- Ameya360 Component Supply Platform >

- Trade news >

- Micro LED & Mini LED Market Expects Explosive Business Opportunities, with an Estimated Market Value of $1.38 Billion by 2022

Micro LED & Mini LED Market Expects Explosive Business Opportunities, with an Estimated Market Value of $1.38 Billion by 2022

Micro LED displays and Mini LED backlight technology have been the focus of spotlight in this year’s exhibitions of consumer electronics and display technology. Major manufacturers including Samsung, Sony, and AUO have showcased related conceptual products. It is also said that Samsung may mass-produce ultra-large Micro LED TVs, driving more manufacturers to invest in Mini LED R&D. According to the latest report of LEDinside, a division of TrendForce, the market value of Micro LED and Mini LED products is estimated at US$1.38 billion by 2022.

New technologies will accelerate the advancement of Micro LED

“Micro LED still faces many technical bottlenecks, including epitaxial wafer/chip, transfer, full color, driver IC, backplane and inspection/repair technology”, says Roger Chu, the Research Director of LEDinside. Transfer technology used to be the biggest bottleneck, but new transfer solutions have been emerging, such as Pick & Place transfer, fluid assembly, laser transfer, and roller transfer. It is expected that there will be more cost-competitive solutions in the future, which may accelerate the advancement of Micro LED.

LEDinside notes that Micro LED technology is most likely adopted to display products with special requirements, especially those beyond the capabilities of LCD and OLED displays. LEDinside expects that Micro LED would be gradually applied to AR micro projections which require high brightness, automotive HUD projection applications, and ultra-large digital display in the near future. LEDinside estimates that the market value of Micro LED products will reach US$694 million by 2022.

Mini LED expects growing demand in high-end backlight market

Considering existing technical barriers for Micro LED technology, manufacturers tend to launch Mini LED backlight solutions this year, hoping to boost the demand. Displays using Mini LED backlight may appear in the market in the second half of 2018, says LEDinside, and the market value of Mini LED products is expected to reach US$689 million by 2022.

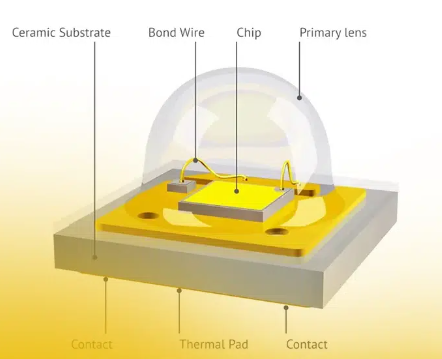

Different from conventional LED backlight, Mini LED chips are smaller in size. Coupled with direct type LED backlight and local dimming, the number of LED chips used will grow at multiples. Therefore, Mini LED will become a key application that drives the demand for LED chips.

However, the costs of Mini LED backlight remain too high for mainstream displays, while problems of heat dissipation and power consumption have not been solved yet. Therefore, Mini LED may cut into the market through high-end consumer products like gaming notebook, gaming monitors, monitor with special applications, as well as niche products like high-end TV with high resolution, high contrast and high color saturation. These products put more focus on specifications than on competitive prices, thus will become the main battlefield for vendors who aim to achieve technology differentiation through Mini LED backlight technology.

Online messageinquiry

- Week of hot material

- Material in short supply seckilling

| model | brand | Quote |

|---|---|---|

| MC33074DR2G | onsemi | |

| TL431ACLPR | Texas Instruments | |

| CDZVT2R20B | ROHM Semiconductor | |

| BD71847AMWV-E2 | ROHM Semiconductor | |

| RB751G-40T2R | ROHM Semiconductor |

| model | brand | To snap up |

|---|---|---|

| TPS63050YFFR | Texas Instruments | |

| BP3621 | ROHM Semiconductor | |

| BU33JA2MNVX-CTL | ROHM Semiconductor | |

| IPZ40N04S5L4R8ATMA1 | Infineon Technologies | |

| ESR03EZPJ151 | ROHM Semiconductor | |

| STM32F429IGT6 | STMicroelectronics |

- Week of ranking

- Month ranking

Qr code of ameya360 official account

Identify TWO-DIMENSIONAL code, you can pay attention to

Please enter the verification code in the image below: