- Ameya360 Component Supply Platform >

- Trade news >

- DRAM Market Again Saw Record High Revenue in 2Q18 but Prices Are Approaching Their Peaks

DRAM Market Again Saw Record High Revenue in 2Q18 but Prices Are Approaching Their Peaks

The global DRAM revenue grew by 11.3% QoQ (from previous quarter) to reach another record high in 2Q18, according to DRAMeXchange, a division of TrendForce. DRAM quotes rose during the period as the market remained in tight supply. Contract prices of most DRAM products advanced by just around 3% QoQ on average in 2Q18, except for contract prices of graphics DRAM products that surged by nearly 15% QoQ on the back of the cryptocurrency-related demand.

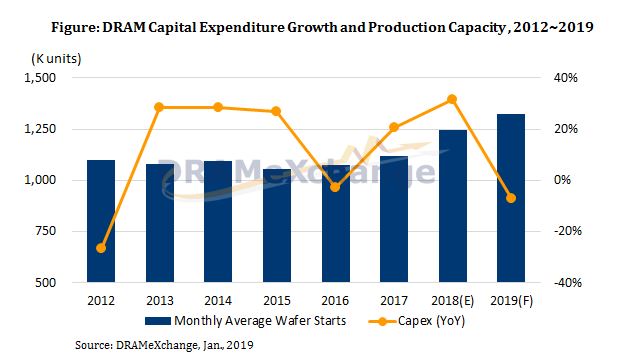

With most contract negotiations completed in July, the 3Q18 contract prices of PC DRAM products for first-tier PC-OEMs have come to an average of US$34.5, showing a 1.5% hike from 2Q18 contract prices. The upswing in PC DRAM contract prices has moderated considerably for 3Q18. On the whole, DRAM prices are almost at their peaks. Looking ahead, DRAMeXchange believes that the chance for another significant hike in contract prices in 4Q18 will be slim because the top suppliers will start using their newly added production capacity in 2H18. At the same time, the demand growth will be fairly limited. Spot prices, which is an early indicator of the contract price trend, are also on a slide.

Samsung still topped the revenue ranking for 2Q18 as its total DRAM revenue for the quarter went up by 8.2% QoQ to a new high of US$11.21 billion. SK Hynix’s 2Q18 revenue leapt up by 19.5% QoQ to US$7.69 billion due to a significant increase in bit shipments. SK Hynix with the large revenue growth was also able to recapture some of the previously lost market share. Samsung’s and SK Hynix’s global market shares in revenue terms came to 43.6% and 29.9%, respectively, in 2Q18. Together, the two South Korean suppliers accounted for about 73.5% of the global market.

Micron stayed at the third place in the ranking with its revenue advancing by 6.3% QoQ to US$5.54 billion. Despite being the price leader among the top three suppliers, Micron’s revenue growth was the smallest because its subsidiary Micron Memory Taiwan (formerly Rexchip) experienced a production disruption in March (related to the interruption of nitrogen gas supply to the fab). This in turn caused flat growth for Micron’s 2Q18 bit shipments. Micron’s global market share also shed by 1 percentage point from the prior quarter to 21.6%.

With respect to the top three suppliers’ operating margins, Samsung was unable to post noticeable growth in 2Q18 because the previous quarter was a much stronger base period for comparison. Furthermore, the anti-monopoly probe by the Chinese government is stifling Samsung’s ability to increase its profit. This is reflected in Samsung’s overall price hike, which is the smallest among the top three suppliers. Also, the supplier’s 1Y-nm technology is currently in the sampling phase and will not be ready for mass production until the middle of 3Q18. Hence, Samsung’s operating margin in 2Q18 was the same as in 1Q18 at 69%. SK Hynix and Micron, by contrast, gained significantly from their die-shrink efforts and the rising prices. The former’s operating margin grew from 61% in 1Q18 to 63% in 2Q18, while the latter saw a jump from 58% to 60% between the two quarters. All of the top three suppliers posted an operating margin surpassing 60%, which is unprecedented.

Nevertheless, suppliers are reaching a limit in raising their profits. In 2H18, suppliers will begin utilizing their newly added capacity and raise the output shares for their 1X- and 1Y-nm processes. Furthermore, Samsung has become more conservative in offering quotes as the company is wary of the ramifications of price hikes. This suggests that it will be more difficult for other suppliers to raise their quotes in the near future as well. Additionally, the top three suppliers are registering an average gross margin of over 70%. For OEM clients, they are now under enormous BOM cost pressure. For suppliers, they are approaching the summit of their overall profitability.

From the aspect of technology migration, Samsung will continue to increase the share of 1X-nm production in its DRAM bit output this year. Apart from that, Samsung is going to deploy the next-generation 1Y-nm technology for the newly added capacity at Line 17 and the new DRAM line at the Pyeongtaek plant. With the expansion of the DRAM capacity at the Pyeongtaek plant, the combined output share of 1X- and 1Y-nm production is projected to reach 70% by the end of 2018 and will keep expanding in 2019. SK Hynix has been working to raise the yield rate of its 1X-nm process since its deployment at the end of 2017, but the 1X-nm migration so far has been challenging for the supplier. SK Hynix’s second 12-inch wafer fab in China’s Wuxi is on track to finish construction by the end of 2018 and will start rolling out DRAM products in 1H19. Micron’s subsidiary Micron Memory Taiwan is now using the 1X-nm technology for all of its DRAM production and will directly move on to the development of 1Z-nm process in 2019. Micron Technology Taiwan (formerly Inotera) has been transitioning from the 20nm to the 1X-nm since 2Q18, and about half of its production capacity is expected to be on the 1X-nm by the end of 2018. The full conversion is forecast to finish in 1H19.

With regard to Taiwan-based DRAM suppliers, Nanya registered a QoQ increase of 28.6% in its 2Q18 revenue thanks to increased bit output from its 20nm process and the price uptrend. Nanya had carried a high level of inventory for DDR3 products in 1Q18, but this problem was effectively controlled by 2Q18. Nanya’s operating margin also rose by 2.5 percentage points from the prior quarter to 46.8% due to the cost improvement resulting from the 20nm deployment. However, Nanya’s profitability will be negatively affected by the tapering of DRAM price hike and the depreciation expense associated with its capacity expansion efforts.

Powerchip’s DRAM revenue fell by 13.5% QoQ in 2Q18 because the company retains a sizable portion of its fab capacity for the foundry business that it has with IC design houses (e.g. ESMT and AP Memory). As for Winbond, its 2Q18 revenue rose by 8.7% QoQ on account of allocating more of its production capacity to its 38nm process.

Online messageinquiry

DRAM Prices Forecast to Crash in Q1

DRAM Market to See Lower Capital Expenditure and Moderated Bit Output in 2019 Due to Weak Demand

DRAM Outlook Dims for 2019

- Week of hot material

- Material in short supply seckilling

| model | brand | Quote |

|---|---|---|

| CDZVT2R20B | ROHM Semiconductor | |

| MC33074DR2G | onsemi | |

| TL431ACLPR | Texas Instruments | |

| BD71847AMWV-E2 | ROHM Semiconductor | |

| RB751G-40T2R | ROHM Semiconductor |

| model | brand | To snap up |

|---|---|---|

| STM32F429IGT6 | STMicroelectronics | |

| TPS63050YFFR | Texas Instruments | |

| ESR03EZPJ151 | ROHM Semiconductor | |

| IPZ40N04S5L4R8ATMA1 | Infineon Technologies | |

| BP3621 | ROHM Semiconductor | |

| BU33JA2MNVX-CTL | ROHM Semiconductor |

- Week of ranking

- Month ranking

Qr code of ameya360 official account

Identify TWO-DIMENSIONAL code, you can pay attention to

Please enter the verification code in the image below: