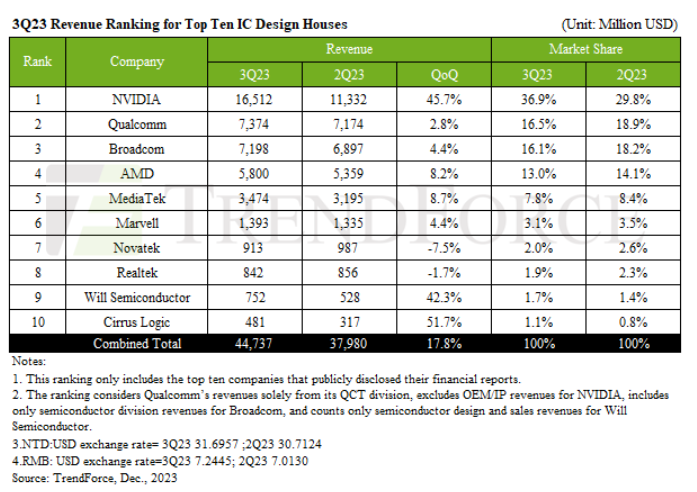

Top Ten IC Design Houses Ride Wave of Seasonal Consumer Demand and Continued AI Boom to See 17.8% Increase in Quarterly Revenue in 3Q23, Says TrendForce

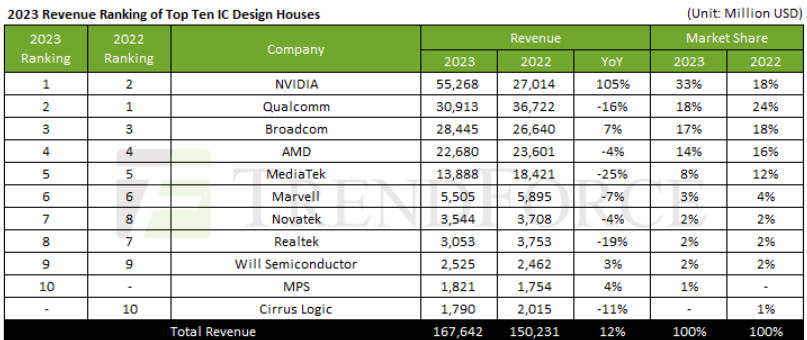

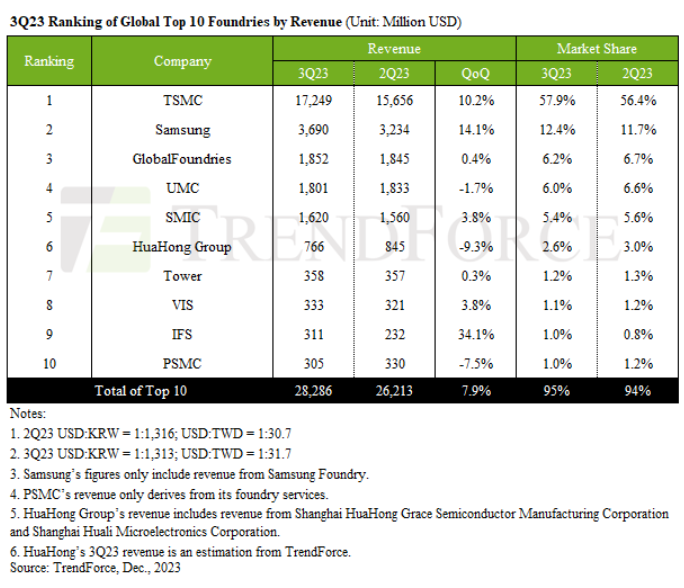

TrendForce reports that 3Q23 has been a historic quarter for the world’s leading IC design houses as total revenue soared 17.8% to reach a record-breaking US$44.7 billion. This remarkable growth is fueled by a robust season of stockpiling for smartphones and laptops, combined with a rapid acceleration in the shipment of generative AI chips and components. NVIDIA, capitalizing on the AI boom, emerged as the top performer in revenue and market share. Notably, analog IC supplier Cirrus Logic overtook US PMIC manufacturer MPS to snatch the tenth spot, driven by strong demand for smartphone stockpiling.

NVIDIA’s revenue soared 45.7% to US$16.5 billion in the third quarter, bolstered by sustained demand for generative AI and LLMs. Its data center business—accounting for nearly 80% of its revenue—was a key driver in this exceptional growth.

Qualcomm, riding the wave of its newly launched flagship AP Snapdragon 8 Gen 3 and the release of new Android smartphones, saw its third-quarter revenue climb by 2.8% QoQ to around US$7.4 billion. However, NVIDIA’s rapid growth eroded Qualcomm’s market share to 16.5%. Broadcom, with its strategic emphasis on AI server-related products like AI ASIC chips, high-end switches, and network interface cards, along with its seasonal wireless product stockpiling, managed to offset weaker demand in server storage connectivity and broadband. This strategic maneuvering led to a 4.4% QoQ revenue boost to US$7.2 billion.

AMD witnessed an 8.2% increase in its 3Q revenue, reaching US$5.8 billion. This success was due to the widespread adoption of its 4th Gen EPYC server CPUs by cloud and enterprise customers and the favorable impact of seasonal laptop stockpiling. MediaTek's revenue rose by 8.7% to US$3.5 billion in the third quarter, buoyed by a healthy replenishment demand for smartphone APs, WiFi6, and mobile/laptop PMIC components, as inventories across brand clients stabilized.

Cirrus Logic ousts MPS from tenth position thanks to smartphone inventory replenishment

Marvell also made significant gains, with its third-quarter revenue hitting US$1.4 billion, a 4.4% QoQ increase. This growth was primarily driven by increasing demand for generative AI from cloud clients and the expansion of its data center business—despite declines in sectors like enterprise networking and automotive. However, the outlook for some sectors remains mixed, with areas like TV and networking still facing uncertainties, leading to a cautious approach from clients. This resulted in some IC design companies, such as Novatek and Realtek, witnessing a decline in revenues by 7.5% and 1.7%, respectively.

Will Semiconductor benefited from the demand for Android smartphone components, breaking free from past inventory corrections with a 42.3% increase in 3Q revenue to US$752 million. Cirrus Logic, similarly capitalizing on the smartphone component stockpiling trend, saw a significant 51.7% jump in revenue to US$481 million, ousting MPS from the top ten.

In summary, TrendForce forecasts sustained growth for the top ten IC design houses in the upcoming fourth quarter. This optimistic outlook is underpinned by a gradual normalization of inventory levels and a modest seasonal rebound in the smartphone and notebook market. Additionally, the global surge in LLMs extends beyond CSPs, internet companies, and private enterprises, reaching regional countries and small-to-medium businesses, further bolstering this positive revenue trend.

在线留言询价

Unveiling the Intricacies of IC Design

- 一周热料

- 紧缺物料秒杀

| 型号 | 品牌 | 询价 |

|---|---|---|

| CDZVT2R20B | ROHM Semiconductor | |

| TL431ACLPR | Texas Instruments | |

| MC33074DR2G | onsemi | |

| RB751G-40T2R | ROHM Semiconductor | |

| BD71847AMWV-E2 | ROHM Semiconductor |

| 型号 | 品牌 | 抢购 |

|---|---|---|

| BP3621 | ROHM Semiconductor | |

| TPS63050YFFR | Texas Instruments | |

| BU33JA2MNVX-CTL | ROHM Semiconductor | |

| STM32F429IGT6 | STMicroelectronics | |

| ESR03EZPJ151 | ROHM Semiconductor | |

| IPZ40N04S5L4R8ATMA1 | Infineon Technologies |

- 周排行榜

- 月排行榜

AMEYA360公众号二维码

识别二维码,即可关注

请输入下方图片中的验证码: