- Ameya360 Component Supply Platform >

- Trade news >

- Cutting edge transistors for semiconductors of the future

Cutting edge transistors for semiconductors of the future

As traditional transistors reach the threshold of their miniaturization potential, the ability to incorporate multiple functionalities within a limited number of units becomes crucial for facilitating the creation of compact, energy-efficient circuits. This, in turn, paves the way for enhanced memory capabilities and the realization of more potent computing systems.

Transistors that can change properties are important elements in the development of tomorrow's semiconductors. With standard transistors approaching the limit for how small they can be, having more functions on the same number of units becomes increasingly important in enabling the development of small, energy-efficient circuits for improved memory and more powerful computers. Researchers at Lund University in Sweden have shown how to create new configurable transistors and exert control on a new, more precise level.

Transistors that can change properties are important elements in the development of tomorrow's semiconductors. With standard transistors approaching the limit for how small they can be, having more functions on the same number of units becomes increasingly important in enabling the development of small, energy-efficient circuits for improved memory and more powerful computers. Researchers at Lund University in Sweden have shown how to create new configurable transistors and exert control on a new, more precise level.

In view of the constantly increasing need for better, more powerful and efficient circuits, there is a great interest in reconfigurable transistors. The advantage of these is that, in contrast to standard semiconductors, it is possible to change the transistor's properties after they have been manufactured.

Historically, computers' computational power and efficiency have been improved by scaling down the silicon transistor's size (also known as Moore's Law). But now a stage has been reached where the costs for continuing development along those lines has become much higher, and quantum mechanics problems have arisen that have slowed development.

Instead, the search is on for new materials, components and circuits. Lund University is among the world leaders in III-V materials, which are an alternative to silicon. These are materials with considerable potential in the development of high-frequency technology (such as parts for future 6G and 7G networks), optical applications and increasingly energy-efficient electronic components.

Ferroelectric materials are used in order to realize this potential. These are special materials that can change their inner polarization when exposed to an electric field. It can be compared to an ordinary magnet, but instead of a magnetic north and South Pole, electric poles are formed with a positive and a negative charge on each side of the material. By changing the polarization, it is possible to control the transistor. Another advantage is that the material "remembers" its polarization, even if the current is turned off.

Through a new combination of materials, the researchers have created ferroelectric "grains" that control a tunnel junction—an electrical bridging effect—in the transistor. This is on an extremely small scale—a grain is 10 nanometers in size. By measuring fluctuations in the voltage or current, it has been possible to identify when polarization changes in the individual grains and thus understand how this affects the transistor's behavior.

- The Future of the Semiconductor Industry

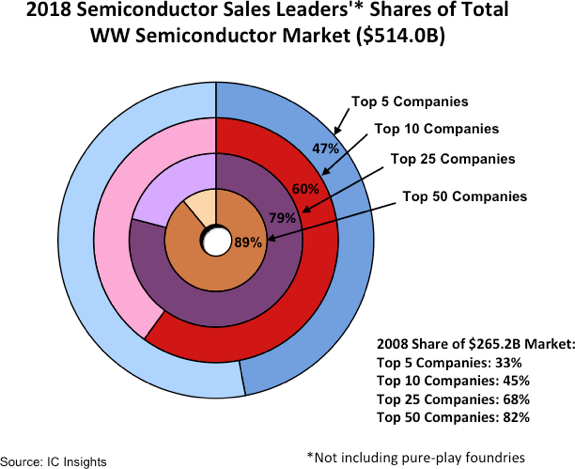

In addition to the upstream IC design, the midstream foundry, the DRAM industry, and the downstream packaging and testing, photomask, equipment and other industries, semiconductors have a huge group, and the application of semiconductors has also expanded to the electronic information industry, automotive electronics, Aerospace, medical, precision machinery and other industries.

While the future of the semiconductor industry looks bright, no one knows with certainty where it’s headed. The direction it moves in depends on many factors, which include the following:

· the experimentation with new semiconductor materials

· the increase in the price of rare earth metals

· the accelerated industrial adoption of new technologies in artificial intelligence (AI), the Internet of Things (IoT), and related fields

These factors and others will inevitably impact sales, create opportunities, and present fresh challenges.

At our core, we have a passion to create a better world by making electronics more affordable through semiconductors. This passion is alive today as we continue to pioneer advances in integrated circuits. Each generation of innovation builds upon the last to make technology smaller, more efficient, more reliable and more affordable. Contact us today to learn more about the services provided by Ameya360.

Online messageinquiry

- Week of hot material

- Material in short supply seckilling

| model | brand | Quote |

|---|---|---|

| BD71847AMWV-E2 | ROHM Semiconductor | |

| MC33074DR2G | onsemi | |

| TL431ACLPR | Texas Instruments | |

| CDZVT2R20B | ROHM Semiconductor | |

| RB751G-40T2R | ROHM Semiconductor |

| model | brand | To snap up |

|---|---|---|

| BU33JA2MNVX-CTL | ROHM Semiconductor | |

| IPZ40N04S5L4R8ATMA1 | Infineon Technologies | |

| STM32F429IGT6 | STMicroelectronics | |

| TPS63050YFFR | Texas Instruments | |

| BP3621 | ROHM Semiconductor | |

| ESR03EZPJ151 | ROHM Semiconductor |

- Week of ranking

- Month ranking

Qr code of ameya360 official account

Identify TWO-DIMENSIONAL code, you can pay attention to

Please enter the verification code in the image below: