TSMC Expected to Lower Capital Expenditure, Potentially Falling Below $30 Billion for the Year

As TSMC’s earnings call approaches, the market is abuzz with rumors that the company may revise down its capital expenditure target for this year. This potential adjustment is believed to be driven by delays in Intel’s 3-nanometer outsourcing and the deferral of the production schedule for TSMC’s 4-nanometer US fab. The initial capital expenditure target, which was close to the $32 billion to $36 billion range, may now be lowered to below $30 billion, marking its lowest point in nearly three years.

According to Taiwan’s Economic Daily, TSMC has refrained from commenting on these speculations. Even if TSMC does adjust its capital expenditure for this year, industry sources suggest that the company will increase its annual R&D expenses, continuing its commitment to advanced research and development.

In recent years, TSMC has rapidly expanded its capital expenditure, reaching a record high of $36.3 billion last year. In the first half of this year, the actual capital expenditure amounted to $18.11 billion, including $8.17 billion in the second quarter, slightly down from the $9.94 billion in the first quarter.

During their July earnings conference, TSMC stated that their capital expenditure for the year would remain in the range of $32 billion to $36 billion. However, considering market dynamics, the actual expenditure for the full year is expected to be towards the lower end of this range.

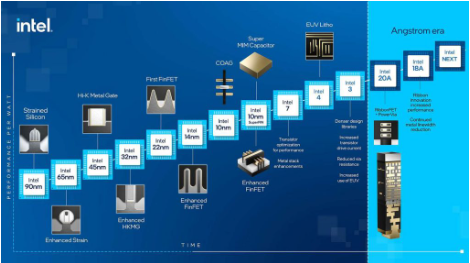

The latest reports suggest that due to the delays in Intel’s 3-nanometer outsourcing and the postponement of the 4-nanometer production schedule at the US fab, approximately $4 billion originally earmarked for this year’s capital expenditure may be postponed until next year, resulting in capital expenditure for this year falling below $30 billion. As for next year’s capital expenditure, it may remain on par with this year.

ASML, a leading supplier of semiconductor lithography equipment, previously revealed in its July earnings conference that there were delays in shipments of EUV equipment due to installation delays at customer factories. However, ASML maintained a robust order backlog and expects overall performance to continue growing in 2024.

Industry experts believe that the “installation delays” mentioned by ASML at that time were related to TSMC, and because of the delay in EUV equipment installation, TSMC’s capital expenditure for this year may be deferred accordingly.

Analysts in the industry suggest that if we consider TSMC’s earlier projection of capital expenditure falling within the $32 billion to $36 billion range, and subtract the actual expenses incurred in the first half of the year, the capital expenditure for the second half of the year could see a decline, estimated to be around $13.89 billion or more. If the postponement rumors materialize, second-half capital expenditure might fall below $10 billion.

在线留言询价

- 一周热料

- 紧缺物料秒杀

| 型号 | 品牌 | 询价 |

|---|---|---|

| BD71847AMWV-E2 | ROHM Semiconductor | |

| RB751G-40T2R | ROHM Semiconductor | |

| TL431ACLPR | Texas Instruments | |

| CDZVT2R20B | ROHM Semiconductor | |

| MC33074DR2G | onsemi |

| 型号 | 品牌 | 抢购 |

|---|---|---|

| ESR03EZPJ151 | ROHM Semiconductor | |

| TPS63050YFFR | Texas Instruments | |

| BU33JA2MNVX-CTL | ROHM Semiconductor | |

| STM32F429IGT6 | STMicroelectronics | |

| IPZ40N04S5L4R8ATMA1 | Infineon Technologies | |

| BP3621 | ROHM Semiconductor |

- 周排行榜

- 月排行榜

AMEYA360公众号二维码

识别二维码,即可关注

请输入下方图片中的验证码: