LED Packaging Companies Work on Niche Markets, Says TrendForce

Mainstream high- and mid-power LED package products in the Chinese market witnessed price declines in December, according to the latest report from LEDinside, a division of TrendForce.

“LED manufacturers have continued to clear their inventories in December due to the weak demand at the year end, which lowered the prices in the general lighting market”, says LEDinside analyst Terri Wang. The average prices of high- and mid-power LED package products slid 2%~4% and 1%~8% respectively.

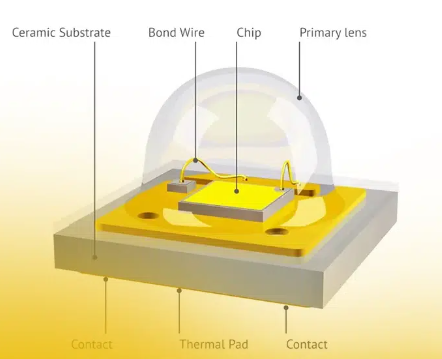

Faced with the sluggish demand, LED packaging companies continue to explore niche markets, with horticultural lighting, human centric lighting, and connected lighting being the focus. For instance, Lumileds has released the LUXEON SunPlus 2835 LED series for horticultural lighting, with eight color options and customized spectrum available. Samsung has also launched a new product series for horticultural lighting, including full-spectrum packages and modules. Blue light, red light, and infrared LEDs are available, and the products have been mass produced. For the future, Samsung plans to integrate smart sensing or connected solutions to horticultural lighting LED products. Nichia introduces COB, a new human centric lighting product series, which can be used for commercial lighting like retailing stores. The color temperature can change according to the features of products displayed, or according to users’ biological clock when used for home lighting.

在线留言询价

- 一周热料

- 紧缺物料秒杀

| 型号 | 品牌 | 询价 |

|---|---|---|

| BD71847AMWV-E2 | ROHM Semiconductor | |

| TL431ACLPR | Texas Instruments | |

| CDZVT2R20B | ROHM Semiconductor | |

| RB751G-40T2R | ROHM Semiconductor | |

| MC33074DR2G | onsemi |

| 型号 | 品牌 | 抢购 |

|---|---|---|

| TPS63050YFFR | Texas Instruments | |

| ESR03EZPJ151 | ROHM Semiconductor | |

| BU33JA2MNVX-CTL | ROHM Semiconductor | |

| IPZ40N04S5L4R8ATMA1 | Infineon Technologies | |

| STM32F429IGT6 | STMicroelectronics | |

| BP3621 | ROHM Semiconductor |

- 周排行榜

- 月排行榜

AMEYA360公众号二维码

识别二维码,即可关注

请输入下方图片中的验证码: