- Ameya360 Component Supply Platform >

- Trade news >

- Intel, Samsung, TSMC Race in Cutting-Edge Processes

Intel, Samsung, TSMC Race in Cutting-Edge Processes

Driven by emerging technologies like AI and high-performance computing, the semiconductor foundry industry increasingly emphasizes the importance of advanced manufacturing processes. Recently, the industry has seen significant developments. Intel announced that it has commenced large-scale production of its Intel 4 process node, while TSMC and Samsung are equally committed to advancing their advanced process technologies.

Intel’s Mass Production of Intel 4 Process Node

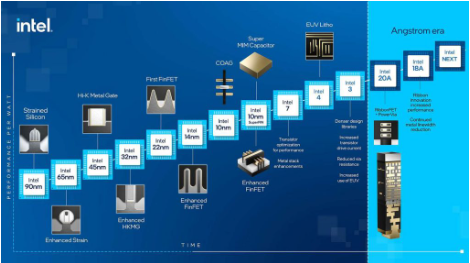

On October 15th, Intel China’s official public account revealed that Intel has initiated large-scale production of the Intel 4 process node using Extreme Ultraviolet Lithography (EUV) technology. According to Intel, they are making significant progress with their “Four Years, Five Nodes” plan. This plan aims to produce next-generation products that meet the computational demands driven by AI’s role in the “Siliconomy.”

Being the first process node produced by Intel using EUV lithography technology, Intel 4 offers substantial improvements in performance, efficiency, and transistor density compared to its predecessors. Intel 4 was unveiled at the Intel Innovation 2023 held in September this year.

In comparison to Intel 7, Intel 4 achieves a 2x reduction in area, providing high-performance computing (HPC) logic libraries and incorporating various innovative features.

In detail, Intel 4 simplifies the EUV lithography process, optimizing it for high-performance computing applications, supporting both low voltage (<0.65V) and high voltage (>1.1V) operations. Compared to Intel 7, Intel 4 boasts more than a 20% improvement in iso-power performance, and high-density Metal-Insulator-Metal (MIM) capacitors deliver outstanding power supply performance.

Intel’s “Four Years, Five Nodes” plan is advancing with the following process updates:

Intel 7 and Intel 4 are currently in large-scale production. Intel 3 is on track to meet its planned target by the end of 2023.

Intel’s Intel 20A and Intel 18A, which use Ribbon FET all-around gate transistors and PowerVia backside power delivery technology, are also progressing well, with a target of 2024. Intel will soon introduce the Intel 18A process design kit (PDK) for Intel Foundry Services (IFS) customers.

With the adoption of Intel 4 process nodes, the Intel Core i9 Ultra processor, codenamed “Meteor Lake,” will be released on December 14th this year, ushering in the AIPC era.

On Intel 3 process nodes, the energy-efficient E-core Sierra Forest processor will be launched in the first half of 2024, and the high-performance P-core Granite Rapids processor will follow closely.

Samsung’s 2nm Process Detailed Production Plan

Samsung has already commenced production of its second-generation 3nm chips and plans to continue focusing on 2nm chips.

On June 28th, Samsung Electronics unveiled its latest foundry technology innovations and business strategies at the 7th Samsung Foundry Forum (SFF) in 2023.

In the era of artificial intelligence, Samsung’s foundry program, based on advanced GAA process technology, offers robust support for customers in AI applications. To this end, Samsung has disclosed a detailed production plan and performance levels for its 2nm process. The plan is to achieve mass production for mobile applications by 2025 and respectively expand to HPC and automotive electronics in 2026 and 2027.

Samsung reports that the 2nm process (SF2) improves performance by 12% compared to the 3nm process (SF3), increases efficiency by 25%, and reduces the area by 5%.

Furthermore, reports indicated that Samsung is ensuring the production capacity for products using the next-generation EUV lithography machine, High-NA, in September. This equipment is expected to have a prototype by the end of this year and officially enter production next year.

TSMC’s Mass Production of 2nm by 2025

This year, TSMC has unveiled its latest advanced semiconductor manufacturing roadmap in various locations, including Santa Clara, California, and Taiwan. The roadmap covers a range of processes from 3nm to 2nm.

TSMC’s current roadmap for 3nm includes N3, N3E, N3P, N3X, and N3 AE, with N3 serving as the foundational version, N3E as an enhanced version with further cost optimization, N3P focusing on improved performance with a planned start in the second half of 2024, N3X targeting high-performance computing devices with a mass production goal in 2025, and N3 AE designed specifically for the automotive sector, offering greater reliability and the potential to shorten time-to-market by 2-3 years.

In the 2nm realm, TSMC is planning to achieve mass production of the N2 process by 2025. TSMC has reported that the N2 process will offer a 15% speed improvement over N3E at the same power or a 30% reduction in power consumption, with a 15% increase in transistor density. In September, media reports revealed that TSMC has formed a task force to accelerate 2nm pilot production and mass production, aiming for risk production next year and official mass production in 2025.

To ensure the smooth development of 2nm process technology, TSMC has initiated efforts in the upstream equipment sector. On September 12th, TSMC announced the acquisition of a 10% stake in IMS Nanofabrication, a subsidiary of Intel, for a price not exceeding $432.8 million. IMS specializes in the research and production of electron beam lithography machines, which find extensive applications in semiconductor manufacturing, optical component manufacturing, MEMS manufacturing, and more. The industry sees TSMC’s IMS acquisition as vital for developing crucial equipment and meeting the demand for 2nm process commercialization.

Online messageinquiry

TSMC Expected to Lower Capital Expenditure, Potentially Falling Below $30 Billion for the Year

- Week of hot material

- Material in short supply seckilling

| model | brand | Quote |

|---|---|---|

| TL431ACLPR | Texas Instruments | |

| BD71847AMWV-E2 | ROHM Semiconductor | |

| RB751G-40T2R | ROHM Semiconductor | |

| MC33074DR2G | onsemi | |

| CDZVT2R20B | ROHM Semiconductor |

| model | brand | To snap up |

|---|---|---|

| BP3621 | ROHM Semiconductor | |

| TPS63050YFFR | Texas Instruments | |

| ESR03EZPJ151 | ROHM Semiconductor | |

| BU33JA2MNVX-CTL | ROHM Semiconductor | |

| STM32F429IGT6 | STMicroelectronics | |

| IPZ40N04S5L4R8ATMA1 | Infineon Technologies |

- Week of ranking

- Month ranking

Qr code of ameya360 official account

Identify TWO-DIMENSIONAL code, you can pay attention to

Please enter the verification code in the image below: