- Ameya360 Component Supply Platform >

- Trade news >

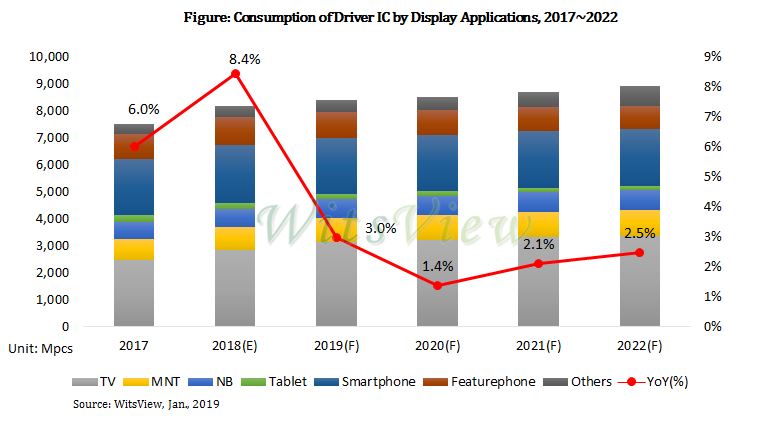

- Total Consumption of Driver IC Grew by 8.4% YoY in 2018, but Growth Would Slow Down to 3% in 2019

Total Consumption of Driver IC Grew by 8.4% YoY in 2018, but Growth Would Slow Down to 3% in 2019

According to the latest report by WitsView, a division of TrendForce, increasing penetration of UHD display panels has driven the consumption of driver IC in the past few years. The total consumption grew by 8.4% YoY in 2018, but the growth would slow down to 3% this year due to technology variation in designs of large-size panels and falling shipments of small-size panels.

As for the breakdown of driver IC consumption by types of application, TV panels would consume around 35% of all the driver ICs, remaining the major growth momentum in 2019, says Julian Lee, the assistant research manager of WitsView. However, with growing demand for narrow-border products and wider adoption of the Gate on Array technology in new devices, growth in the consumption of driver ICs by large-size panels would be moderated this year. In the segment of small-size panel, the consumption of driver ICs would drop due to weak sales in the global smartphone market and the decrease in tablet market size. Overall speaking, growth in the driver IC market would slow down compared with past few years, before momentum appears again after 2021, when electronic devices anticipate a new wave of specs upgrade due to higher transmission speed in the maturing 5G network. By then, the next wave of replacement demand for smartphones, higher penetration of 8K TV, and the emergence of new applications like Internet of Vehicle and IoT would again trigger growth in the driver IC market.

Film for Chip-on-Film packaging would see undersupply in 2019

As 18:9 becomes the mainstream aspect ratio for new generation smartphones, phone makers have been working to make bezels narrower. Therefore, smartphones, such as the three new iPhones launched last year, have been switching from solutions based on Chip-on-Glass (COG) packaging to those on Chip-on-Film (COF) packaging. On the other hand, new production capacity of large-size panels in China has pushed up the shipments of TV panels, increasing the demand for films used in COF packaging as well. However, in the past few years, makers of the film for COF packaging have not invested new capacity due to weak profitability, so the recent demand increase may result in a tight supply of films.

WitsView notes that TVs and LCD monitors also use COF packaging, but the profits are lower than COF packaging for smartphones. Since the number of smartphones using COF packaging is highly likely to double in 2019, the supply of film for TVs and LCD monitors may be squeezed. The global shipments of panel would also be influenced as films in COF packaging for large-size panels may see undersupply in 1H19.

Online messageinquiry

Unveiling the Intricacies of IC Design

- Week of hot material

- Material in short supply seckilling

| model | brand | Quote |

|---|---|---|

| RB751G-40T2R | ROHM Semiconductor | |

| BD71847AMWV-E2 | ROHM Semiconductor | |

| MC33074DR2G | onsemi | |

| TL431ACLPR | Texas Instruments | |

| CDZVT2R20B | ROHM Semiconductor |

| model | brand | To snap up |

|---|---|---|

| ESR03EZPJ151 | ROHM Semiconductor | |

| STM32F429IGT6 | STMicroelectronics | |

| BU33JA2MNVX-CTL | ROHM Semiconductor | |

| IPZ40N04S5L4R8ATMA1 | Infineon Technologies | |

| BP3621 | ROHM Semiconductor | |

| TPS63050YFFR | Texas Instruments |

- Week of ranking

- Month ranking

Qr code of ameya360 official account

Identify TWO-DIMENSIONAL code, you can pay attention to

Please enter the verification code in the image below: