category, accounting for more than 60% of the global optoelectronic device market.

Electronic components market structureFrom the perspective of geographical distribution, Asia is the main consumption area of the global electronic components market, accounting for more than 60% of the global market. Among them, China is the largest consumer of electronic components in Asia and the world, accounting for more than 40% of the Asian market. Europe and North America accounted for 15% and 14% of the global market, respectively, while other regions accounted for 11%.

From the perspective of industry applications, consumer electronics is the largest terminal demand field in the global electronic components market, accounting for more than 30% of the global market. Among them, mobile phones, smart homes, and personal computers are the main application products in the field of consumer electronics. Automobile is the fastest-growing terminal demand field in the global electronic components market, accounting for about 15% of the global market. Among them, new energy vehicles, smart cars, and Internet of Vehicles are the main application directions in the automotive field. Other industry applications include communications, industry, medical, military, etc., each accounting for about 10% of the global market.

Development trend of electronic components marketThroughout 2023, the global electronic components market will be affected by the following aspects:

(1) Demand in emerging fields. With the rapid development of emerging fields such as 5G communications, new energy vehicles, the Internet of Things, and artificial intelligence, the demand for electronic components will continue to grow. The requirements for electronic components in these emerging fields are not only an increase in quantity, but also an improvement in quality, requiring higher performance, lower power consumption, smaller size, and higher integration. This will promote the electronic components industry to accelerate technological innovation and product upgrading.

(2) Acceleration of domestic substitution. Affected by the United States export controls on China’s semiconductor technology, China’s electronic components industry is facing the challenge of supply chain disruption and security risks. In order to protect its own development and national security, the Chinese government and enterprises will increase investment and support for the electronic components industry, and promote breakthroughs in core technologies and independent innovation. It is expected that by 2023, China’s domestic substitution rate in subdivided fields such as memory chips, power chips, and analog chips will increase significantly, and some products will achieve self-sufficiency or export.

(3) Impact of trade frictions. The U.S. escalation of China’s semiconductor technology export control not only affects the development of China’s electronic components industry but also has an impact on the supply-demand balance and price stability of the global electronic components market. In the short term, this may lead to a shortage of supply and higher prices in the global electronic components market, putting cost pressure on downstream industries. In the long run, this may prompt the adjustment and reorganization of the global electronic components industry chain, forming a multi-polar competition pattern.

(4) Promotion of digital transformation. With the development of technologies such as the Internet, big data, and cloud computing, the electronic components industry will also accelerate digital transformation, using digital platforms to improve production efficiency, reduce operating costs, optimize supply chain management, and improve customer experience. Especially under the influence of the pandemic, the electronic components industry will pay more attention to the development and operation of online channels, and use e-commerce platforms to expand market coverage and service scope.

Online messageinquiry

- Week of hot material

- Material in short supply seckilling

| model | brand | Quote |

|---|---|---|

| MC33074DR2G | onsemi | |

| BD71847AMWV-E2 | ROHM Semiconductor | |

| TL431ACLPR | Texas Instruments | |

| RB751G-40T2R | ROHM Semiconductor | |

| CDZVT2R20B | ROHM Semiconductor |

| model | brand | To snap up |

|---|---|---|

| STM32F429IGT6 | STMicroelectronics | |

| TPS63050YFFR | Texas Instruments | |

| ESR03EZPJ151 | ROHM Semiconductor | |

| BP3621 | ROHM Semiconductor | |

| IPZ40N04S5L4R8ATMA1 | Infineon Technologies | |

| BU33JA2MNVX-CTL | ROHM Semiconductor |

- Week of ranking

- Month ranking

Qr code of ameya360 official account

Identify TWO-DIMENSIONAL code, you can pay attention to

Please enter the verification code in the image below: