- Ameya360 Component Supply Platform >

- Trade news >

- Top 10 IC Design Houses’ Combined Revenue Grows 12% in 2023, NVIDIA Takes Lead for the First Time, Says TrendForce

Top 10 IC Design Houses’ Combined Revenue Grows 12% in 2023, NVIDIA Takes Lead for the First Time, Says TrendForce

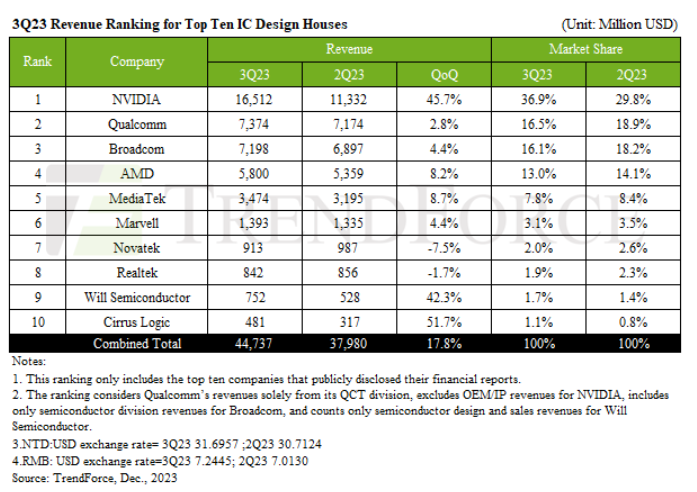

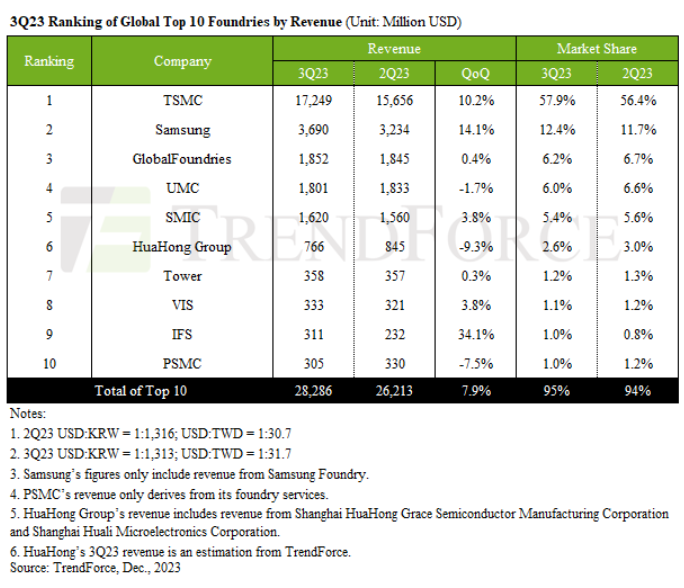

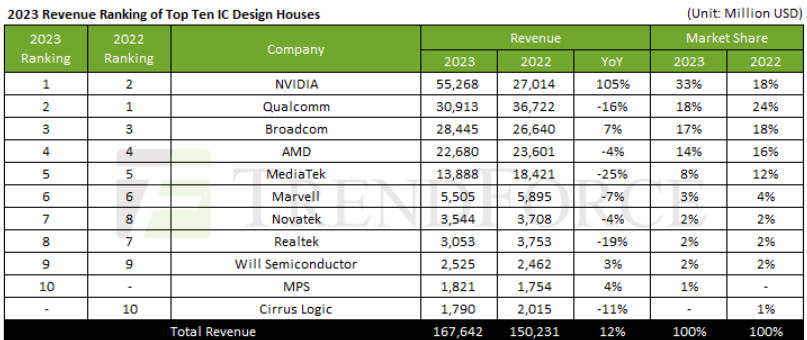

In 2023, the combined revenue of the world’s top ten IC design houses reached approximately $167.6 billion, marking a 12% annual increase. This growth was primarily driven by NVIDIA, which saw a remarkable 105% increase in revenue, significantly boosting the overall industry. While Broadcom, Will Semiconductor, and MPS experienced only marginal revenue growth, other companies faced declines due to economic downturns and inventory reductions, says TrendForce.

Looking ahead to 2024, TrendForce predicts that with IC inventory levels returning to healthy standards and driven by the AI boom, major CSPs will continue to expand the construction of LLMs. Additionally, AI applications are expected to penetrate personal devices, potentially leading to the introduction of AI-powered smartphones and AI PCs. Consequently, the global IC design industry's revenue growth is expected to continue its upward trajectory.

NVIDIA, Broadcom, and AMD benefit from a surge in demand for AI

The top five IC design houses boosted their 2023 revenues to $55.268 billion—a 105% year-over-year increase—primarily driven by NVIDIA’s AI GPU H100. Currently, NVIDIA captures over 80% of the AI accelerator chip market, and its revenue growth is expected to continue in 2024 with the release of the H200 and next-generation B100/B200/GB200. Broadcom’s revenue reached $28.445 billion in 2023 (semiconductor segment only), growing by 7%, with AI chip income accounting for nearly 15% of its semiconductor solutions. Despite stable wireless communications revenue, Broadcom expects a near-double-digit decline in broadband and server storage connectivity this year.

AMD’s revenue fell by 4% to $22.68 billion in 2023, due to declining PC demand and inventory reductions, affecting most of its business segments. Only its data center and embedded businesses, boosted by the acquisition of Xilinx, grew by 17%. AMD’s AI GPU MI300 series, launched in the fourth quarter of 2023, is expected to be a major revenue driver in 2024.

Conversely, Qualcomm and MediaTek were impacted by the downturn in the smartphone market. Qualcomm’s 2023 revenue decreased by 16% YoY to $30.913 billion (QCT only) due to weak demand in the handheld device and IoT sectors, with China’s smartphone shipments hitting a decade low. However, Qualcomm is actively promoting the automotive market, expecting automotive revenues to more than double by 2030.

MediaTek’s revenue also fell in 2023, dropping 25% YoY to $13.888 billion, with declines in smartphone, power management IC, and smart edge businesses. Nevertheless, due to the adoption of its Dimensity 9300 by several Chinese clients and expected growth in high-end smartphone shipments, the company predicts a return to double-digit growth for all of 2024.

Two significant changes in the ranking from sixth to tenth took place: First, Cirrus Logic fell off the list from its last place spot and was replaced by MPS, whose 2023 revenue rose 4% YoY to $1.821 billion thanks to automotive, enterprise data, and storage computing businesses—offsetting declines in communication and industrial sectors.

Secondly, Realtek’s revenue fell by 19% annually to $3.053 billion in 2023, dropping the company down to eighth place. The decline was mainly due to a sharp decrease in PC shipments, a suspension of telecom tenders in China, and early inventory write-offs. However, after clearing inventory, Realtek saw a slight improvement in PC and automotive shipments in the first quarter of 2024 over networking and consumer electronics. With the launch of WiFi-7 in the third quarter, the restart of telecom tenders, and participation in the development of edge computing frameworks through the Arm alliance, Realtek’s revenues are poised for growth.

Online messageinquiry

Unveiling the Intricacies of IC Design

- Week of hot material

- Material in short supply seckilling

| model | brand | Quote |

|---|---|---|

| TL431ACLPR | Texas Instruments | |

| CDZVT2R20B | ROHM Semiconductor | |

| BD71847AMWV-E2 | ROHM Semiconductor | |

| MC33074DR2G | onsemi | |

| RB751G-40T2R | ROHM Semiconductor |

| model | brand | To snap up |

|---|---|---|

| STM32F429IGT6 | STMicroelectronics | |

| ESR03EZPJ151 | ROHM Semiconductor | |

| BP3621 | ROHM Semiconductor | |

| IPZ40N04S5L4R8ATMA1 | Infineon Technologies | |

| BU33JA2MNVX-CTL | ROHM Semiconductor | |

| TPS63050YFFR | Texas Instruments |

- Week of ranking

- Month ranking

Qr code of ameya360 official account

Identify TWO-DIMENSIONAL code, you can pay attention to

Please enter the verification code in the image below: