- Ameya360 Component Supply Platform >

- Trade news >

- December Startup Funding: Big Rounds As 2018 Ends

December Startup Funding: Big Rounds As 2018 Ends

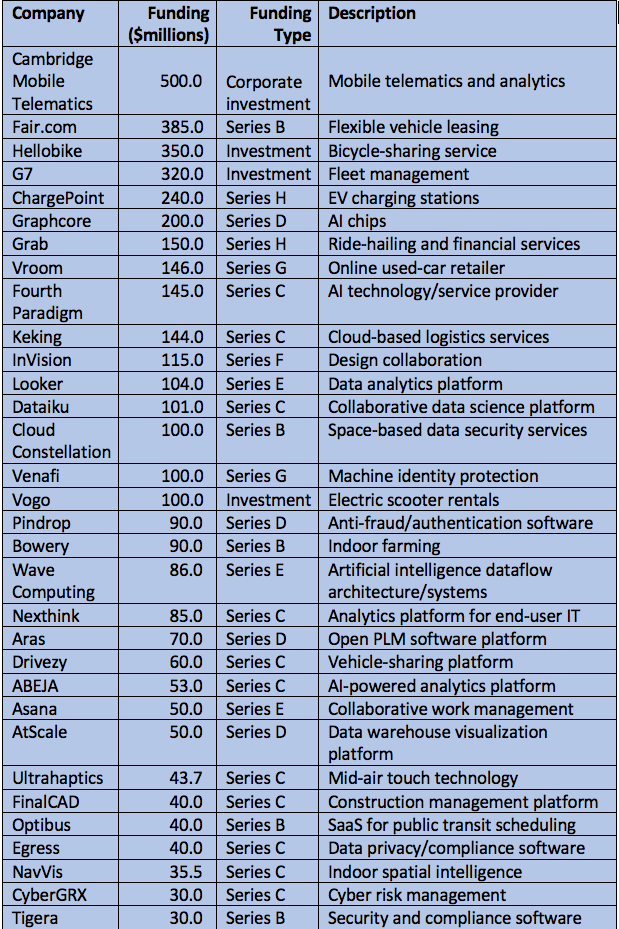

During the month of December, 16 startups had private funding rounds of $100 million and up, with half of them in the mobility area. Those 16 rounds totaled $3.2 billion as the year concluded.

Before the holidays, the SoftBank Vision Fund invested $500 million in Cambridge Mobile Telematics, provider of the DriveWell platform used by insurers, vehicle fleets, wireless carriers, and others to promote driver safety. The Cambridge, Mass.-based startup employs artificial intelligence, behavioral science, and mobile sensing for measuring driving performance for insurance pricing, providing incentives to improve driving quality, and lowering operating costs by reducing crash rates and automating some claims processing functions. CMT operates in more than 20 countries, while working with AIG, Liberty Mutual, State Farm, and other insurers.

Also on the mobility tip, Fair.com of Santa Monica, Calif., received $385 million in Series B funding led by the SoftBank Vision Fund. The company has taken in about $500 million in total equity funding, along with up to $1 billion in debt financing. Uber last year sold its $400 million vehicle leasing business to Fair, which specializes in flexible leasing plans. Fair continues to work with Uber. Also participating in this new mega-round for the car-as-a-service company are Exponential Ventures, Munich Re Ventures’ ERGO Fund, G Squared Funding, and CreditEase.

China’s Hellobike received $350 million in new funding with investors that included Ant Financial Group, which invested $321 million in the bike-sharing company six months earlier.

The next biggest round of the month went to a Chinese company, G7, which raised $320 million primarily from Chinese investors, including HOPU Investments, a private equity firm that led the round, and Tencent, a previous investor in the fleet management company, which has received $510 million in total private funding since its Series A funding eight years ago. G7 describes itself as an Internet of Things startup. G7 President Julian Ma touts the company’s use of artificial intelligence in IoT with its proprietary connected platform, bringing together drivers, fleet managers, shippers, and trucks. The Beijing-based startup says it has 60,000 customers around the world, connecting 800,000 commercial vehicles, and 85% of China’s largest logistics providers do business with the company.

As impressive as G7’s fundraising prowess is, its big round could soon be eclipsed by Megvii of China, which Reuters says is pulling together a round of $500 million. Another source says the funding round may be worth $600 million. Bank of China Group Investment is reportedly leading the round, investing $200 million in the AI startup, which is known as Face++ for its facial recognition technology. Alibaba Group invested $327 million in Megvii in 2018, with its Alipay unit offering a “scan your face to pay” function. In 2017, Megvii raised $460 million from Ant Financial Services Group, Foxconn Technology Group, and the China State-Owned Capital Venture Investment Fund. The new funding round would value Megvii at $3.5 billion, Reuters reports.

Also getting a gargantuan funding round was ChargePoint, a provider of charging stations for electric vehicles. The 11-year-old company raised $240 million in Series H funding, with all of its private funding now totaling $532.2 million. Investors participating in the new round include Chevron Technology Ventures, American Electric Power, and GIC, Singapore’s sovereign wealth fund. They were joined by the Canada Pension Plan Investment Board and Quantum Energy Partners (the lead investor). BMW i Ventures, Daimler Trucks & Buses, Exelon, and Siemens are existing investors in ChargePoint, which says it has more than 57,000 independently owned public and semi-public charging stations.

Robotics

While mobility was getting massive investor support in December, robotics startups were also attracting interest, albeit with smaller investments.

Somerville, Mass.-based RightHand Robotics received $23 million in Series B funding led by Menlo Ventures, which was joined by new investor GV and by existing investors Dream Incubator, Matrix Partners, and Playground Global. Established in 2014, RightHand has founders who came from a DARPA challenge-winning team drawn from the Harvard Biorobotics Lab, Yale’s GRAB Lab, and MIT. The startup has raised a total of $34.3 million in private funding.

Robotiq of Quebec City, Canada, raised C$31 million (about $22.8 million) from Battery Ventures. The company was founded in 2008, and this is its first round of institutional financing. It is a spinout of Quebec’s Laval University. Robotiq specializes in collaborative robotics, including cameras, grippers, and sensors.

New York-based Temi, which offers a personal telepresence robot for the home, received $21 million in Series B funding led by John Wu, the former chief technology officer of Alibaba Group, and by Generali Investments Europe and Ogawa Health Care International. The company has offices in Tel Aviv, Singapore, and Shenzhen, China.

Roam Robotics of San Francisco, which provides robotic exoskeletons for skiing, snowboarding and other applications, raised $12 million in Series A funding led by Yamaha Motor. Also participating were a mix of existing and new investors—Boost VC, Heuristics Capital Partners, Menlo Ventures, R7 Partners, Spero Ventures, Valor Equity Partners, and Venture Investment Associates. Roam is a spinout of Otherlab, an independent R&D lab based in San Francisco.

Boston-based Sea Machines Robotics received $10 million in Series A funding led by Accomplice and Eniac Ventures, bringing its total private funding to $12.5 million. Other investors include Toyota AI Ventures, Brunswick Corp. through investment partner TechNexus Venture Collaborative, NextGen Venture Partners, Geekdom Fund, LaunchCapital and LDV Capital. Sea Machines bridges the fields of autonomy, mobility and robotics. It was founded in 2014 and has an office in Hamburg, Germany. The company is developing autonomous vessels, also called robo-ships, for applications in the industrial marine sector, such as aquaculture, commercial fishing, maritime transportation, and offshore energy development.

Formant has come out of stealth mode with $6 million in seed funding from SignalFire, a venture-capital fund. The San Francisco startup was founded by Google X engineers and roboticists with the goal of developing a cloud-based infrastructure for robot-data management, which can be applied to automotive electronics, construction, health care, and retail. In addition to Google, Formant’s team members came from Redwood Robotics and Savioke.

Elementary Robotics of Pasadena, Calif., raised $3.6 million in seed funding led by Fika Ventures and Fathom Capital. Also investing in the robotics platform startup are Toyota AI Ventures, Ubiquity Ventures, Riot.vc, Osage University Partners, and Stage Venture Partners. Elementary has total private funding of $4.8 million.

Melbourne, Fla.-based Tomahawk Robotics took in $2.4 million in seed funding led by Mosley Venture Partners. Naples Technology Ventures, Scout Ventures, and Stout Street Capital also participated in the funding. Tomahawk is another startup in collaborative robotics with its Kinesis platform, described as a control offering for the robotic Internet of Things. The company was founded in 2018.

Mobility and cybersecurity

Mobility and cybersecurity were two other fields attracting investors as 2018 wound down.

Singapore-based Grab, the ride-hailing and financial services company, raised $150 million in Series H funding by Yamaha Motor, while Vroom, an online used-car retailer, received $146 million in Series G funding led by AutoNation; also investing in the New York firm were T. Rowe Price, L Catterton, General Catalyst Partners, and Fraser McCombs Capital.

Constellation Communications took in $100 million in Series B funding from HCH Group Company. The startup’s SpaceBelt Data Security-as-a-Service offers cloud-based data security and storage with a network of eight satellites in low Earth orbit.

Vogo, an electric scooter rental startup in India, raised $100 million from Ola, a ride-hailing service that previously invested in Vogo’s Series A funding last summer, which also attracted Matrix Partners and other investors.

ACV Auctions of Buffalo, N.Y., received $93 million in Series D funding led by Bain Capital Ventures and Bessemer Venture Partners, bringing its total private funding to more than $145 million. Also participating in the new round are Future Fund, Tribeca Ventures and Armory Square Ventures. ACV is an automotive marketplace.

Mountain View, Calif.-based Boosted raised $60 million in Series B funding led by Khosla Ventures and iNovia Capital. The startup makes electric skateboards. Stanford’s StartX Fund and Bay Meadows also invested in the company.

India’s Drivezy is wrapping up $60 million in Series C funding for its vehicle-sharing platform. Formerly known as JustRide, the startup counts Bain Capital and Yamaha Motor among its investors. In November, the company received $20 million in Series B funding led by Das Capital, along with $100 million in asset financing provided by AnyPay, a payments firm in Japan.

Denver-based CyberGRX raised $30 million in Series C funding led by Scale Venture Partners, joined by existing investors Aetna Ventures, Allegis Group, Bessemer Venture Partners, The Blackstone Group, ClearSky Cyber Security, GV, MassMutual Ventures, and TenEleven Ventures. The company offers third-party cyber risk management through the CyberGRX Exchange risk assessments-as-a-service.

Tigera of San Francisco, which provides security and compliance software for Kubernetes platforms, received $30 million in Series B funding led by Insight Venture Partners. Existing investors Madrona Venture Group, New Enterprise Associates and Wing Venture Capital also participated. Those three investors came up with $10 million in Tigera’s Series A funding, which closed last January. The startup has received total private funding of $53 million.

New York-based Avanan, an enterprise cybersecurity startup with an office in Tel Aviv, Israel, raised $25 million in Series B funding from StageOne Ventures, Magma Venture Partners, and Greenfield Partners, all existing investors. Avanan’s software-as-a-service secures cloud-based collaboration, email and messaging.

Dott of Amsterdam, the Netherlands, received $23 million in venture capital, with EQT Ventures and Naspers Ventures leading the new round. Also participating were Axel Springer Digital Ventures, DN Capital, Felix Capital, FJ Labs, U-Start Club, and angel investors. Dott develops electric scooters and bicycles. It plans to begin a pilot program for its e-scooters in January at the Station F startup campus in Paris, France. The program is connected with Station F’s new Flatmates co-living space.

San Francisco-based Firefly raised $21.5 million in seed funding led by NFX and joined by Pelion Venture Partners, Decent Capital, and Jeffrey Housenbold, managing director of the SoftBank Vision Fund and former CEO of Shutterfly. The startup works directly with ride-sharing drivers to install advertising displays atop their vehicles.

FreeWire Technologies of San Leandro, Calif., received $15 million in Series A funding led by BP Ventures. Also participating were Volvo Cars Tech Fund, Stanley Ventures, and other investors. FreeWire crafts portable charging products for electric vehicles and other devices.

Berlin-based Vimcar, a developer of fleet management software-as-a-service, raised $13 million in Series B funding led by Acton Capital, joined by existing investors Coparion, UVC Partners, and Atlantic Labs, bringing its total private funding to around $20 million.

Etergo, formerly known as Bolt Mobility, raised €10 million (about $11.4 million) from an unidentified German automotive specialist to fund volume production of its AppScooter model. The Amsterdam-based startup in 2017 held a €5 million ($5.7 million) crowdfunding campaign to develop its e-scooter. Etergo plans to introduce the AppScooter in the United Kingdom, with deliveries of production vehicles in Germany and the Netherlands during the latter half of 2019, and followed by deliveries in the U.K. and other markets.

Eclypsium of Beaverton, Ore., developer of an enterprise firmware protection platform, received $8.75 million in Series A funding led by Madrona Venture Group. Existing investors Andreesen Horowitz, Intel Capital and Ubiquity Ventures also participated in the new round. Former Intel employees started the company.

Trustology raised $8 million in seed funding led by Two Sigma Ventures and ConsenSys. The startup specializes in securing digital assets. It is based in London, England, U.K.

BacklotCars of Kansas City, Mo., is an online used-car marketplace for automotive dealers. It received $8 million in Series A funding led by Origin Ventures, joined by Revolution’s Rise of the Rest Seed Fund, Pritzker Group Venture Capital, KCRise Fund, Royal Street Ventures, Chaifetz Group and other investors. The startup’s credit facility was increased by $10 million, in addition to the equity funding.

Cybeats, a Toronto-based cybersecurity startup involved in various aspects of IoT, raised $3 million in funding led by Ripple Ventures. Also participating were GreenSoil Building Innovation Fund, MaRS Investment Accelerator Fund, Maple Leaf Angels 48, ScaleX and iNovia Capital.

Semiconductors

On the semiconductor side, Graphcore of Bristol, England, took in $200 million in Series D funding led by Atomico and Sofina to continue development of its AI chips, known as the Intelligence Processor Unit. BMW i Ventures and Microsoft also participated. The startup has raised more than $300 million in total capital from investors that include Dell Technologies Capital, Robert Bosch Venture Capital and Samsung Electronics. Goldman Sachs advised the company on the new funding round, which values Graphcore at $1.7 billion.

Meanwhile, Wave Computing of Campbell, Calif., received $86 million in Series E funding led by Oakmont Corporation. Wave’s total private funding is now more than $200 million. Munich-based Codasip raised $10 million in Series A funding led by several private equity firms and by Western Digital, a strategic investor interested in the startup’s processor IP incorporating the open-source RISC-V instruction-set architecture.

It’s been an exciting and interesting year in funding for startups in AI, the IoT, cybersecurity, and mobility. Here’s to a prosperous new year in 2019!

Fig. 1: Top funding in December 2018.

Online messageinquiry

Pushing the boundaries of semiconductors

- Week of hot material

- Material in short supply seckilling

| model | brand | Quote |

|---|---|---|

| RB751G-40T2R | ROHM Semiconductor | |

| BD71847AMWV-E2 | ROHM Semiconductor | |

| TL431ACLPR | Texas Instruments | |

| MC33074DR2G | onsemi | |

| CDZVT2R20B | ROHM Semiconductor |

| model | brand | To snap up |

|---|---|---|

| TPS63050YFFR | Texas Instruments | |

| ESR03EZPJ151 | ROHM Semiconductor | |

| BP3621 | ROHM Semiconductor | |

| IPZ40N04S5L4R8ATMA1 | Infineon Technologies | |

| STM32F429IGT6 | STMicroelectronics | |

| BU33JA2MNVX-CTL | ROHM Semiconductor |

- Week of ranking

- Month ranking

Qr code of ameya360 official account

Identify TWO-DIMENSIONAL code, you can pay attention to

Please enter the verification code in the image below: